Although the Fed's final decision on monetary policy was expected, and the interest rate was raised by 0.75%, it was no longer of interest to investors as Jerome Powell surprised markets with his statements.

According to the chief of the Federal Reserve, it is too early to think about the easing of rate hikes because inflation is still higher than their target. This is different than the signal given earlier, which is a reduction in growth rate and a possible pause in interest rate increases. Piwell said the central bank will take into account the cumulative tightening of monetary policy, the lag with which it affects economic activity and inflation, as well as economic and financial development.

Consequently, markets are affected, with stocks seeing another negative dynamics. US was the first one to fall, followed by Asia, then Europe. As for dollar, prices rose sharply, adding 0.71% to 112.01 points. Treasury yields also grew 1.39% to 4.118%. If this continues, dollar will rise further, which could push EUR/USD below 0.9800.

Forecasts for today:

EUR/USD

The pair is testing the level of 0.9800. Further pressure will lead to another fall to 0.9715.

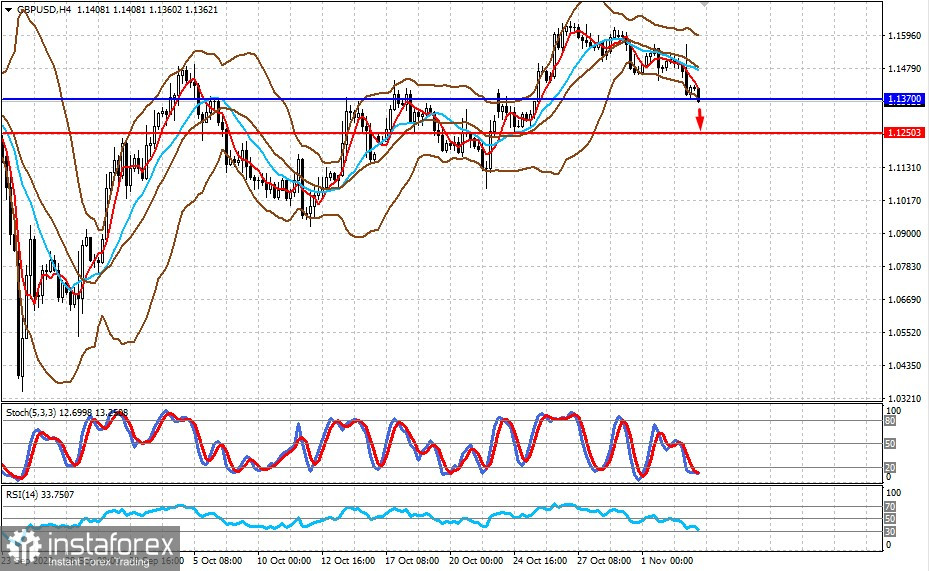

GBP/USD

The pair is testing the level of 1.1370. Further pressure will push the quote to 1.1250.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română