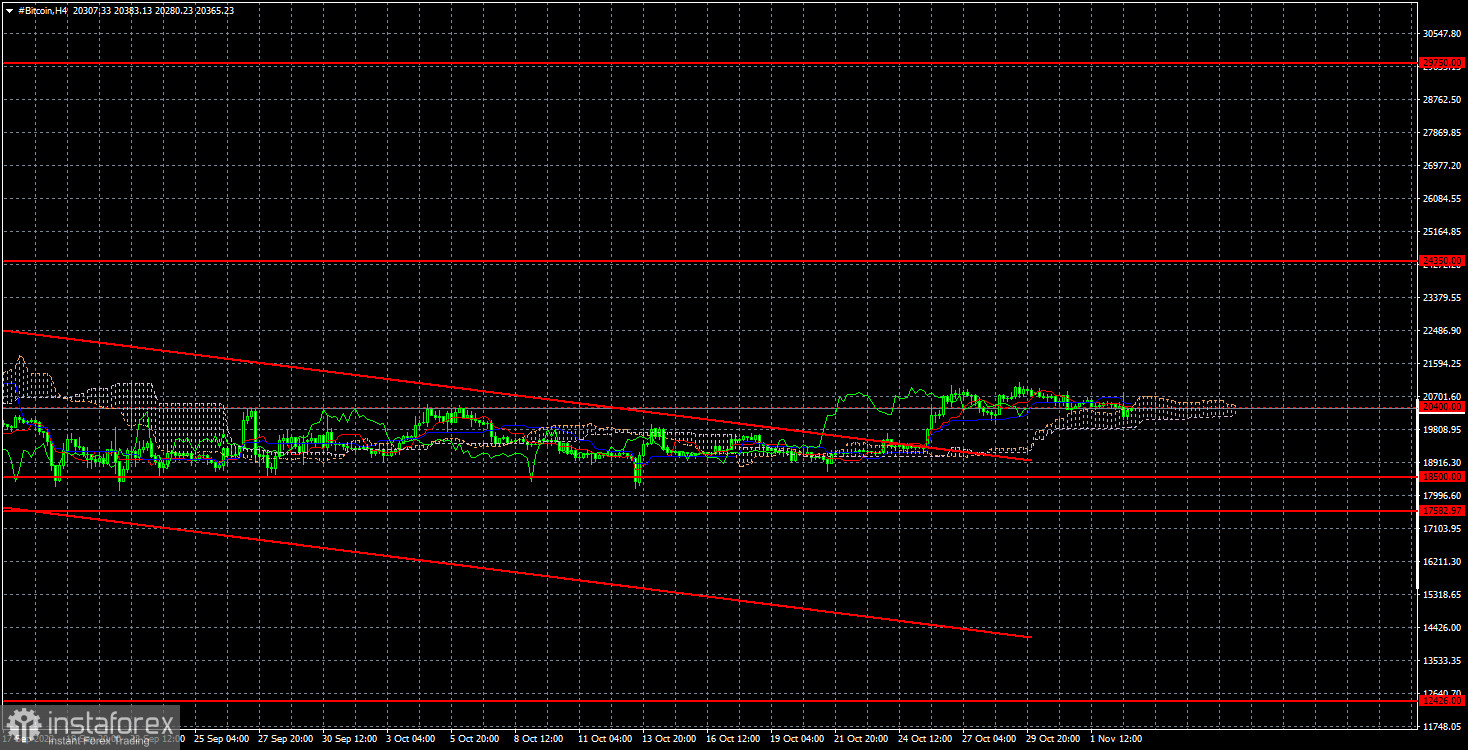

At the 4-hour TF, we increased the scale since the current movements of the cryptocurrency are already quite difficult to consider. They are so weak. Last night, bitcoin had the opportunity to peel off from the $20,400 level, but in the end, we saw only a slight decline, which did not take away from the specified level. Thus, it can be concluded that bitcoin ignored the results of the Fed meeting and remained inside the side channel, and it also continues to trade with minimal volatility. Recall that quotes exceeded the descending channel earlier, so they are not relevant now. The $18,500 was reinforced concrete, and bears cannot overcome it.

We believe that the current "bottom" for bitcoin is not final. One has only to analyze the following thought: if the current "bottom" is the maximum possible fall of bitcoin, then why has it not gone into growth over the past four months? If traders are no longer ready to sell it, a new "bullish" trend will begin; then why doesn't it begin? If current prices are very attractive to investors, why don't institutions rush to buy the first cryptocurrency in the world if there will be no lower prices? We believe it is because many are waiting for an even greater drop in "bitcoin." Whatever forecasts Kiyosaki, Cathie Wood, and Michael Saylor put together, not everyone believes that bitcoin can grow to $100,000 or more. And the growth to $30,000 will hardly interest anyone.

Allianz Chief Economist Mohamed Ali El-Erian believes that the forecasts associated with growth above $100,000 are based on the assumption of full acceptance of bitcoin by the whole world. However, he believes that bitcoin will not become a world currency, will not displace the dollar and other fiat currencies, will not become "digital gold," and will not compete with conventional money. "When people say that bitcoin will reach $100,000, $200,000, or $300,000, they assume the mass distribution of the first cryptocurrency, but this will not happen," El-Erian believes. He also noted that bitcoin is going through a typical cycle. After an increase in price to $69,000 and a significant increase in asset-related products, a recession set in. El-Erian assumes that the first cryptocurrency in the world will show growth, but it will not be as strong as in 2020–2021.

In the 4-hour timeframe, the quotes for "bitcoin" continue to move sideways. We believe the decline will continue in the medium term, but we need to wait for the price to consolidate below the area of $17,582-$18,500. If this happens, the first target for the fall will be a level of $ 2,426. The rebound from $18,500 (or $17,582) can be used for small purchases, but be careful – we still have an absolute flat.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română