ECB President Christine Lagarde's speeches after the press conference on October ECB meeting outcome and at the start of November were completely different. At the press conference, Lagarde spoke about slowing down economic activity, which investors took as a signal for slower restrictive monetary policy. During her speech at the beginning of November, the ECB president said that the goal was clear and she had not reached it yet. Consequently, first the EUR/USD pair fell from its 6-week highs and then it returned above 0.99.

According to Christine Lagarde, the interest rate cap in the current cycle should guarantee that inflation returns to the 2% target. Although the ECB president declined to name it, she said that the cost of borrowing should rise more significantly. Apparently, Lagarde did not like how the market reacted to her press conference and decided to eliminate mistakes.

However, it is not easy. Currently, investors expect the Fed to announce its decision on the federal funds rate. The November 75-basis-point rate hike does not raise deep concern in the markets. The key aspect is the Fed's next plans, mainly how much it will raise borrowing costs in December? That question is extremely relevant!

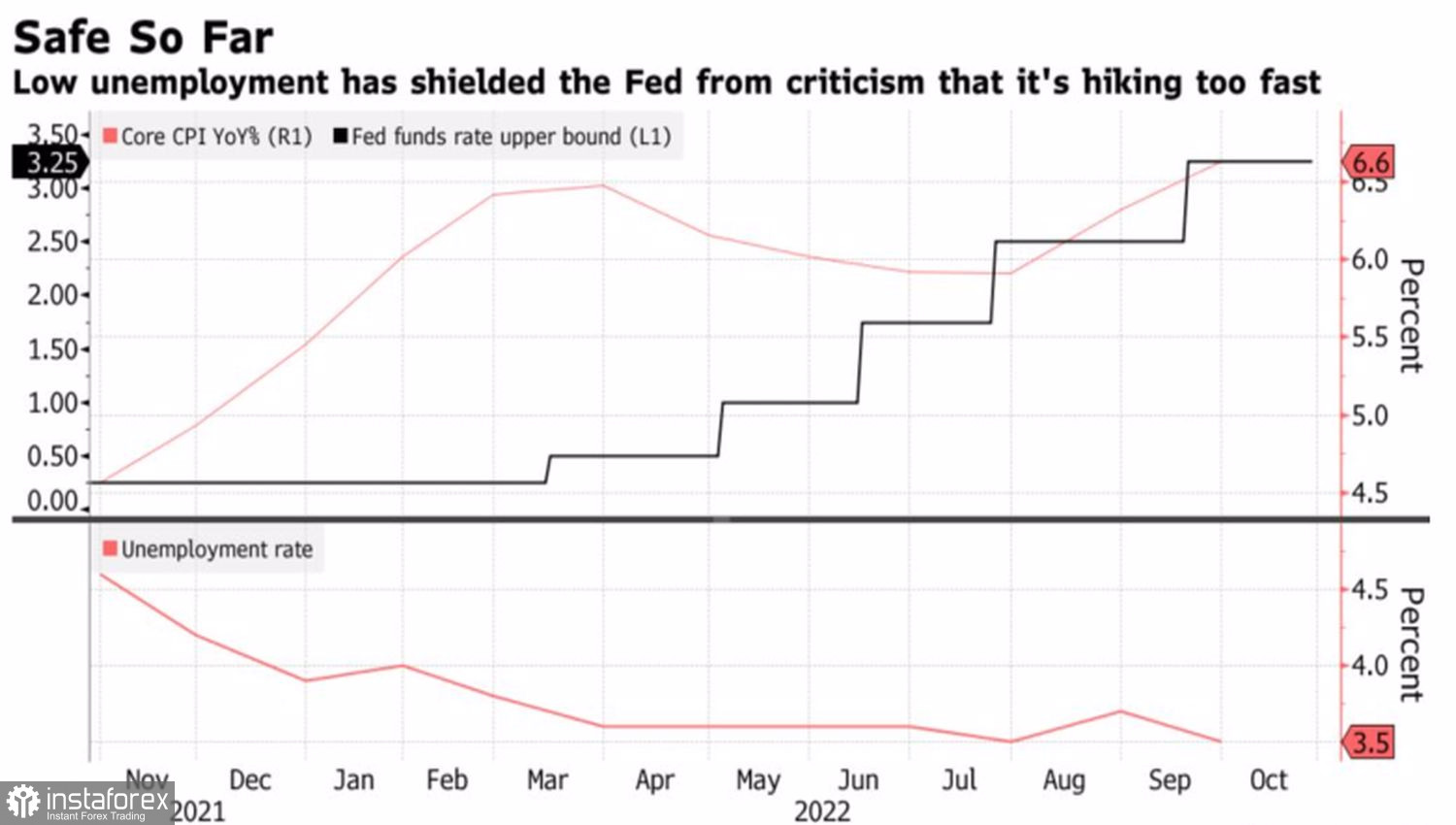

US inflation, unemployment, and Fed rate dynamics

A 50-basis-point rate hike is favored by the slowdown in certain inflation indicators, including consumer prices, worsening macro statistics, democrats, and the time lag between monetary tightening and the cooling economy. Obviously, an overly aggressive monetary policy will trigger a recession, which would be negative for the Democratic Party led by US President Joe Biden. Therefore, some members of US Congress urge Jerome Powell not to tighten monetary policy.

On the contrary, supporters of a 75-basis point rate hike in December point to the experience of Paul Volcker. He adopted an aggressive stance on the US economy which faced two recessions. Consequently, Volcker got inflation under control. If you start focusing on negative signals, it is almost impossible to achieve price stability. Strong measures are necessary. The Fed has taken them so far. However, any sign of a slowdown in monetary policy tightening could hit the US dollar hard.

According to Citi, even if Jerome Powell gives a signal to slow down the rate hike, which will initially cause an increase in risk appetite and the EUR/USD rally, there is no need to be mistaken. A slowdown in the Fed's monetary policy tightening does not mean a pause or reversal. The cycle will continue and the major currency pair will soon continue a downtrend.

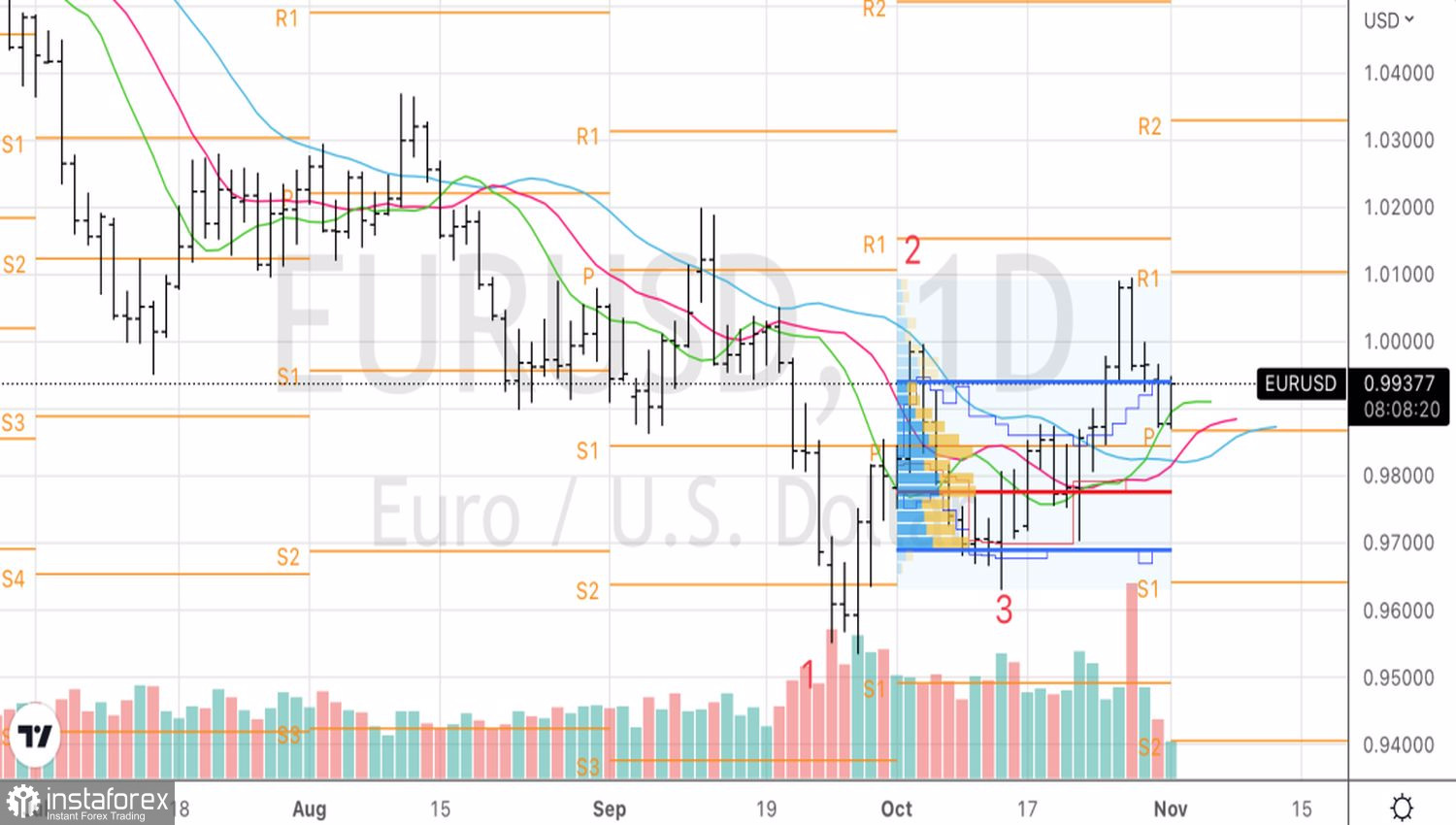

Technically, the EUR/USD daily chart shows that a short-term consolidation is highly probable ending with a significant growth or collapse of the quotes. Its range is likely to be 0.986-1.000. It is advisable not to enter the market until the FOMC meeting results are announced. Then it is recommended to focus on the pair's breakthrough.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română