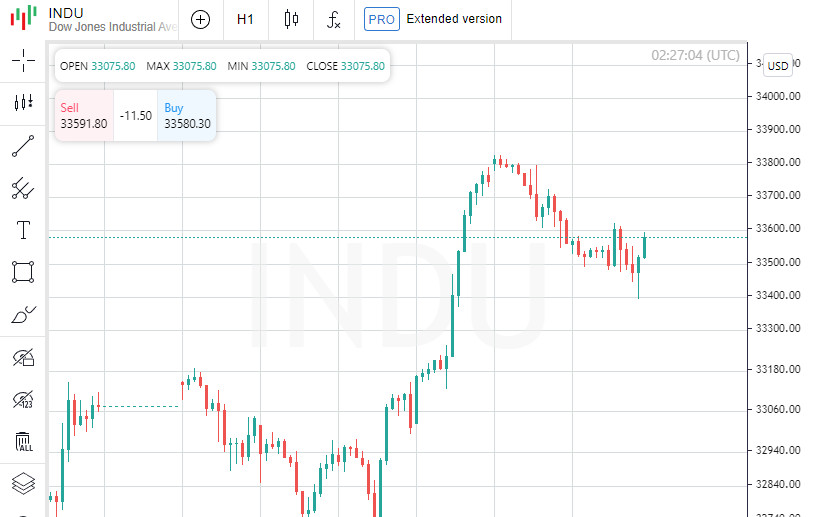

As of 17.20 GMT + 2, the Dow Jones Industrial Index rose by a symbolic 0.02% to 33570.2 points, the NASDAQ high-tech index decreased by 0.01% to 13229.55 points, the S&P 500 broad market index increased by 0 .09%, up to 4278 points. Minutes earlier, all three indices showed weak growth, and before that they were declining.

On Monday, the Institute for Supply Management (ISM) published data on the index of business activity in the US services sector, which unexpectedly fell to 50.3% in May from 51.9% a month earlier. After that, US stock indices fell following the results of trading.

The Fed is due to meet next week to decide what to do next as economic data show the country's economy is slowing but the labor market remains tight. Futures traders believe there is a 75% chance the Fed will pause its rate hike next week, while just over half of traders believe a quarter-point rate hike will follow in July.

The next CPI reading, this time for May, is due on Tuesday, just as the Fed begins its two-day meeting.

Fed officials are now on pause ahead of the meeting, but last week several of them gave speeches to justify the need for such a pause.

The prospect of a halt in interest rate hikes has lifted stocks, especially tech stocks, in recent weeks, pushing the Nasdaq higher.

Shares of Coinbase Global Inc. (NASDAQ: COIN) fell 15.8% after the Securities and Exchange Commission sued the crypto exchange for operating as an unregistered broker and exchange. Just on Monday, the SEC sued Binance and its founder for violating securities regulations.

Shares of Apple Inc. (NASDAQ: AAPL) fell 0.9% after unveiling the first major new product in a decade, a $3,499 mixed reality headset.

Shares of Thor Industries Inc. (NYSE: THO) jumped 13% after the recreational vehicle maker reported higher-than-expected earnings and revenue and raised its full-year guidance.

Oil has fallen in price. WTI futures fell 1.5% to $71.08 a barrel, while Brent futures fell 1.4% to $75.64 a barrel. Gold futures fell 0.06% to $1.973.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română