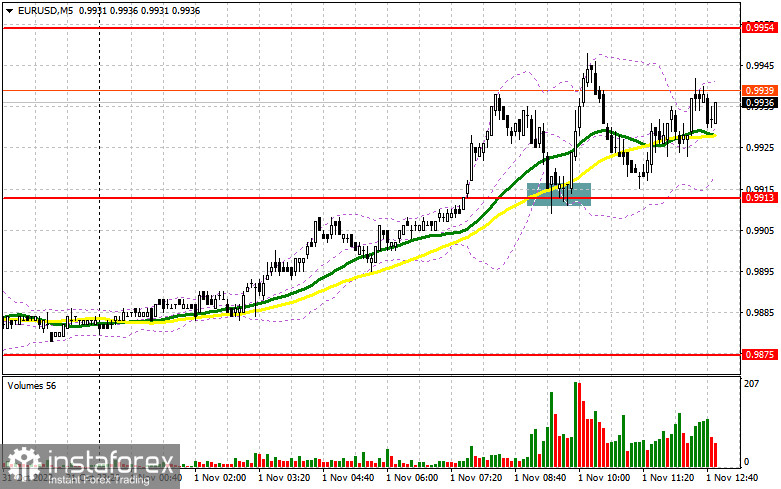

In my morning review, I mentioned the level of 0.9913 and recommended entering the market from there. Let's analyze the pair on the 5-minute chart. A decline and a false breakout at this level created a great entry point for going long. As a result, the pair advanced by more than 35 pips. Yet, it still failed to reach the nearest resistance of 0.9954. In the afternoon, the technical picture remains unchanged, just as the strategy itself.

For long positions on EUR/USD:

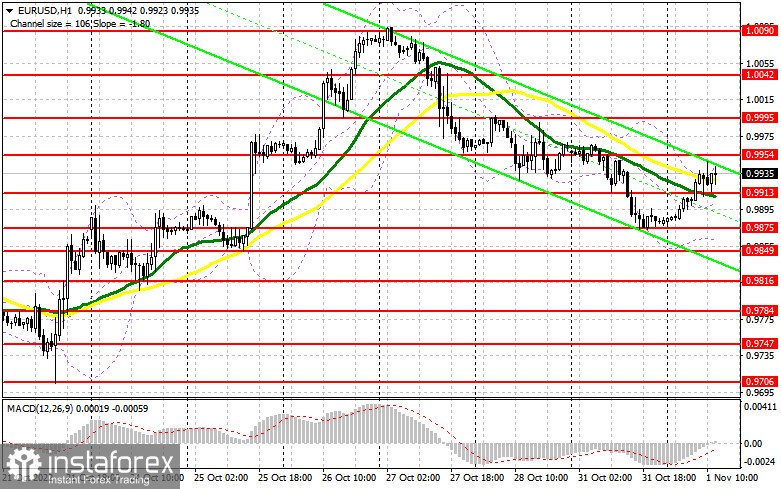

Today, traders should pay attention to an important ISM Manufacturing PMI report. This data may shape the intraday trajectory of the pair. If the indicator drops below 50, the US dollar will come under more pressure which may result in a rapid surge of the pair to the level of 0.9954. In case the actual reading beats the forecast, it is better to wait until EUR/USD starts to decline toward the nearest support at 0.9913. This level was successfully tested in the first half of the day. A false breakout at this level will generate a buy signal and clear the way further to the upside. This will allow the quote to head for the resistance area of 0.9954. A breakout and a downward retest of this range will pave the way for the pair to the high of 1.0000 if the US data comes in worse than expected. This in turn will inspire bulls to push the quote higher to 1.0042. The level of 1.0090 will serve as the highest target where I recommend profit taking. In case EUR/USD declines in the New York session and bulls are idle at 0.9913, the pressure on the pair will increase as bulls will continue to take profit ahead of the important Fed meeting. In this scenario, you can buy the euro only after a false breakout at the support of 0.9875. Going long on EUR/USD right after a rebound is possible at the support level of 0.9849 or near the low of 0.9816, bearing in mind an upside intraday correction of 30-35 pips.

For short positions on EUR/USD:

Bears failed to return the price below 0.9913 which can be a problem in the future unless they succeed to do it later in the day. Trading below 0.9954 allows bears to keep the pair under pressure. However, this factor is unlikely to cause a large sell-off in the euro without proper drivers. A good moment to open short positions will be a false breakout of the resistance at 0.9954. This will indicate that large market players have joined the market, anticipating a fall in EUR/USD after another rate hike by the Fed. The US regulator will announce its decision on Wednesday. If so, the pair may retest the 0.9913 level below which it failed to break earlier. Consolidation of the price and an upward retest of 0.9913 will form an additional signal to sell the euro. In this case, stop-loss orders set by the bulls will be triggered, and the price will drop to 0.9875 where I recommend profit taking. The price may break through this level only if the US data turns out to be positive. In case EUR/USD moves up in the course of the North American session and bears are idle at 0.9954, the pair may surge to the upside and approach the parity level. If this happens, it is recommended to wait until the quote hits 1.0000. A false breakout at this level will create a new entry point for going short. Selling EUR/USD right after a rebound will be possible from the high of 1.0042 or 1.0090, keeping in mind a downward correction of 30-35 pips.

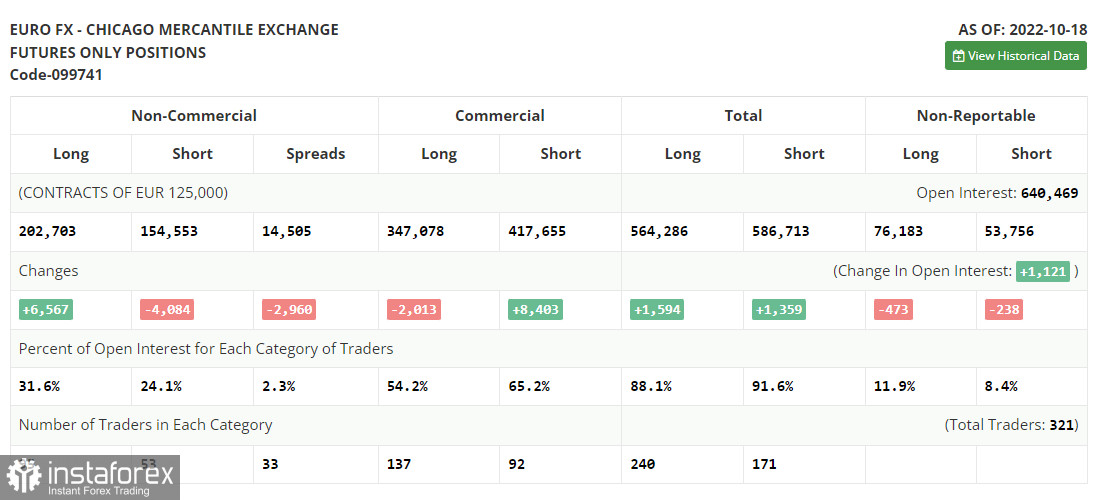

COT report

The Commitment of Traders report for October 18 showed a rapid fall in the number of long positions and a jump in the short ones. Obviously, the US dollar is losing its shine among investors as more signs point to the looming recession amid ultra-aggressive monetary policy by the Fed. The regulator is likely to maintain this pace of monetary tightening. Last week, the data revealed that the US housing market continued to contract. The manufacturing and services PMI also posted a decline. This naturally weakens the US dollar against the euro. Notably, the demand for the European currency is rising as the ECB promises to continue its rate-hiking cycle in an attempt to tackle inflation. By the way, the inflation rate for September slowed down and stayed below 10.0%. According to the COT report, the long positions of the non-commercial group of traders increased by 6,567 to 202,703 while short positions dropped by 4,084 to 154,553. At the end of the week, the non-commercial net position remained positive at 48,150 after hitting 37,499 a week earlier. This indicates that investors are benefiting from a cheaper euro and keep buying it while it is trading below parity. They might also be accumulating long positions as they hope that the pair will start to recover sooner or later. The weekly closing price advanced to 0.9895 from 0.9757.

Indicator signals:

Moving Averages

Trading near the 30- and 50-day moving averages indicates market uncertainty.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

In case of a downward movement, the lower band of the indicator at 0.9860 will serve as resistance.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română