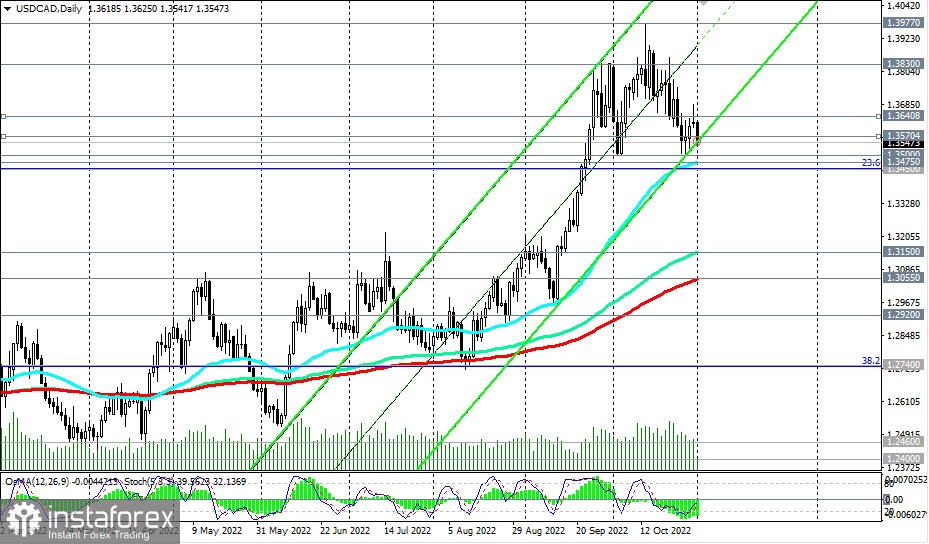

Being above the key support levels 1.3055 (EMA200 on the daily chart), 1.2920 (EMA200 on the weekly chart), USD/CAD remains in the bull market zone.

As we mentioned in today's "Fundamental Analysis", in general, the upward dynamics prevails. However, a breakthrough into the zone below the support levels of 1.3475 (EMA50 on the daily chart), 1.3450 (Fibonacci level 23.6% of the downward correction in the USD/CAD growth wave from 0.9700 to 1.4600) will increase the risks of breaking the bullish trend, sending it to the side key support levels 1.3150 (EMA 144 on the daily chart), 1.3055.

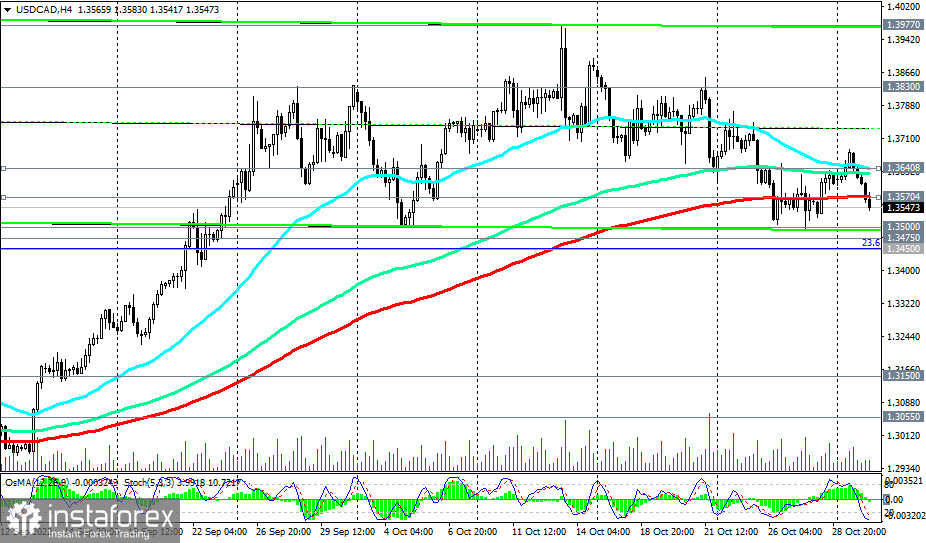

In the main scenario, we expect a rebound from the support level of 1.3570 (EMA200 on the 4-hour chart and the lower line of the rising channel on the daily chart) and the resumption of growth. Breakdown of resistance levels 1.3640 (EMA200 on the 1-hour chart), 1.3685 (local resistance level) will be a confirming signal for long positions.

In general, the USD/CAD bullish trend prevails, and given the strong upward momentum, it is logical to assume further growth.

Support levels: 1.3570, 1.3500, 1.3475, 1.3450, 1.3150, 1.3055, 1.2920

Resistance levels: 1.3640, 1.3685, 1.3800, 1.3830, 1.3900, 1.3977, 1.4000

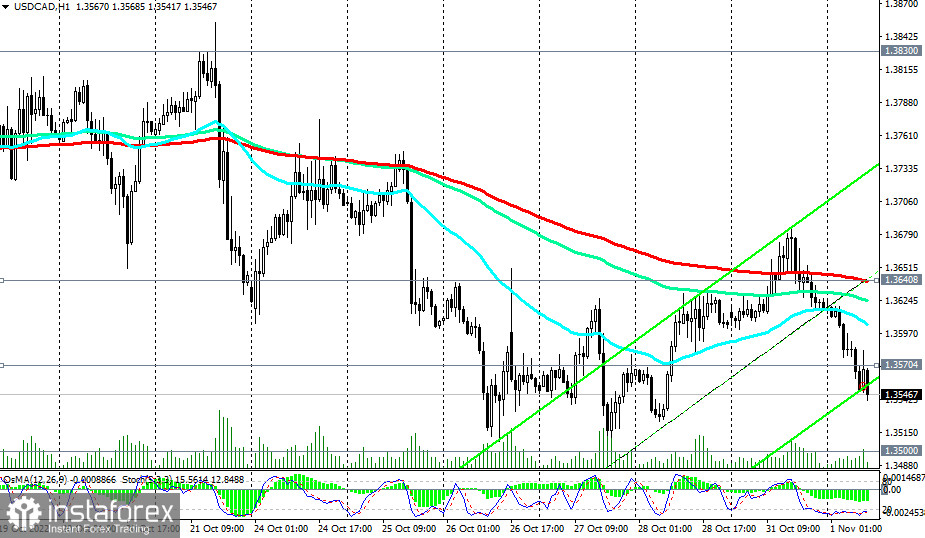

Trading scenarios

Sell Stop 1.3535. Stop Loss 1.3610. Take-Profit 1.3500, 1.3475, 1.3450, 1.3150, 1.3055, 1.2920

Buy Stop 1.3610. Stop Loss 1.3535. Take-Profit 1.3640, 1.3685, 1.3800, 1.3830, 1.3900, 1.3977, 1.4000

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română