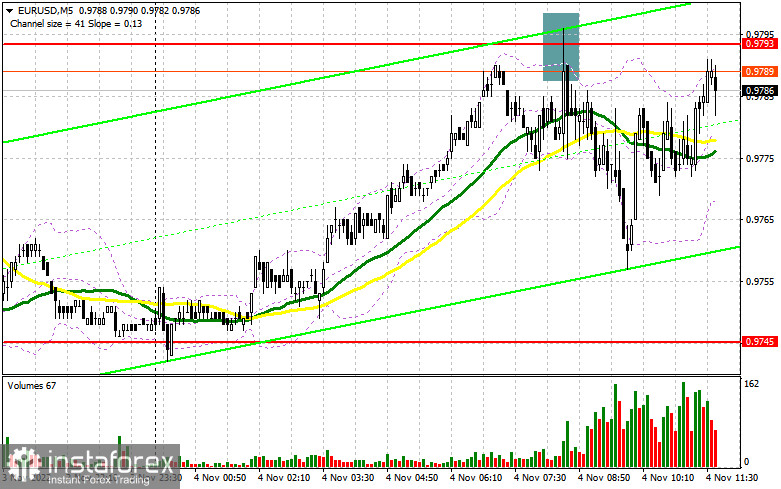

An excellent sell signal was formed in the first half of the day. Let's look at the 5-minute chart and figure out what happened there. In my morning forecast, I paid attention to 0.9793 and advised selling from this level. The growth and the formation of a false breakdown in the area of 0.9793 led to the entry point into short positions, and the released statistics on the eurozone did not greatly please traders. As a result, the pair fell by more than 35 points, but we did not reach the nearest support of 0.9745. For the second half of the day, the technical picture has not changed in any way, nor has the strategy itself changed.

To open long positions on EURUSD, you need the following:

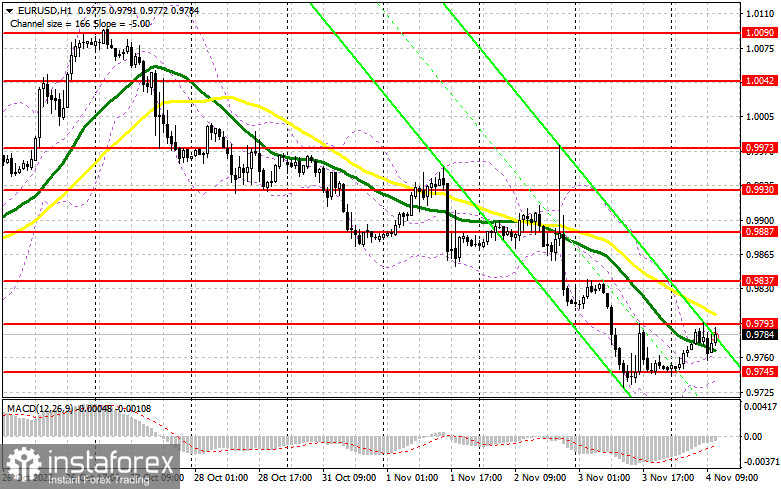

The entire focus will be on the data on the United States unemployment rate and the change in the number of people employed in the non-agricultural sector in October this year. If unemployment rises and the number of people employed sharply decreases, we buy euros and expect a good upward leap at the end of this week. If the data come out again better than economists' forecasts, at the same time, the unemployment rate will remain unchanged, and the number of employed will exceed the September figure, I advise you to continue selling the euro according to the trend to reach new monthly lows. In case of a further fall in good reports, it will be possible to count on the support level of 0.9745. Only a false breakout there will signal to opening of long positions to develop an upward correction, which will help to return to the 0.9793 resistance formed by yesterday's results and not allow the euro to break higher. A breakout and a top-down update of this range will open the way to 0.9837, giving additional hope for a larger upward movement to 0.9887, where I recommend taking profits. The farthest target will be the 0.9930 area, but the movement to this level will occur only because of the extremely poor economic indicators in the labor market. With the option of a decline in EUR/USD during the American session, and most likely it will be, as well as the absence of buyers at 0.9745, the pressure on the pair will only increase. In this case, only a false breakdown in the area of the next support of 0.9693 will be a reason to buy the euro. I advise you to open long positions on EUR/USD immediately for a rebound only from the support of 0.9635, or even lower – around the minimum of 0.9592 with the aim of an upward correction of 30-35 points within a day.

To open short positions on EURUSD, you need the following:

Sellers have done everything possible today and are ready to continue to put pressure on the euro. Until trading is conducted below 0.9793, the bears will retain market control. A good option for opening short positions will be another false breakdown in this resistance, which will indicate the presence of large players in the market, counting on a drop in EUR/USD after reports on the unemployment rate in the United States. In this case, we can expect a decrease in the 0.9745 test. Fixing and updating from the bottom up 0.9745 form an additional sell signal with the demolition of buyers' stop orders and the euro's decline to 0.9693, where I recommend fixing the profits. We can expect to go beyond this level only after strong statistics on the USA to update 0.9635. In the event of an upward movement of EUR/USD during the US session, as well as the absence of bears at 0.9793, sharp profit-taking on short positions will begin, which will lead to a rebound of the pair up to the 0.9837 area, where the bears will get down to business again. If there is no one there, I advise you to postpone sales until 0.9887. The formation of a false breakout there will become an additional point for entering short positions. You can sell EUR/USD immediately for a rebound from the maximum of 0.9930 or even higher – from 0.9973 with the aim of a downward correction of 30-35 points.

Signals of indicators:

Moving Averages

Trading is conducted around the 30 and 50-day moving averages, which indicates the lateral nature of the market before important data.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

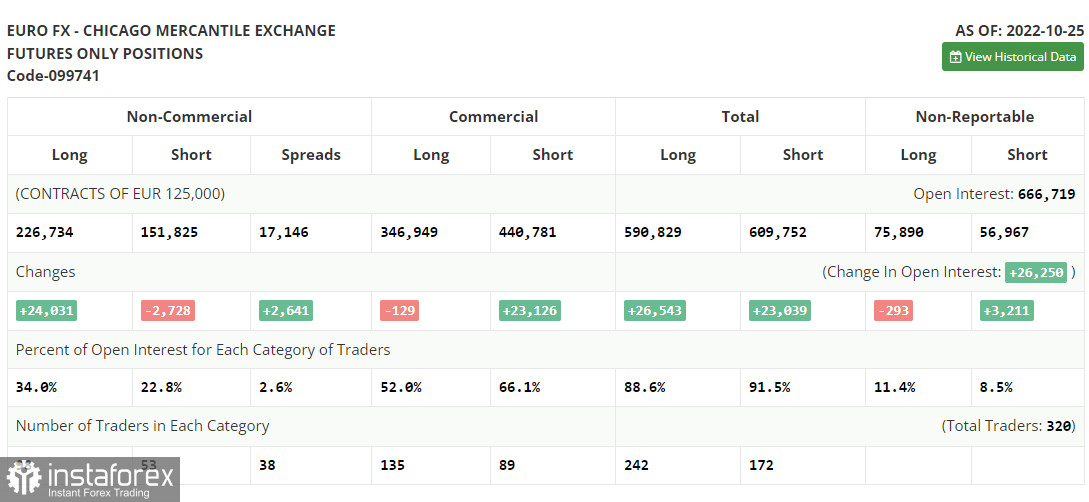

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română