The market has been waiting for central bank meetings for a long time, which took place within one week. The euro and the pound were growing. And in the last few days before the Fed meeting, they were declining, as if playing off a possible Fed rate hike, and then they collapsed, which does not fit with any results and decisions. Let's look at everything in more detail.

The ECB raised the rate by 75 basis points (as I expected) and promised to continue raising it since inflation remains very high in the European Union. No matter how much the rate will eventually rise and how long it will take – the ECB has signaled to the market that monetary policy will tighten. Here, the market played out more or less logically as the demand for the euro currency grew.

The Fed raised the rate by 75 basis points (as I expected) and made it clear that the rate will continue to rise, perhaps at a slower pace. However, the market interpreted one small remark by Jerome Powell (the rate may rise more than previously expected) as a signal to increase demand for the dollar. Therefore, both instruments fell the night before last and yesterday (demand for the dollar increased).

The Bank of England raised the rate by 75 basis points (as I expected), and demand for the pound fell even lower than after the Fed meeting. Andrew Bailey said that the British economy is in a very difficult state. Inflation will continue to rise, and the recession will begin in the next quarter and will last about eight quarters in total, which will be longer than during the crisis in 2008-2009. GDP forecasts for the coming years were also lowered, and unemployment forecasts were raised. Thus, the news background for the British pound was very bad. But it remains a mystery why the market did not pay attention to the strongest rate hike in the last 20 years. The prospects for the British economy are very gloomy, but they are no less pleasant for the European or American economies.

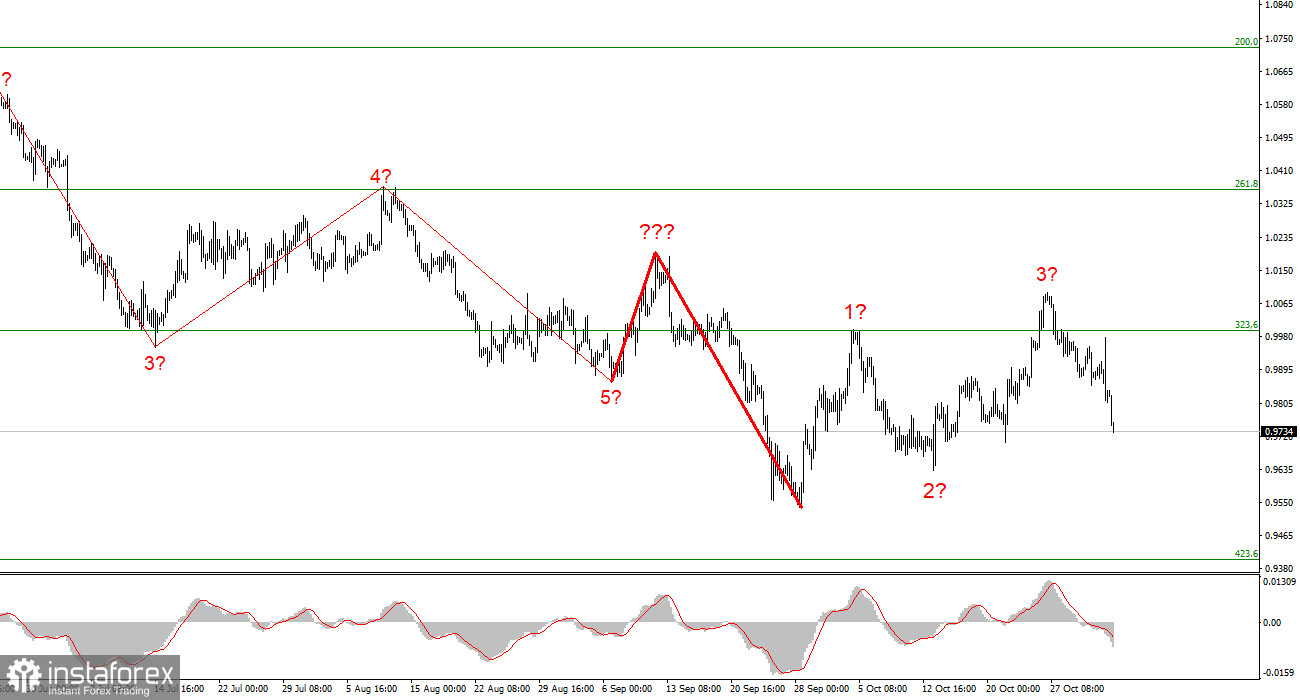

Thus, the market successfully played all three meetings of regulators, but it did not play them as it would be logical following the decisions made and with the rhetoric voiced. Now the wave markings for both instruments will either become much more complicated, remaining corrective, or the construction of new downward trend lines will begin. Choose which of the options is preferable. In recent weeks, the panic in the foreign exchange market has been slowly subsiding, and many felt that the worst for the euro and the pound was already over. Even two days ago, the prospects for the British and the European were quite good. But the market reaction to the meetings of the Bank of England and the Fed turned out to be such that now it is quite possible to expect a fall in both instruments to the annual low and even lower.

Based on the analysis, I conclude that the construction of the upward trend section is completed. At this time, the instrument could start building the first wave of a new descending section, so I advise selling with targets near the estimated 0.9401 mark, which equates to 423.6% by Fibonacci, by MACD reversals "down." The entire trend segment originating after September 28 may take the form a-b-c-d-e. Then we will see another upward wave and a downward trend section.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română