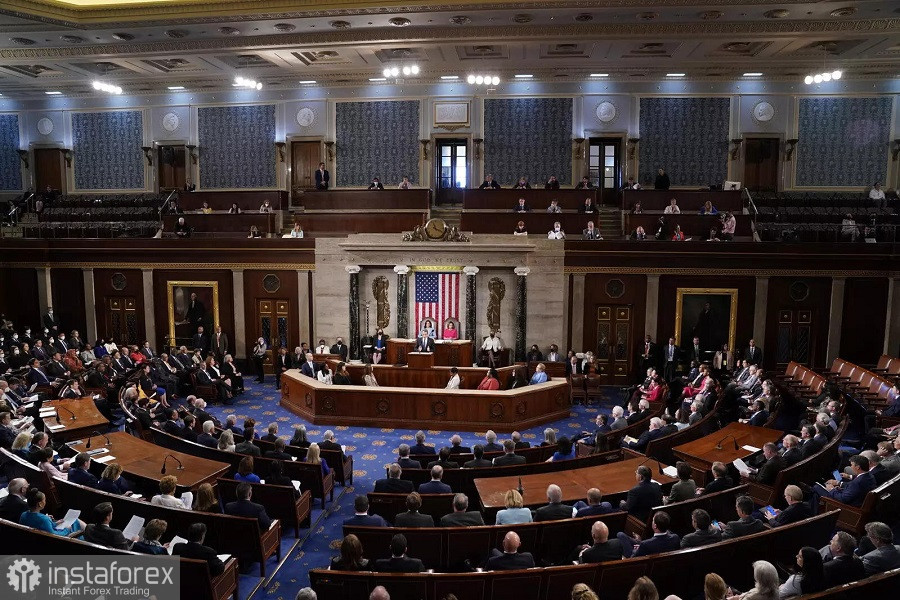

Midterm elections will be held in the United States on November 8, the results of which will determine who will control Congress - Democrats or Republicans. From a political point of view, this is clearly a major event, and not only for the United States, given the current geopolitical situation in the world. However, this is not a passing event for the currency market either. Its echoes will be reflected primarily in the dollar pairs that will follow the US dollar index. In particular, some currency strategists believe that the US election could hit the dollar if the Democrats lose control of the two houses of Congress. Today we will talk about the prospects for the development of such a scenario.

So, as you know, midterm elections are held in the middle of the presidential term: they elect the entire composition of the House of Representatives and a third of the Senate, as well as governors in many (36) states. According to a number of sociologists, the 2022 elections will be characterized by a high turnout amid a strong polarization of public sentiment (in 2014, the turnout was one of the lowest in US history - 42% - and in 2018 - almost 54%).

Today, the lower house of Congress (House of Representatives) is completely controlled by the Democrats. However, in the upcoming elections, the Democratic Party has little chance of maintaining a majority there - observers voice only a 15% chance of such a scenario being realized. This is facilitated by both specific factors that are unique to the United States (gerrymandering, the effect of presidential elections, etc.), as well as general ones, where 8% inflation is at the forefront.

All these circumstances play against US President Joe Biden, the White House, and ultimately against the Democratic Party. The Democrats tried (and are still trying) to play the card of value issues, but, judging by the latest polls, this strategy did not bring the desired effect. It's about abortion. Conservative states have been able to almost or completely ban them on their territory after the Republican majority in the Supreme Court ruled that the country's constitution does not guarantee the right to terminate a pregnancy. Many Americans opposed this resolution, and the Democrats supported them on this issue. But in the context of the elections, economic problems still came to the fore: the Democratic Party is likely to lose control of the House of Representatives, after which the agenda there will be determined by representatives of the Republican Party.

As for the Senate, the situation here is no longer so unambiguous. Control over the upper house of Congress can either remain with the Democrats or pass to the Republicans. In a number of states, a tough struggle has unfolded between representatives of these political forces - the Democrats need to win three (out of four) of them. And according to political experts, "it does not look impossible."

The market also makes its own assumptions, which, in general, are based on the analysis of the latest opinion polls. For example, ANZ currency strategists have a 55% chance that both houses of Congress will be controlled by the Republicans. The probability of a split Congress is estimated at 41%. And accordingly, the chances that the Democrats will maintain the status quo are only 4%. Such predictive estimates prevail in the foreign exchange market.

And yet, it cannot be said that traders are ready to ignore the election results, even despite a certain predetermination. The intrigue regarding the Senate is still preserved, which means that the dollar will react to the announced results with increased volatility.

But at the same time, there is no consensus on the market about the short-term fate of the greenback. According to some analysts, the dollar will be in high demand as a defensive asset in light of the upcoming disagreements between Congress and the president. According to other experts, the US currency will be under pressure, and in general for the same reasons. According to supporters of the second version, Republicans, in particular, will begin to actively push for a reduction in spending on social security and medical care in exchange for an increase in the debt ceiling. Also among the possible risks of a split Congress is a possible shutdown, that is, the cessation of funding for federal institutions due to the lack of an approved budget.

In my opinion, the dollar will indeed react negatively to the results of the midterm elections, but this reaction will be of a short-term nature. In the very near future, the greenback will switch to other, classical fundamental factors (first of all, we are talking about the release of data on inflation in the United States).

Firstly, the political landscape in the United States will not change overnight: the new composition of Congress will begin work only in January 2023. Secondly, the Democrats, in any, even the most pessimistic, scenarios will have effective levers of influence (filibuster, the right of the president's veto, the Republicans' lack of resources to overcome the veto, etc.). Therefore, cardinal political or economic reversals are not to be expected.

Actually, for this reason, the greenback's reaction will also be of a short-term nature: as soon as the first emotions subside, traders will return to current issues, in particular, to the prospects for further tightening of the Federal Reserve's monetary policy in the context of the October report on inflation growth in the US.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română