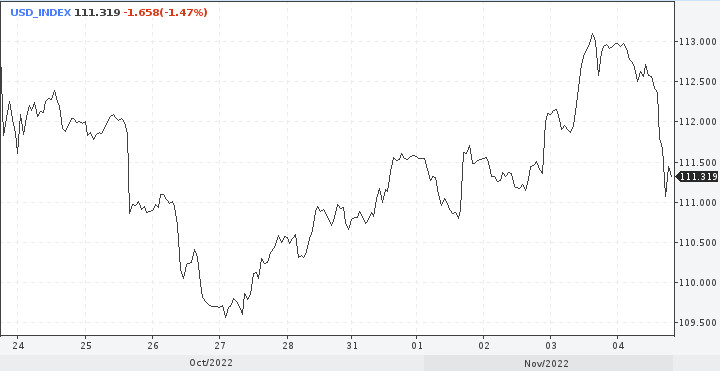

The dollar reacted emotionally to the October payrolls. The US currency index went down sharply and at the moment lost more than 1%. The most pronounced selling activity was against the Australian and New Zealand dollars, as higher commodity prices pushed up rates on both currencies. In general, the final report on the labor market turned out to be optimistic, but some details revealed the beginnings of weakness in this direction.

The number one question in the foreign exchange market is what will happen next with the dollar. Why did such a sudden weakness occur and will bulls be able to return the US currency back to the 113.00 mark?

Anyway, the DXY rose by almost 1.5% this week, as hawkish rhetoric from the Federal Reserve gave optimism to the bulls. The central bank raised interest rates by 75 basis points, a widely expected move on Wednesday, while Fed Chairman Jerome Powell signaled that rates could peak despite hinting at a slower pace of increases later this year.

NFP

U.S. job growth increased more than expected in October. The economy added 261,000 vacancies, which significantly exceeded the consensus forecast of 200,000. Moreover, the September figure was revised upward to an impressive 315,000.

The average hourly wage increased by 0.4%, exceeding expectations of 0.3%, and confirmed the continuing dynamics of wages, which will support domestic inflationary pressure in the future.

Thus, the data is consistent with the Fed's position, which believes that it is too early to consider ending the rate hike cycle.

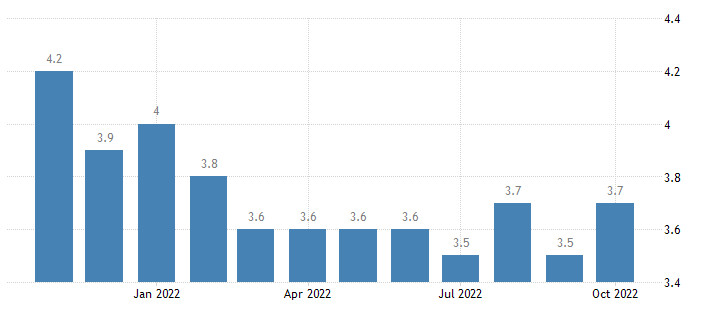

Meanwhile, the unemployment rate rose to 3.7%, which suggests a slight weakening of labor market conditions. This will push the Fed to move to a smaller increase in interest rates starting in December.

Perhaps it was this factor that provoked the dollar's collapse and a sharp increase in risk appetite. Investors saw a crack in the labor market, and hence in the Fed's plans. This sounded encouraging to them, as there were hopes not only for a slowdown in rate hikes, but also for a possible dovish turn. Is this really the case, or is a cold shower waiting for them again?

"The Fed will probably decide that job growth is too big and wage growth is too high. This confirms Powell's assessment this week that the final interest rate is likely to be higher than previously expected," UniCredit Bank economists said.

It is possible that the current weakness of the dollar represents only profit-taking after Wednesday's growth. There is nothing in the latest batch of data on the labor market that would indicate any drastic changes.

Dollar forecast

The sharp drop in the dollar observed after the release of employment data on Friday is unlikely to represent a turn in the trend. This can only happen after a string of clearly weak employment data and surprisingly weak inflation data.

Given that two more reports on the consumer price index and the November employment report will be released before the next Fed meeting (December 13-14), it is premature to draw conclusions now. As a result, the data may indicate another increase in the Fed's rate by 75 bps in December.

More convincing signs of easing inflationary pressure will be needed to convince officials of the US central bank to slow down the pace of rate hikes, analysts say. The labor market still looks strong.

Economists' opinions are based on the fact that employment growth will continue to slow down, but will remain positive. The unemployment rate will be slightly higher for the rest of this year.

The base scenario assumes an increase in the rate by 50 bps in December, but the possibility of a larger increase, that is, by 75 bps, is not excluded.

If so, the situation for the dollar will remain positive until the end of the year. There is no reason to change the current trend.

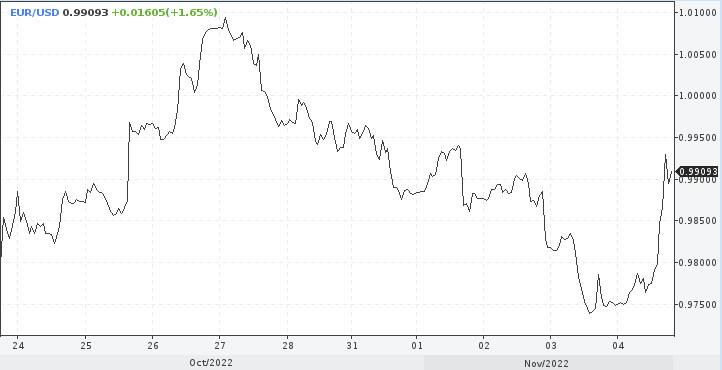

The EUR/USD pair will continue to remain under pressure, and there are risks of a more significant decline in the quote. According to analysts, the problems faced by the eurozone have not yet been fully incorporated into the European currency.

"We still note the probability of the EUR/USD pair falling to 0.9500 in the coming weeks and see the potential that the euro will remain at lower levels against the dollar for a longer time," Rabobank economists comment.

As for the pound, it will obviously be able to stay above the 1.1000 mark against the dollar, despite the obvious dovish message of the Bank of England.

In general, the central bank acted boldly at the November meeting and this is not the last rate hike. There should be another 50 bps in December, then 25 bps in February, to the level of 3.75%. At the same time, all of the central bank's steps will depend on incoming data and updates of fiscal policy, economists at Bank of Montreal are sure.

The GBP/USD pair is likely to stand within 1.1000, but the Fed's more aggressive than expected policy remains a downside risk factor.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română