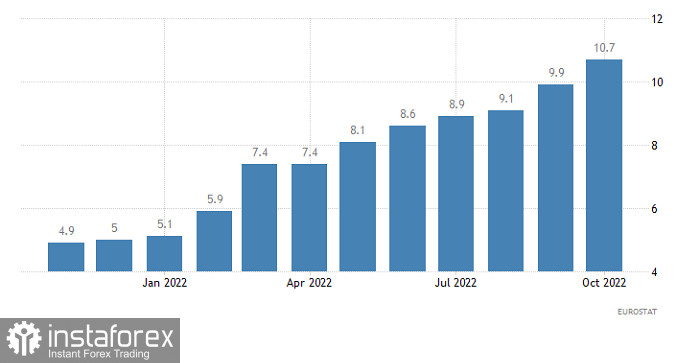

Yesterday, investors were shocked by the eurozone preliminary inflation figures. No one doubted that it would increase, but no one could imagine such a jump. According to the most pessimistic forecasts, inflation should have increased to 10.4% from 9.9%. In fact, it surged to 10.7%. At first, the market stagnated, and closer to the US trade, the euro started falling, though very slowly. Analysts had expected the euro to rise since such a jump in inflation may force the ECB to hike the benchmark rate by 100 basis points. It seems that the market has not realized such a possibility yet and remains a bit puzzled.

Eurozone Inflation

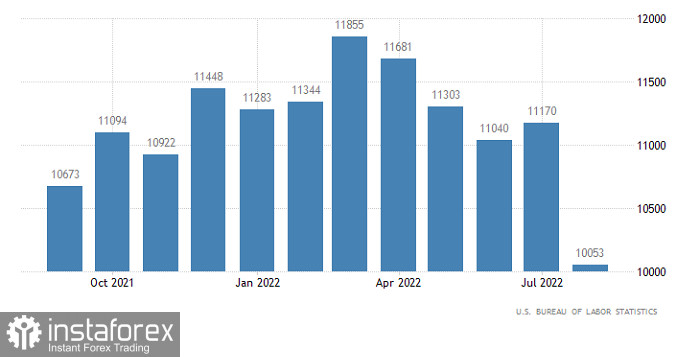

Today, the market is likely to revive only during the US trade since in most European countries, including France and Italy, it is a weekend today. Even a part of Germany is not working today because of the celebration of All Saints' Day. Meanwhile, in the US, it is an ordinary working day. Only data on the US job openings may prevent the market from recovering. According to the forecast, the number of vacancies may increase to 10,200 million from 10,053 million. It means that the US labor market situation continues to improve. Since the change is insignificant, traders may ignore it, focusing on the imbalance.

US JOLTs Job Openings

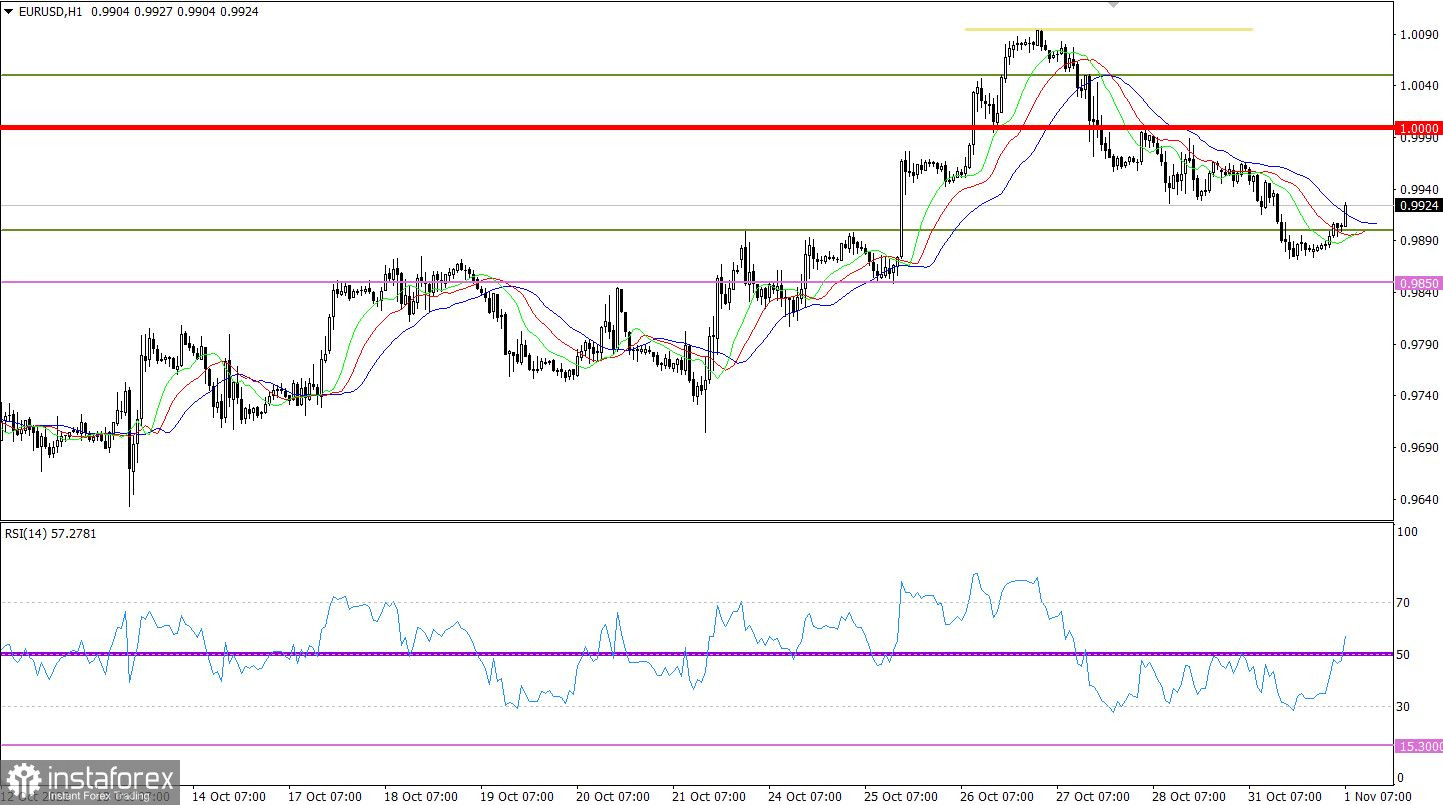

The euro/dollar pair started falling faster amid high speculative activity. As a result, the pair slid below 0.9900. In the last three days, the euro has depreciated by about 2% which is about 200 pips.

On the four-hour chart, the RSI technical indicator stopped hovering along the mid line 50. The indicator moved to the lower area of 30/50, which points to the mainly bearish sentiment in. the intraday period. On the daily chart, the RSI indicator is above the middle line. That is why the pair still has a chance to rise.

On the four-hour chart, the Alligator's MAs are headed downwards, which corresponds to the downward cycle. The signal is not stable.

Outlook

Speculative activity which led to an increase in the volume of short positions on the euro was local. That is why the pair opened a new trading day with a rise above 0.9900. Under the current conditions, traders should monitor the price behavior above 0.9900. If the price consolidates above this level, it will have more chances to return to the parity level.

In terms of the complex indicator analysis, we see that in the short-term period, technical indicators are signaling buy opportunities because of the rise above 0.9900. In the intraday period, we see a sell signal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română