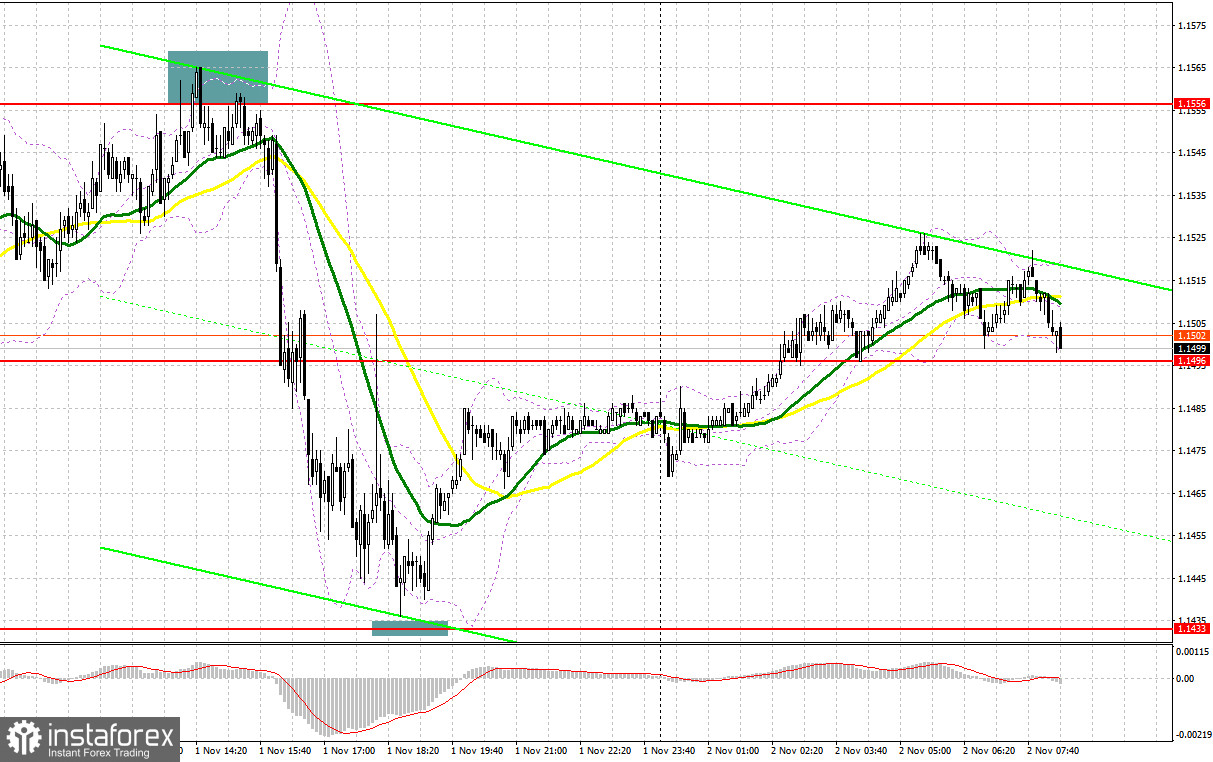

Yesterday there was only one signal for entering the market. Let's take a look at the 5-minute chart and see what happened. Earlier, I asked you to pay attention to the 1.1496 level to decide when to enter the market. Data on the manufacturing PMI index turned out to be better than economists' forecasts, which kept the balance in the market. We missed the nearest support at 1.1496 by just a few points, which did not allow us to buy the pound. The same can be said about the nearest resistance at 1.1556, which also was not tested in the morning. However, there was a false breakout at 1.1556 in the afternoon, which led to an excellent entry point for short positions and the fall of the pound by more than 100 points to the 1.1433 area. Before it was tested, this area lacked just a couple of points, so it was not possible to enter a long position there.

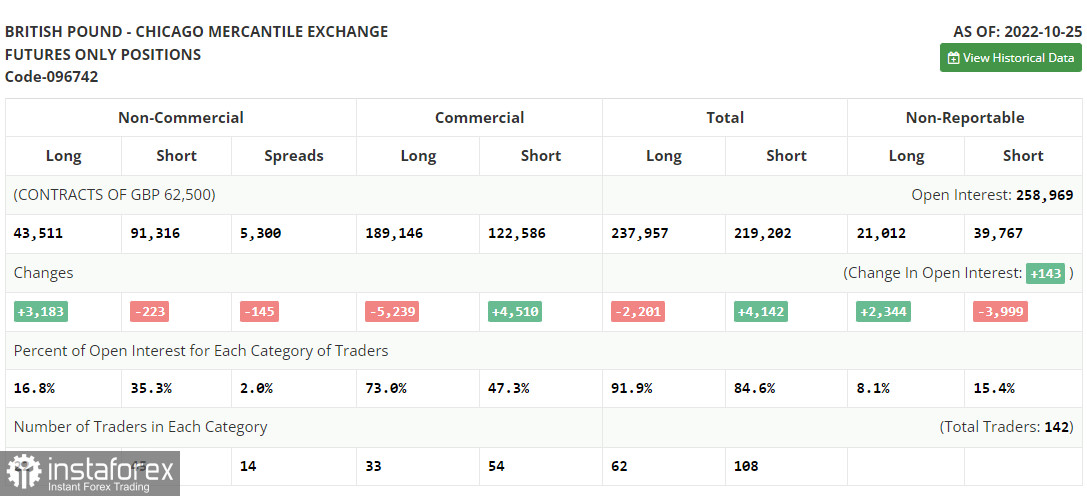

COT report:

Before analyzing the technical picture of the pound, let's look at what happened in the futures market. The Commitment of Traders (COT) report for October 25 showed that short positions decreased while long ones had grown. Political changes in the UK are playing on the bulls' side, but now many are waiting for how the Bank of England will behave in relation to rates, as well as a new economic program from British Prime Minister Rishi Sunak. Do not forget that the pound, as a risky asset, largely reacts to the Federal Reserve's decisions on interest rates. The committee will hold a meeting this week, where the rate will be raised by 0.75%, which may weaken the position of GBP/USD and lead to a larger decline. However, only the Fed's commitment to maintaining a super-aggressive policy in the near future will be able to change the upward trend in the pound. Otherwise, it will be possible to observe the next pullback of the pound up. The latest COT report indicates that long non-commercial positions increased by 3,183 to the level of 43,511, while short non-commercial positions decreased by 223 to the level of 91,316, which led to a slight decrease in the negative value of the non-commercial net position to -47,805 versus -51,211 a week earlier. The weekly closing price rose to 1.1489 against 1.1332.

When to go long on GBP/USD:

Today there are no statistics on the UK, which may put pressure on the British pound in the short term. To maintain the upward potential, the bulls need to show themselves in the area of the nearest support at 1.1496. A false breakout at this level, by analogy with what I analyzed above, will lead to a buy signal with a re-exit at 1.1556, which we failed to break through yesterday. Without this level, it will be difficult for the bulls to build sharp growth. We can only talk about continuing the upward correction if the pair moves higher, and a breakdown of 1.1556, together with a test, will open the way to a high of 1.1610, where it will become more difficult for the bulls to control the market. The farthest target is located at 1.1666 and I recommend taking profit there. However, we can only expect this kind of growth after the Fed meeting, which we will talk about in the afternoon.

If the bulls do not cope with the tasks set and miss 1.1496, and this level was surpassed yesterday, then the pair will be under pressure. If this happens, I recommend postponing long positions to 1.1439. It will be wise to go long after a false breakout. It is also possible to buy the asset just after a bounce off from 1.1392, or even lower - around 1.1348, expecting a rise of 30-35 pips.

When to go short on GBP/USD:

Bears are in control of the market, achieving daily renewal of local lows. It is important to protect the resistance at 1.1556, which they did well yesterday. They should not release the pair outside this range, as this will provoke new longs, allowing the bulls to strengthen their position in the market. In case the pair grows, a false breakout should be formed at 1.1556 and you can open shorts, counting on the return of the bearish trend and a fall to the nearest support at 1.1496, the breakdown of which will take place any minute. A breakthrough and upwardly test of this level will provide an entry point and an update of the low of 1.1439. The farthest target will be located at 1.1392, where I recommend taking profits.

In case the pair grows and bears fail to protect 1.1556, the bulls will continue to enter the market, counting on building a new upward trend to the area of the weekly high at 1.1610. A false breakout at this level will provide an entry point into shorts with the goal of moving down. If bears are not active there, then we might see a surge up to the high of 1.1666. Therefore, I advise you to go short after a rebound, expecting a decline of 30-35 pips.

Indicator signals:

Trading is performed below the 30- and 50-day moving averages, which indicates problems for bulls on the pound.

Moving averages

Note: The period and prices of moving averages are considered by the author on the one-hour chart, which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

A break of the upper limit of the indicator in the 1.1556 level will lead to a new wave of growth for the pound.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română