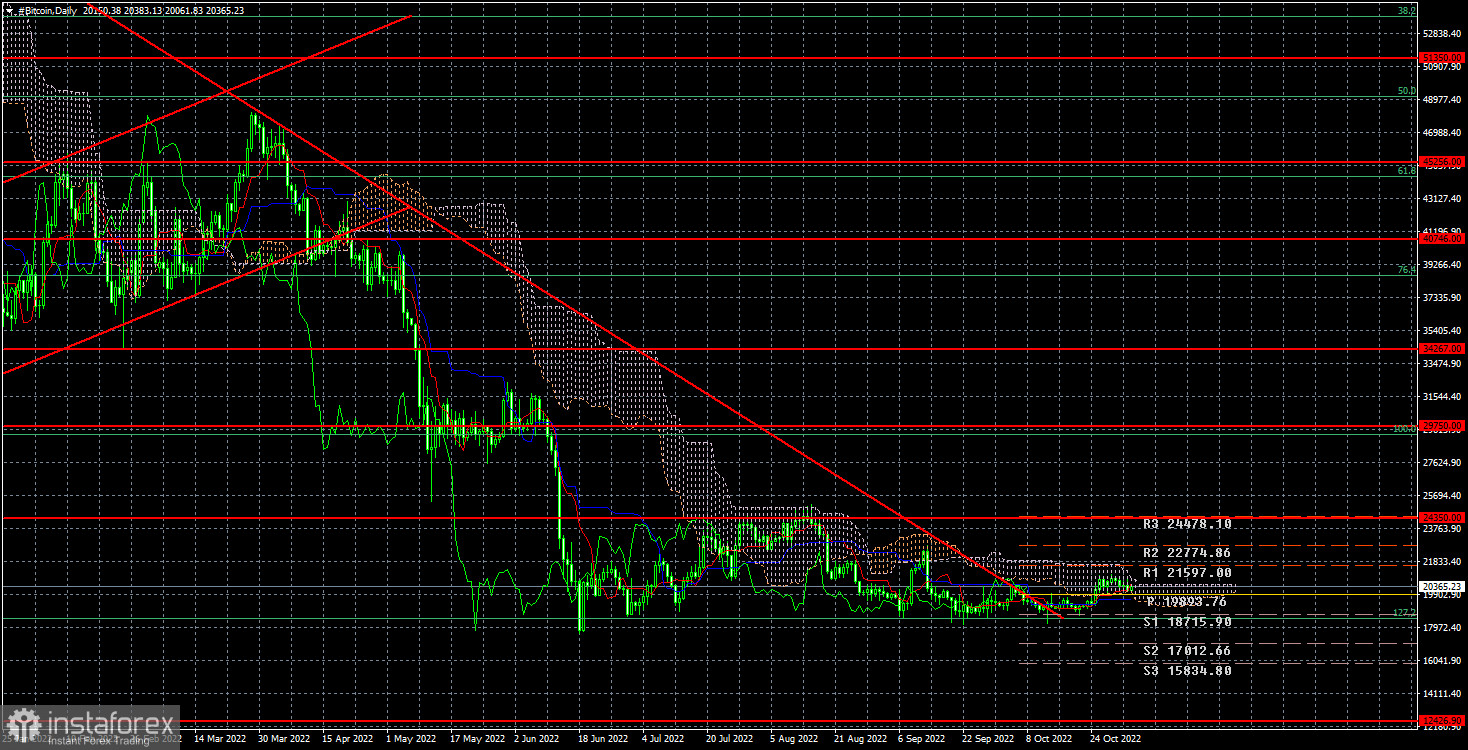

Last week, Bitcoin managed to advance by $2,000 from its previous level of $18,500. However, BTC has remained in the $20,400 area since then. The cryptocurrency is now moving sideways once again, indicating that the technical situation has not changed. The trend line in the D1 time frame is no longer relevant, but because BTC broke above it during a sideways trend, this breakout cannot be a buy signal or a trend reversal signal. The quote remains within the $18,500-$24,350 range and could stay in this range for a long time.

The long-anticipated statement by the Fed chairman Jerome Powell finally happened yesterday. For market players, this event was more important than the interest rate hike itself. The FOMC increased interest rates by 0.75%, matching expectations, but there were questions about the regulator's plans. Jerome Powell unambiguously stated that the Federal Reserve would consider slowing down the pace of rate hikes at its next meeting, but the rate could be increased even higher and at a faster pace depending on the situation. By situation, Powell referred to inflation, which did decrease but only to 8.2%. The Fed chairman also acknowledged the lags with which monetary policy affects economic activity and inflation. Therefore, the next two CPI data releases will be key – they will indicate whether inflation is slowing down under a 4% Fed funds rate or not. If not, the Federal Reserve could decide to move the interest rate up aggressively again.

According to the baseline scenario, there could be two more interest rate hikes in the United States. The Fed could increase the rate by 0.5% and 0.25%, with the Fed funds rate reaching 4.75% at the beginning of 2023. However, Powell signalled the market that interest rates could be moved even higher, as inflation could exceed earlier forecasts made by the Fed in September. Therefore, Fed monetary policy could be tightened even further, and the interest rate could exceed 4.75%, well above the 3.5% expected at the beginning of 2022. This is a bearish factor for BTC.

Bitcoin has been unable to break through the $18,500 level (the Fibo level of 127.2%) for the past several months. It is unclear how much time BTC will remain in the horizontal channel. In this situation, traders should not rush in to open positions until the cryptocurrency breaks out of the trend channel. A breakout below $18,500 will open the way towards $12,426. Small-sized long positions can be opened if BTC bounces off $18,500 upwards.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română