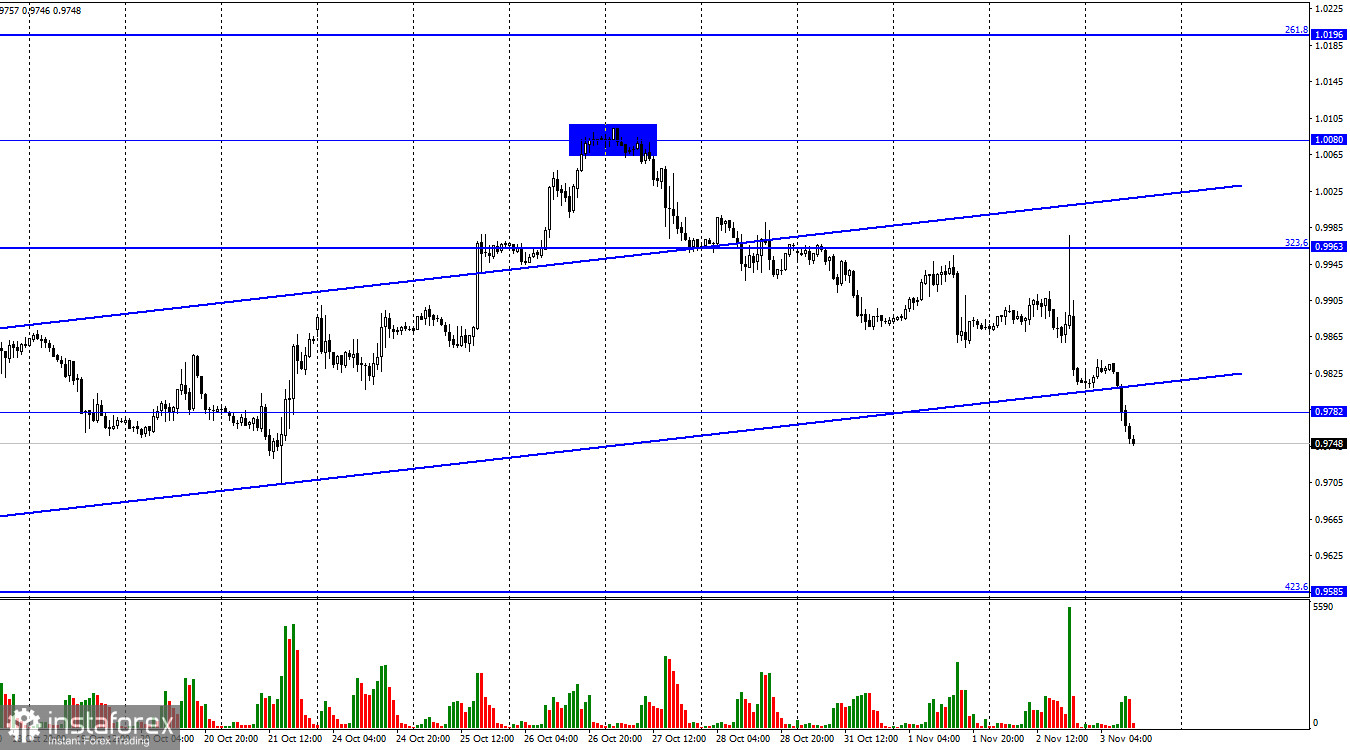

Hi, dear traders! On Wednesday, EUR/USD continued to decline and tested the lower end of the ascending trend channel at the end of the trading day, closing below the channel and the level of 0,9782. Afterwards, the pair continued to slide down early on Thursday. It can continue its downside movement towards the retracement level of 423.6% (0.9585), the pair's 20-year low.

Such a slump of the euro and the rise of the US dollar was triggered solely by the Fed meeting and its aftermath. The 0.75% rate hike, the fourth such move in a row that brought the Fed funds rate to the highest level since 2008, was not unexpected. However, Jerome Powell's statements at the press conference after the meeting sent the US dollar skywards.

At first glance, the Fed chairman struck a more dovish tone, saying that the Fed would consider slowing down the pace of monetary tightening at its next meeting. However, he also said that the Fed funds rate could be increased higher than previously expected. That means that the regulator could for example raise the rate by 0.50% in December and February instead of a 0.50% hike in December followed by a 0.25% move in February. The pace of hikes will be slowed down, but the peak interest rate will be much higher than expected before the meeting yesterday. Therefore, Powell's rhetoric can be considered hawkish. Once again he noted that the FOMC should use all its tools to bring inflation under control. Traders ignored all other events and data releases that happened on Wednesday.

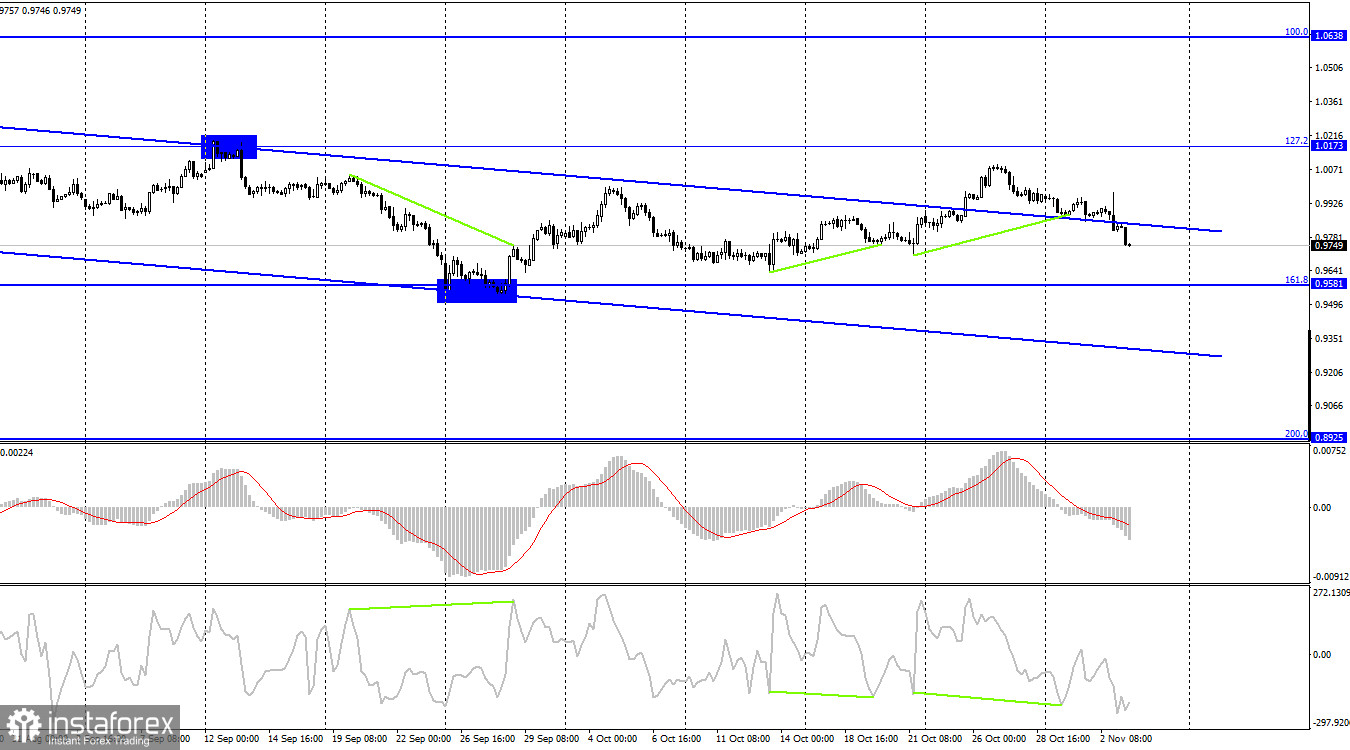

According to the H4 chart, the pair reversed downwards, cancelling the bullish divergence, and began to decline towards the retracement level of 161.8% (0.9581). EUR/USD is very close to resuming its downward trend of the past year or two. If the pair bounces off 0.9581, it could then increase somewhat.

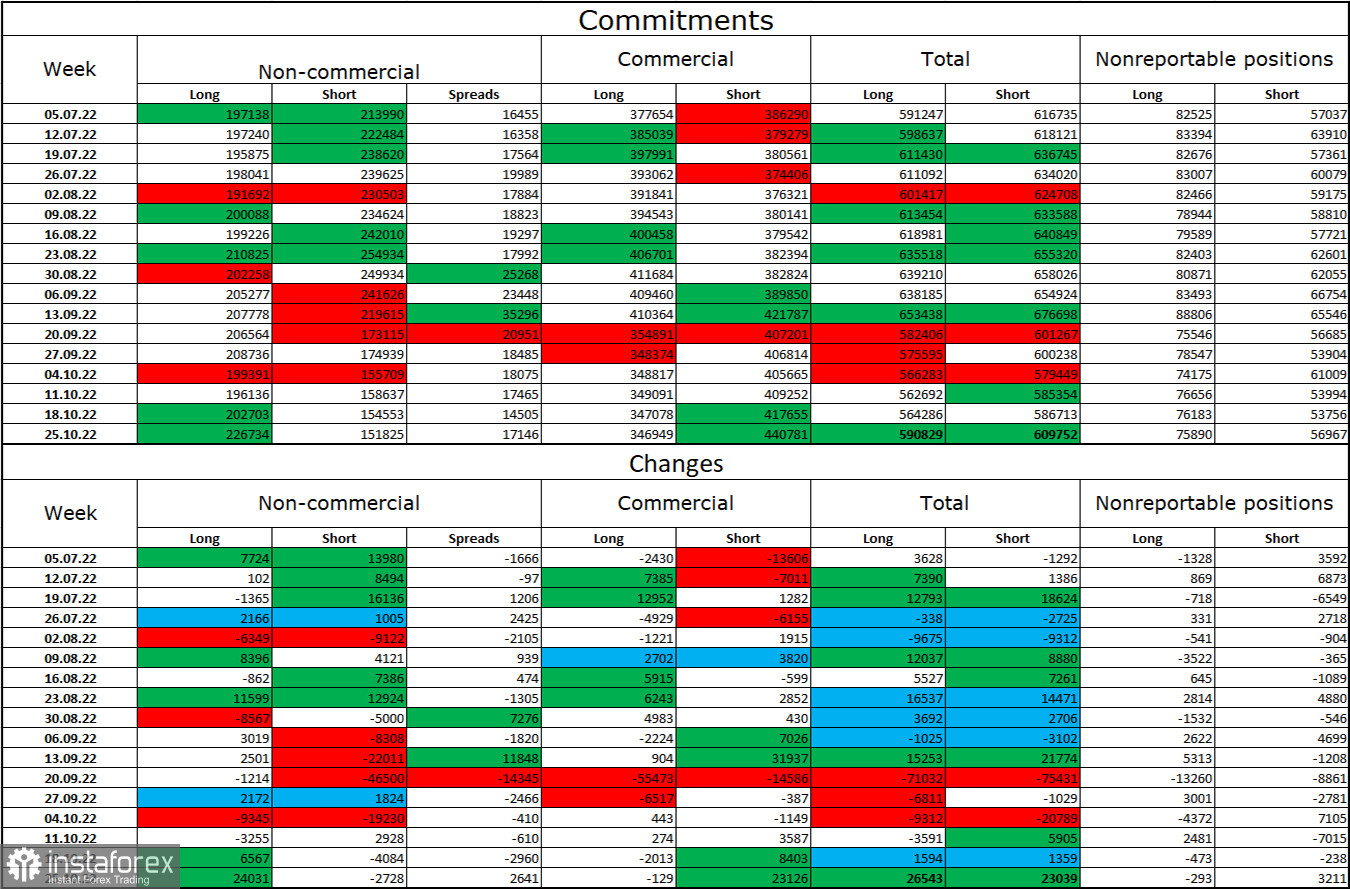

Commitments of Traders (COT) report:

Last week, traders opened 24,031 Long positions and closed 2,728 Short positions, indicating that major players are much more bullish than before. Net long positions now stand at 226,000 against 151,000 net short positions. However, the euro still struggles to advance. Over the past several weeks, EUR's upward movement became more likely, but traders continue to favor USD over the European currency. The euro's performance on the H4 chart will be key - earlier, the pair successfully closed above the key descending channel in this timeframe. Therefore, it could continue to rise in the future. At this point, however, not even the bullish sentiment of traders could help the European currency increase strongly.

EU and US economic calendar

EU - Unemployment Rate (10-00 UTC).

US - Initial Jobless Claims (12-30 UTC).

US - ISM Services PMI (14-00 UTC).

US - Services PMI (13-45 UTC).

There are several important events on the economic calendar today, such as the ISM index. These data releases can influence traders significantly.

Outlook for EUR/USD:

Earlier, traders were recommended to go short on the pair if EUR/USD bounced off 1.0080 with 0.9963 and 0.9782. The pair has hit both these targets and dropped below them. Short positions can be kept open with 0.9585 being the target. New long positions can be opened if the pair bounces off 0.9581 on the H4 chart with 0.9782 being the target.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română