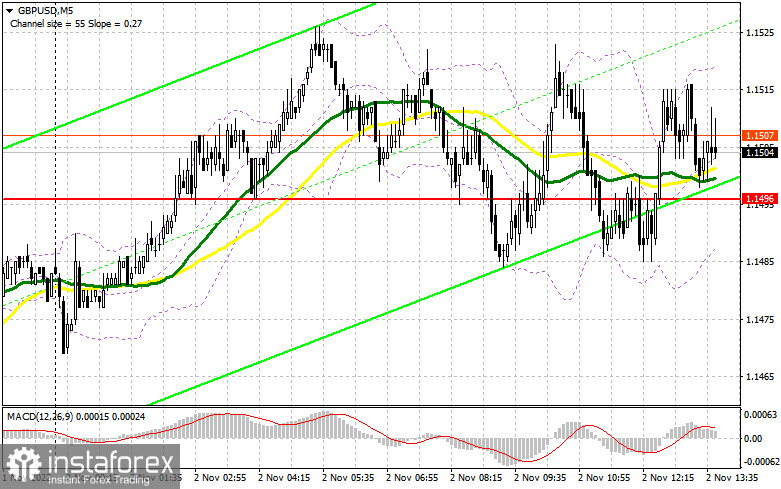

In my morning forecast, I paid attention to the 1.1496 level and recommended entering the market there. Let's look at the 5-minute chart and figure out what happened. There was no data, so there was nothing to sell the pound below 1.1496. The reverse test after the breakdown did not occur, and the bulls quickly returned 1.1496 under their control. In the afternoon, the technical picture underwent minimal changes.

To open long positions on GBP/USD, you need the following:

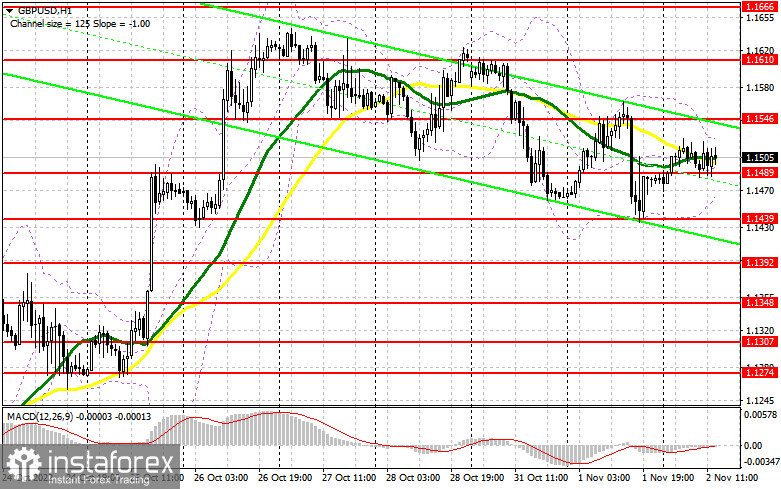

If the Fed announces the previous strategy: 0.75% today, 0.75% in December, and 0.5% at the beginning of next year – this is a bullish scenario for the dollar, and it is better to continue betting on its strengthening and the decline of the pound in the near future. If the option is announced: 0.75% today, 0.5% in December, and 0.25% at the beginning of next year, this is a direct signal to buy the pound to build a new bull market. Until the publication of the results of the committee meeting, it is unlikely that any statistics will matter. Considering that the strategy for the second half of the day was practically not revised, it is best to start from the level of 1.1489. A false breakdown will give a buy signal with a return to the resistance level of 1.1546. As I said, without this area, it will be difficult to count on the further building of the bull market and updating the monthly maximum. A breakdown of 1.1546, as well as a reverse test from top to bottom, will open the way to a maximum of 1.1610, and then it will be close to the resistance of 1.1666, where it will become more difficult for buyers to control the market. A more distant target will be the 1.1722 area, which will lead to a fairly large capitulation of sellers - I recommend fixing profits there. If GBP/USD falls and there are no buyers at 1.1489, we may reach a new low of 1.1439, as formed by yesterday's results. Therefore, do not rush to enter the market. Only a false breakout at 1.1439 will ensure the presence of major players. It is possible to open long positions on GBP/USD immediately for a rebound from 1.1392, or around the minimum of 1.1348, with the aim of correction of 30-35 points within a day.

To open short positions on GBP/USD, you need the following:

The bears are still sitting on the sidelines and waiting for the results of the meeting. Data on the US labor market may shake up prices a little, but it is unlikely that something global will happen. Sellers need to defend the resistance at 1.1546 with all their might since they can completely say goodbye to the downward correction if they miss it. In the case of GBP/USD growth against weak US statistics, only the formation of a false breakdown will give a sell signal based on the return of pressure on the pound and its repeated correction to the nearest support of 1.1489. A breakout and a reverse test from the bottom up of this range will already give an entry point for sale with an update of the 1.1439 minimum. A more distant target will be the 1.1392 area, where I recommend fixing profits. The market will remain balanced with the option of GBP/USD growth and the absence of bears at 1.1546 in the afternoon. In this case, it will be possible to count on an upward movement to the maximum of 1.1610. Only a false breakout at this level forms an entry point into short positions in the expectation of a new downward trend of the pair. If there is no activity there, there may be a jerk up to the maximum of 1.1666, where I advise selling GBP/USD immediately for a rebound, counting on the pair moving down by 30-35 points within a day.

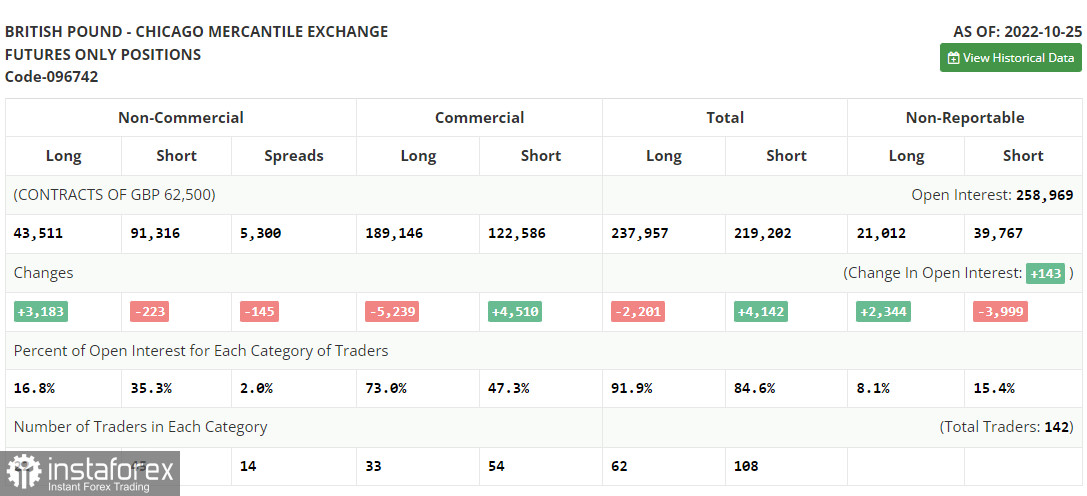

The COT report (Commitment of Traders) for October 25 recorded a reduction in short positions and an increase in long ones. Political changes in the UK are playing to the advantage of pound buyers. Still, many are waiting for how the Bank of England will behave about rates and a new economic program from British Prime Minister Rishi Sunak. Do not forget that the pound, as a risky asset, largely reacts to the decisions of the Federal Reserve System on interest rates. A committee meeting will be held this week, where the rate will be increased by 0.75%, which may weaken the position of GBP/USD and lead to a larger decline. However, only the Fed's commitment to maintaining a super-aggressive policy in the near future will be able to change the upward trend in the pound. Otherwise, observing the next pullback of the pound will be possible. The latest COT report indicates that long non-commercial positions increased by 3,183 to 43,511. In contrast, short non-commercial positions decreased by 223 to 91,316, which led to a slight decrease in the negative value of the non-commercial net position to -47,805 versus -51,211 a week earlier. The weekly closing price rose to 1.1489 against 1.1332.

Signals of indicators:

Moving Averages

Trading is conducted around the 30 and 50-day moving averages, which indicates market uncertainty.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of growth, the upper limit of the indicator around 1.1525 will act as resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română