The last week ended on a very interesting note. In fact, the previous week was rich in events and reports. Apart from the US statistical data and the Fed's meeting, traders were also focused on the BoE's meeting. Although the pound sterling had more reasons to rise, the euro also showed almost the same dynamic. The market continues ignoring all the actions taken by the Bank of England. Today, we are going to take a close look at the US statistical reports and try to predict the instruments' movement in the near future.

According to the report, in October, the US unemployment rate increased to 3.7%. Two months ago, we saw the same picture when the unemployment rate also rose to 3.7% from 3.5%. Thus, there is nothing special in this situation. From March to June, the indicator was at the level of 3.6%. Until then, it was actively falling. That is why the readings of 3.5% and 3.7% deviate from the average one by just 0.1%. Thus, the market reaction to the data could hardly be called reasonable. Notably, on Friday, demand for the US dollar slumped.

Meanwhile, the non-farm payroll report unveiled a rise of 261,000 in the number of new jobs. Economists had expected an increase of 200,000-240,000 and a positive reaction to the data, but all in vain. Since last October, when the NFP totaled 677,000, the indicator was falling, thus reflecting recovery after the pandemic. Most economic indicators were showing incredible figures because the Fed was keeping the interest rates at zero level and was actively printing money to prop up the economy. Then, the regulator started increasing the benchmark rate and announced the end of the QE program since the pandemic did not have a damaging effect anymore. That is why the NFP, like other indicators, now is showing more moderate results. However, this should not be considered a negative factor.

I suppose that 261,000 new jobs are a perfect result, which exceeds the forecast. Thus, both reports published on Friday were positive. They could not be defined as weak or negative. The US labor market has been showing positive signs even amid the aggressive monetary policy tightening. The labor market condition is a good indicator of economic growth. It may slacken amid the key interest rate hike. However, the stronger the market is, the less the economy will fall.

Thus, I think that the US dollar decline is a short-lived phenomenon. After the euro and the pound sterling end the formation of the correctional sections of the trend, they may start falling again.

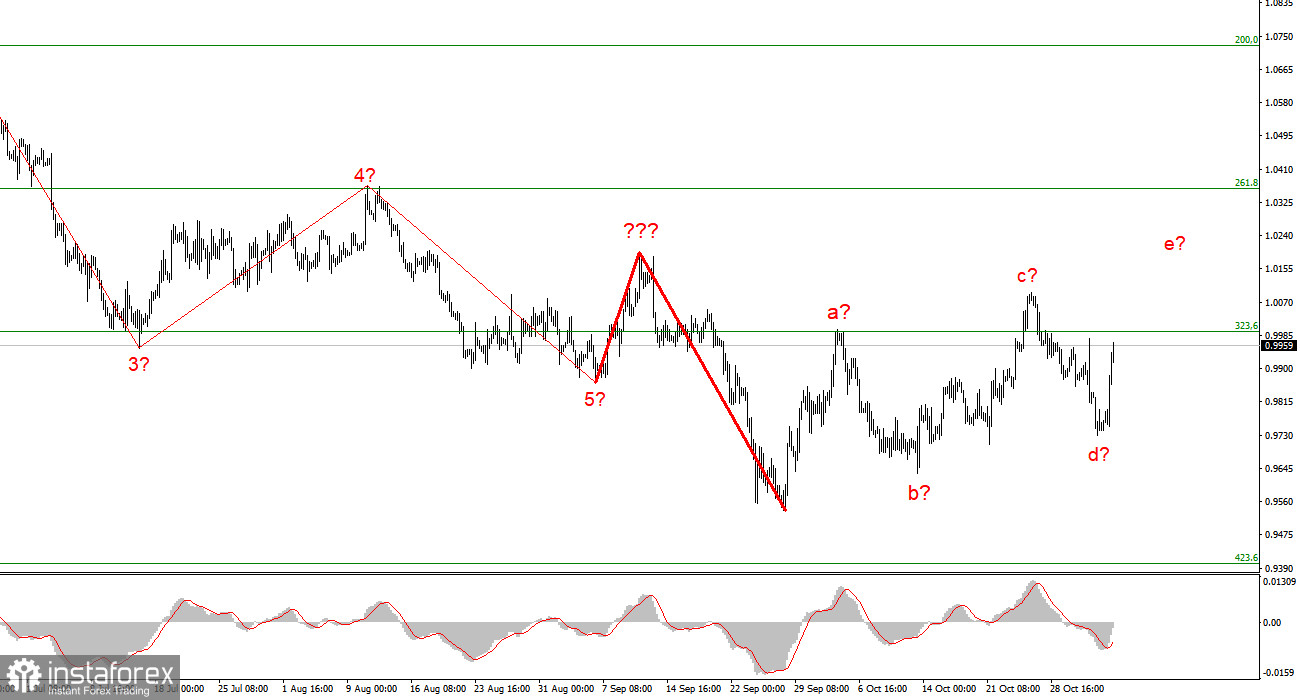

In this light, the upward section of the trend will contain 5 waves. At the moment, the instrument could be forming the 5th wave. That is why traders have a chance to buy the asset with the targets located above the peak of wave c. The MACD indicator should be headed upwards. The trend section, which started its formation on September 28, could be described as a-b-c-d-e. Once the price ends its formation, it may start the formation of a downward section.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română