EUR/USD

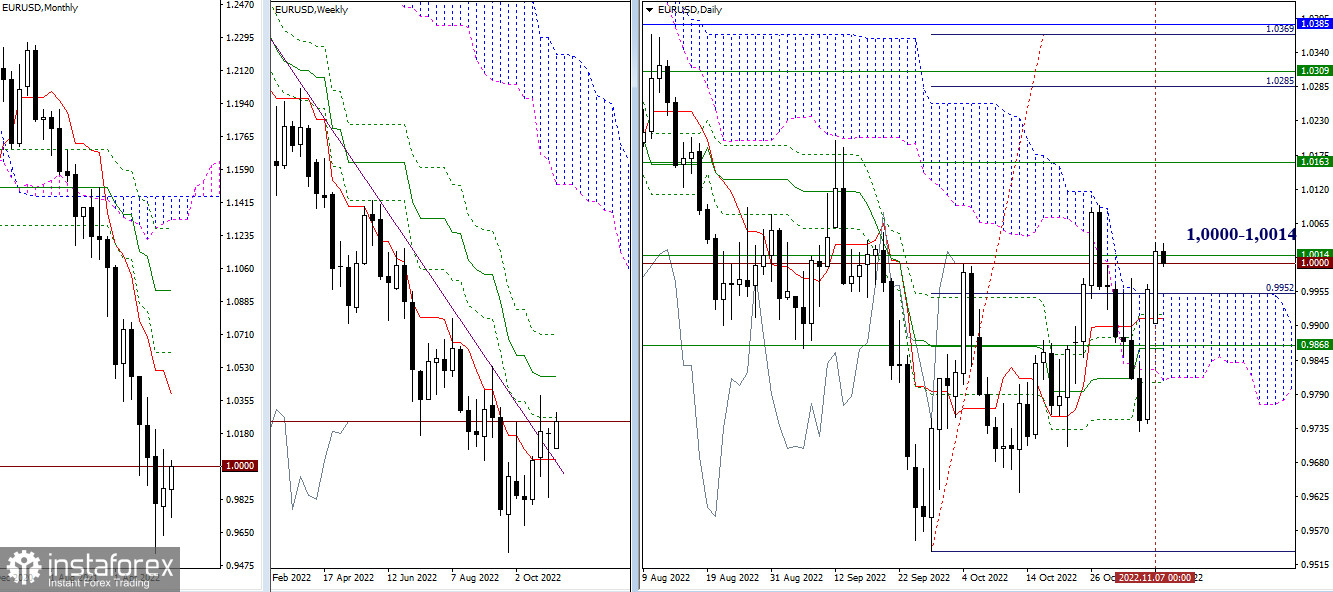

Higher timeframes

Bulls yesterday not only covered the downward gap but also rose to the resistance at 1.0000 – 1.0014 (weekly and psychological level). The test result will determine further opportunities for the development of the situation. Consolidation above will confirm the presence of prospects, which can now be identified at the boundaries of 1.0163 – 1.0309 (final levels of the weekly Ichimoku cross) and 1.0385 (monthly short-term trend), as well as reference points for an upward target on the breakdown of the daily cloud (1.0285 - 1.0369). In case of formation of a rebound from the met resistances (1.0000–14), the relevance will return to the supports. In this situation, support can be noted at 0.9952 (the upper limit of the daily cloud) and 0.9912 - 0.9863 - 0.9808 (levels of the daily cross), with an increase in the area of 0.9868 (weekly short-term trend).

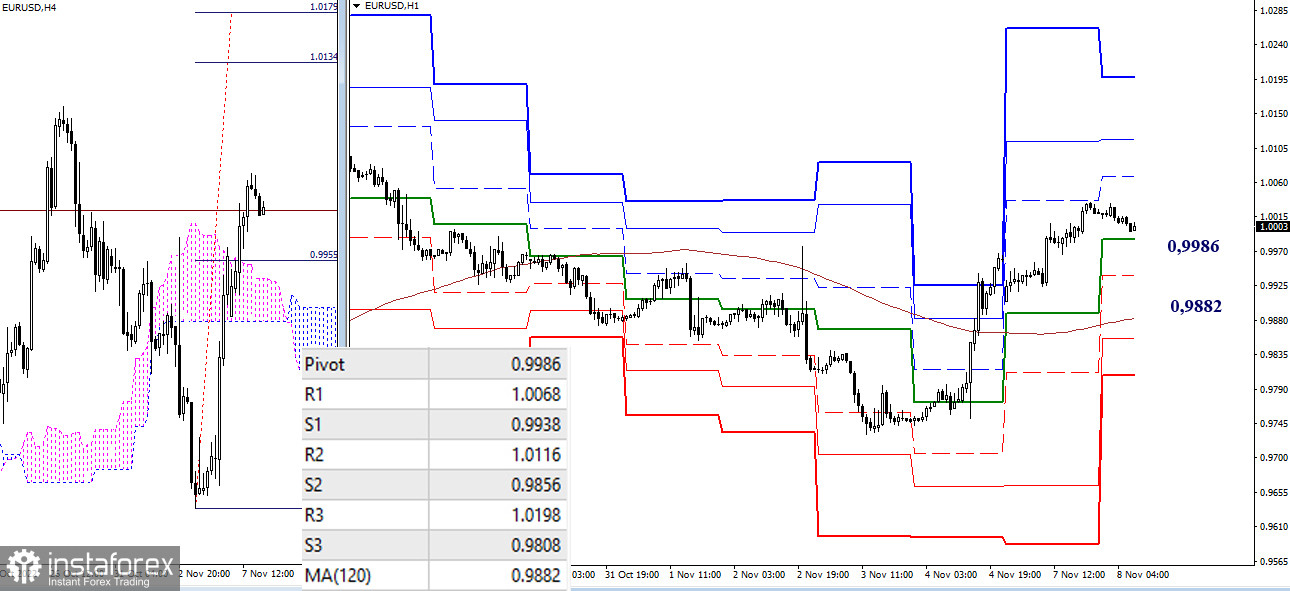

H4 – H1

As of writing, the main advantage on the lower timeframes belongs to the bulls. Among the upward benchmarks within the day, we can note the resistance of the classic pivot points (1.0068 - 1.0116 - 1.0198) and the target for the breakdown of the H4 cloud (1.0134 - 1.0179). The key levels today act as supports, which will seek to limit the corrective decline at the levels of 0.9986 (central pivot point) and 0.9882 (weekly long-term trend). Consolidation below and reversal of the moving average can change the current balance of power in the lower timeframes.

***

GBP/USD

Higher timeframes

The bulls managed to close the downward gap identified at the opening and continued the rally that started on Friday. Now the weekly medium-term trend (1.1511) is being tested. With a reliable consolidation above, attention will be directed to such upward benchmarks as the area of accumulation of monthly and weekly resistances (1.1781 - 1.1842 - 1.1895), the daily target for the breakdown of the cloud (1.2099 - 1.2292) and the monthly medium-term trend (1.2302). The support zone in the current situation is quite wide and is formed from different levels of the daily and weekly timeframes (1.1411 - 1.1324 - 1.1238 - 1.1046).

H4 – H1

Bulls have seized the key levels of the lower timeframes, thanks to which they have been turned into support and are located at 1.1447 (central pivot point) and 1.1387 (weekly long-term trend) lines. With the development of the upward movement, the resistance of the classical pivot points (1.1604 - 1.1698 - 1.1855) will come into play. If it consolidates below the key levels (1.1447 - 1.1387), the market's attention within the day will be directed to the support of the classic pivot points (1.1353 - 1.1196 - 1.1102).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română