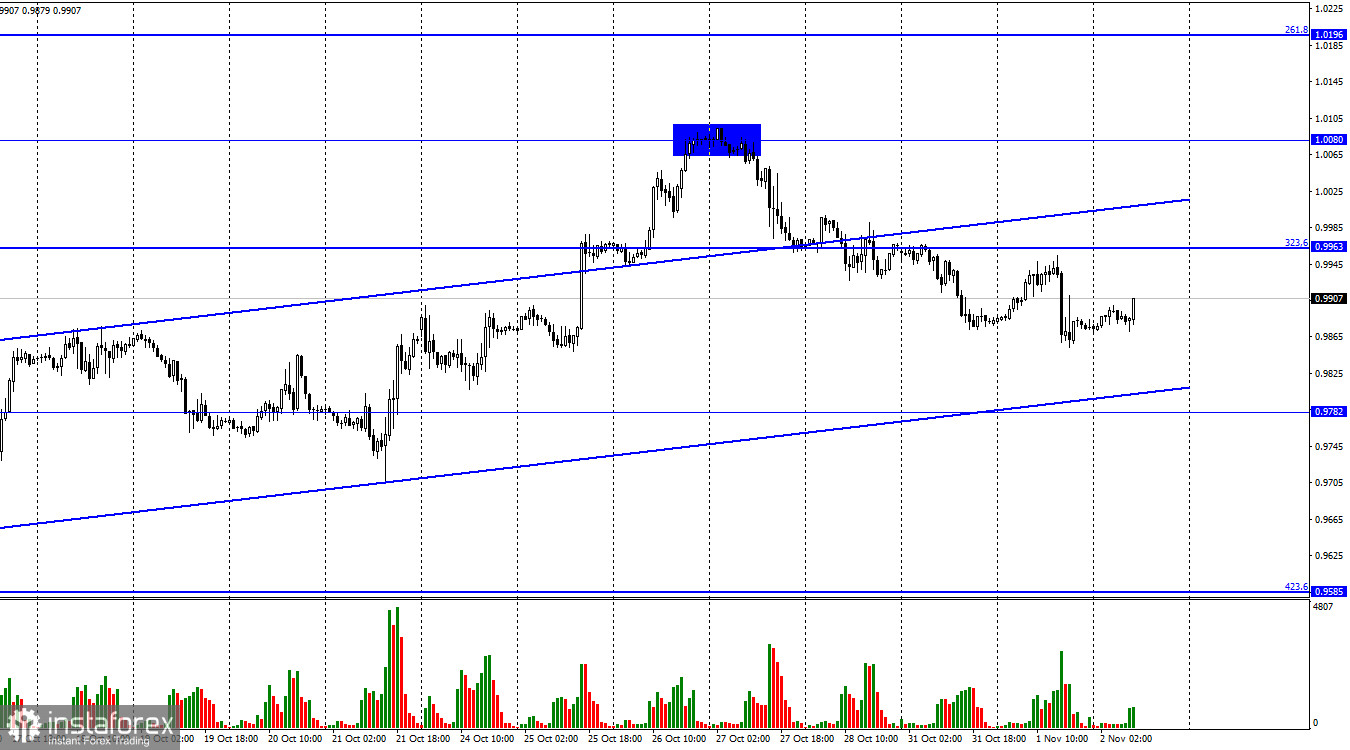

Hi, dear traders! On Tuesday, EUR/USD reversed upwards and rose slightly towards the retracement level of 323.6% (0.9963). However, the pair reversed downwards when only a few points separated it from the retracement level. The quote then dropped below yesterday's low. EUR/USD remains within the ascending trend channel, indicating that the sentiment of traders remains bullish. If the pair settles below the trend channel, it will make further downside movement towards the next Fibo level of 423.6% (0.9585) more likely.

The only data release that could have pushed up the US dollar in the second half of Tuesday was US business activity data. In October, the S&P manufacturing PMI declined to 50.4 points from 52 in, while the more important ISM manufacturing PMI decreased to 50.2 points from 50.9. However, traders expected the indexes to drop even further, which perhaps gave support to the dollar yesterday. However, there was another favorable data release for the US dollar – JOLTS open vacancies reached 10.7 million, exceeding the expected increase to 10 million job openings. The US is not experiencing severe unemployment at the moment, with the number of people out of job remaining at the lowest level in 50 years. The labor market remains quite strong, which possibly supported EUR/USD bears.

The long-anticipated meeting of the Federal Reserve will happen today. The euro's performance against the US dollar depends more on the ECB than the Fed. The Federal Reserve's tightening cycle is steadily approaching its limit, while the European Central Bank is yet to increase the rate to the level that could slow down inflation in the EU even slightly. Yesterday, Bundesbank President Joachim Nagel said that he would back further aggressive monetary tightening. If other ECB board members support his position, the ECB interest rate could increase strongly for quite a long period of time. This would favor EUR/USD bulls.

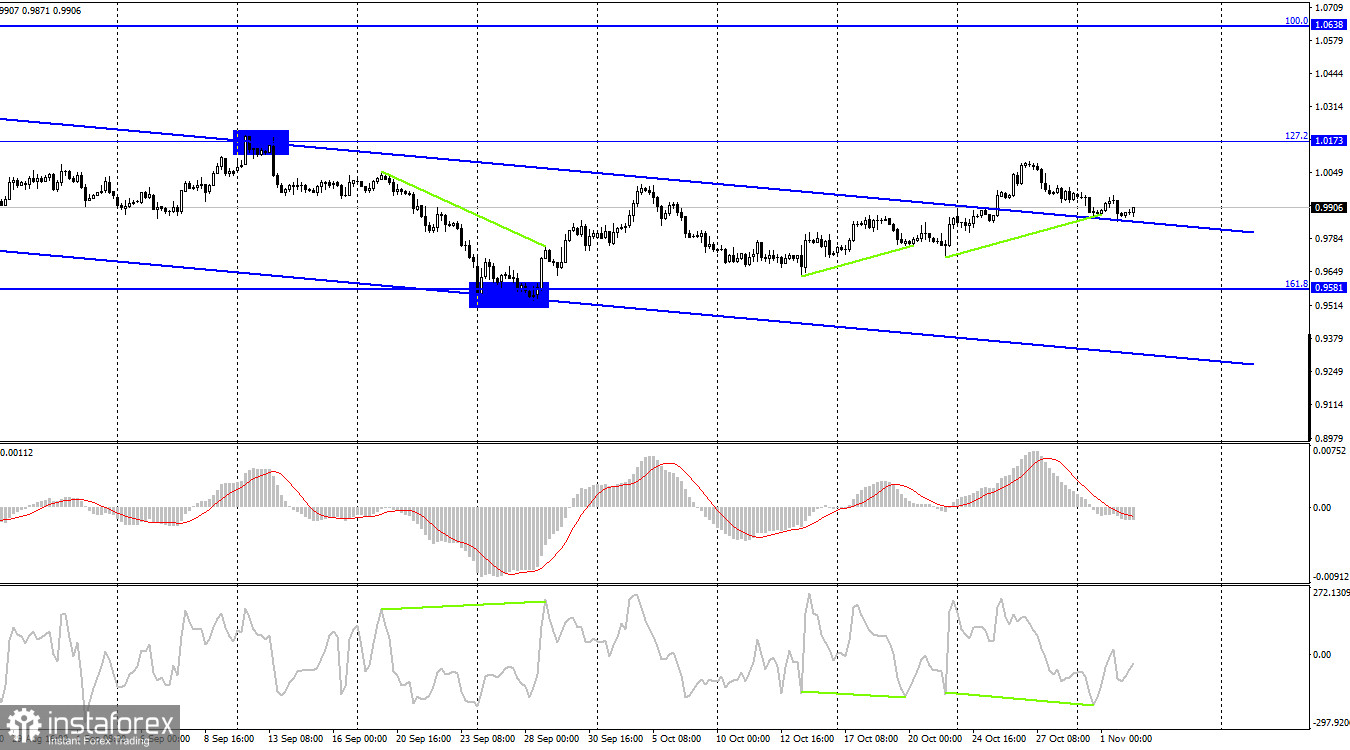

According to the H4 chart, the pair has settled above the descending channel. From there, it could continue to rise towards the retracement level of 127.2% (1.0173). This is a key moment of this month – the overall trend on the chart is now bullish. EUR/USD has also formed a bullish CCI divergence, making further upside movement of EUR/USD more likely.

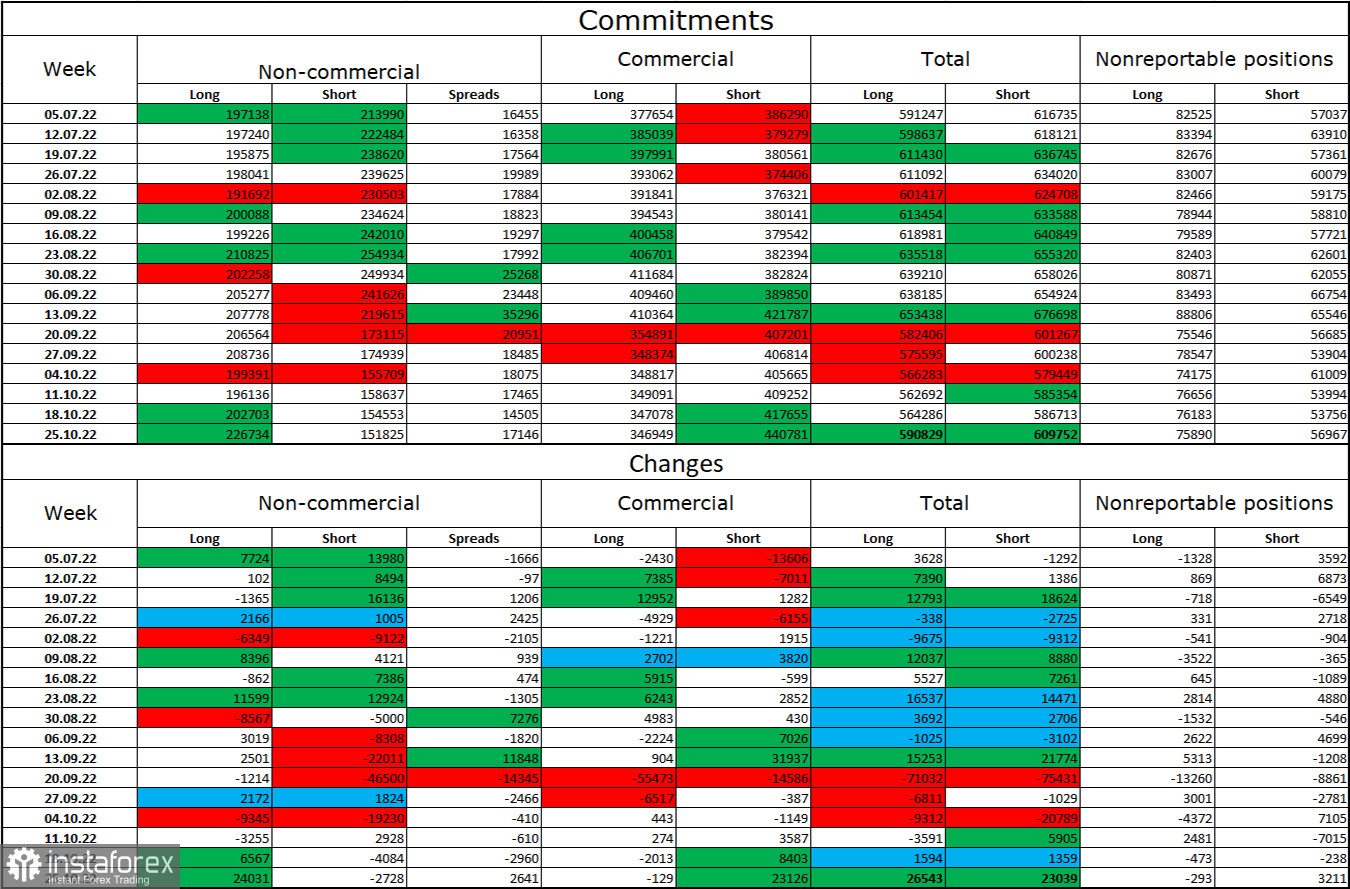

Commitments of Traders (COT) report:

Last week, traders opened 24,031 Long positions and closed 2,728 Short positions, indicating that major players are much more bullish than before. Net long positions now stand at 226,000 against 151,000 net short positions. However, the euro still struggles to advance. Over the past several weeks, EUR's upward movement became more likely, but traders continue to favor USD over the European currency. The euro's performance on the H4 chart will be key - earlier, the pair successfully closed above the key descending channel in this timeframe. Therefore, it could continue to rise in the future. At this point, however, not even the bullish sentiment of traders could help the European currency increase strongly.

US and EU economic calendar:

EU - Manufacturing PMI (09-00 UTC).

US - ADP Non-Farm Employment Change (12-15 UTC).

US - FOMC Rate Decision (18-00 UTC).

US - FOMC Press Conference (18-30 UTC).

Besides the meeting of the Federal Reserve, there are at least two more important events today. Overall, the events on the economic calendar can influence traders very strongly.

Outlook for EUR/USD:

Earlier, traders were recommended to go short on the pair if EUR/USD bounced off 1.0080 with 0.9963 and 0.9782. The pair has already hit its first target and could hit the second one later. New long positions can be opened if the pair bounces off 0.9872 on the H1 chart with 0.9963 and 1.0080 being targets.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română