US stock index futures started the day in positive territory but then declined to Tuesday's closing levels ahead of the Federal Reserve meeting. The dollar index declined slightly, and gold rose.

US and European futures are anticipating serious volatility amid signs of slowing global growth and further tightening monetary policy by key central banks. The S&P 500 declined 0.1%, while the tech-heavy NASDAQ dropped 0.2%. The industrial Dow Jones remains near zero.

At the moment, traders are weighing mixed economic data to understand how the US Central Bank will act, which is likely to raise interest rates by 75 basis points today for the fourth time in a row. The European Central Bank raised its rates last week, and a similar decision is expected from the Bank of England this Thursday.

Treasury bond yields also remained virtually unchanged, and the yen strengthened, indicating that traders expect a moderate impact on this currency after the Fed's actions.

The focus today will be on the comments of Fed Chairman Jerome Powell. The continuation of the recent rally in stocks depends on whether the Fed will support the "reversal rate," as well as on the optimism of the market on this issue. However, many economists warn that expectations that the Central Bank will change course are extremely erroneous. If the Fed continues to adhere to a strict policy, the pressure on risky assets, including the stock market, will increase significantly. This will lead to a new major sale.

As the latest data showed, manufacturing activity in the eurozone fell to its lowest level since 2020, and wheat prices declined after Russia agreed to renew a deal allowing the safe export of Ukrainian crops.

Shares of Advanced Micro Devices Inc. rose due to the expansion of its presence in the server processor market, which helped offset the decline in the personal computer market last quarter. Shares of Apple Inc. fell after China ordered a seven-day lockdown of the territory around the main plant of Foxconn Technology Group in Zhengzhou, which will seriously reduce the supply of the world's largest iPhone factory.

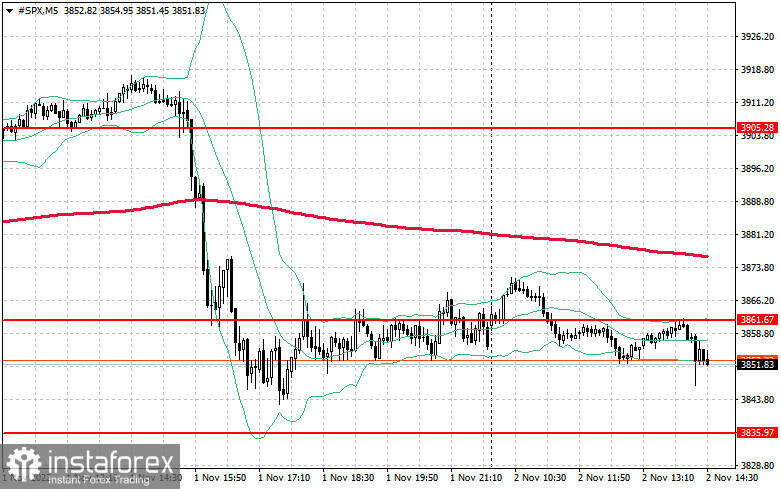

As for the technical picture of the S&P 500, after yesterday's decline, demand for the index remains rather sluggish. The main task for buyers now is to protect the support of $3,835. As long as trading is conducted above this level, we can expect continued demand for risky assets, especially if the Fed loosens its grip. This will also create good prerequisites for further strengthening the trading instrument and returning $3,861 under control, just above which $3,905 and $3,942 are located. Only such a scenario will strengthen the hope for an upward correction with an exit from the resistance of $3,968. The furthest target will be the $4,000 area. In the case of a downward movement, buyers are obliged to declare themselves in the region of $3,835. A breakdown of this range will quickly push the trading instrument to $3,808 and open up the possibility of updating the support of $3,773.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română