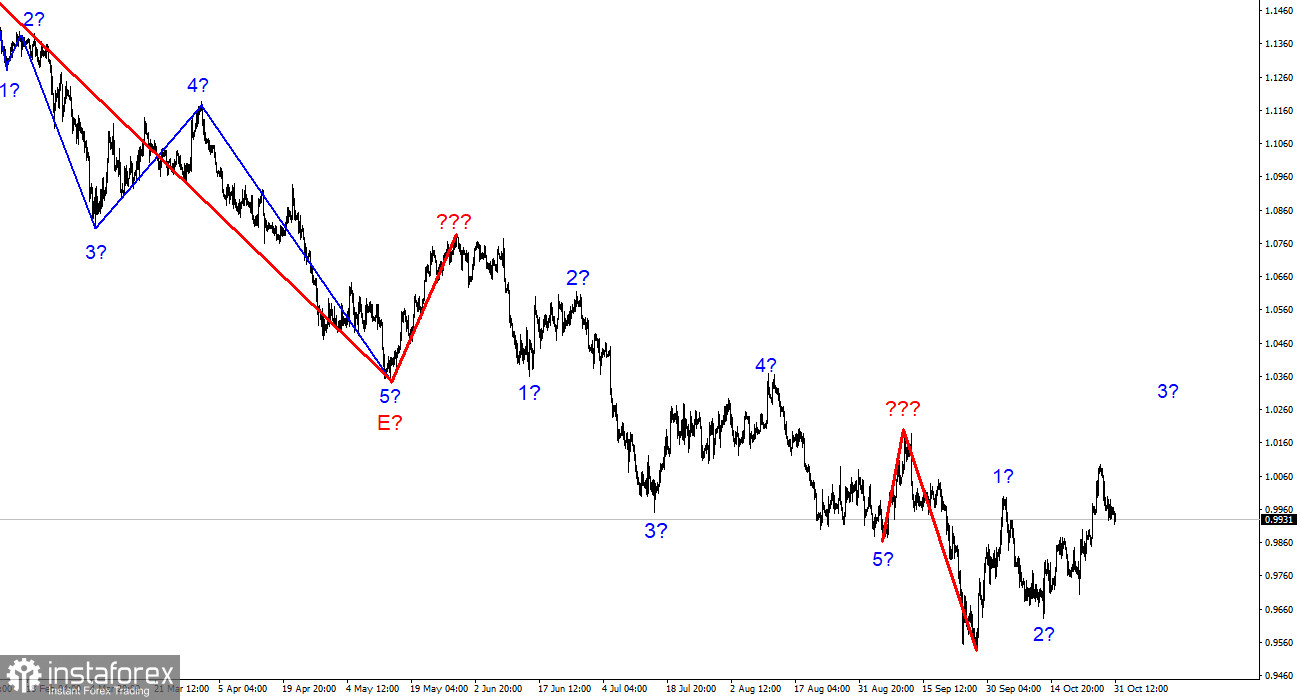

The wave marking of the 4-hour chart for the euro/dollar instrument has finally undergone certain changes. The demand for the European currency has been growing recently, and quotes have been rising, which has led to the fact that they have gone beyond the peak of the last rising wave. Thus, now we have at least a three-wave ascending structure, which can become a new upward section of the trend for five or more waves or remain a three-wave corrective. In the first case, the European currency has a good chance of growth over the next few months. In the second case, the quote decline may resume at any moment. The most important thing is that now the wave markings of the pound and the euro coincide. If you remember, I have repeatedly warned about the low probability of a scenario in which the euro and the pound will trade in different directions. Theoretically, this is certainly possible, but it rarely happens in practice. Both instruments assume the construction of at least one more upward wave, and the low of September 28 can be considered a new starting point. The downward section of the trend has become so complicated that even its internal waves are very difficult to identify correctly. But now we have a clear starting point.

The market expects a new rate hike from the Fed

The euro/dollar instrument declined by 30 basis points on Monday, but the amplitude during the day was very low. Even though there was important information for the market today, he preferred to wait for the Fed meeting, which will take place Tuesday-Wednesday. A few hours ago, the European Union released a report on GDP for the third quarter and inflation. Most analysts were right when they predicted a slowdown in the growth of the European economy and an increase in inflation. However, they were wrong about the scale. GDP growth in the third quarter was only 0.2%, and inflation in October rose to 10.7% YoY. Thus, even the most pessimistic forecasts were exceeded. Strangely, the market did not respond with a decrease in demand for these data since they fall into the category of the most important for the European economy and, accordingly, for the euro.

However, this Wednesday, the results of the Fed meeting will be announced, which will overshadow any other statistics, especially from the Eurozone. The market is waiting for a new rate hike, and in addition to the increase, it is waiting for "hawkish" rhetoric from the regulator. Let me remind you that at the beginning of the year, it was about raising the rate to 3.5%, now, everyone is waiting for it to rise to 4.5%, but already there has been talk of 5% or higher. The thing is that inflation in the US has started to slow down, but it is doing it too slowly. The interest rate is 3.25%, and inflation has dropped to only 8.2%. Its maximum value was 9.1% in June. The decline was only 0.9% annually, although the Fed rate increased from 0.25% to 3.25%. Thus, many understand that even an increase to 4.5% may not be enough for inflation to fall to the target value.

General conclusions

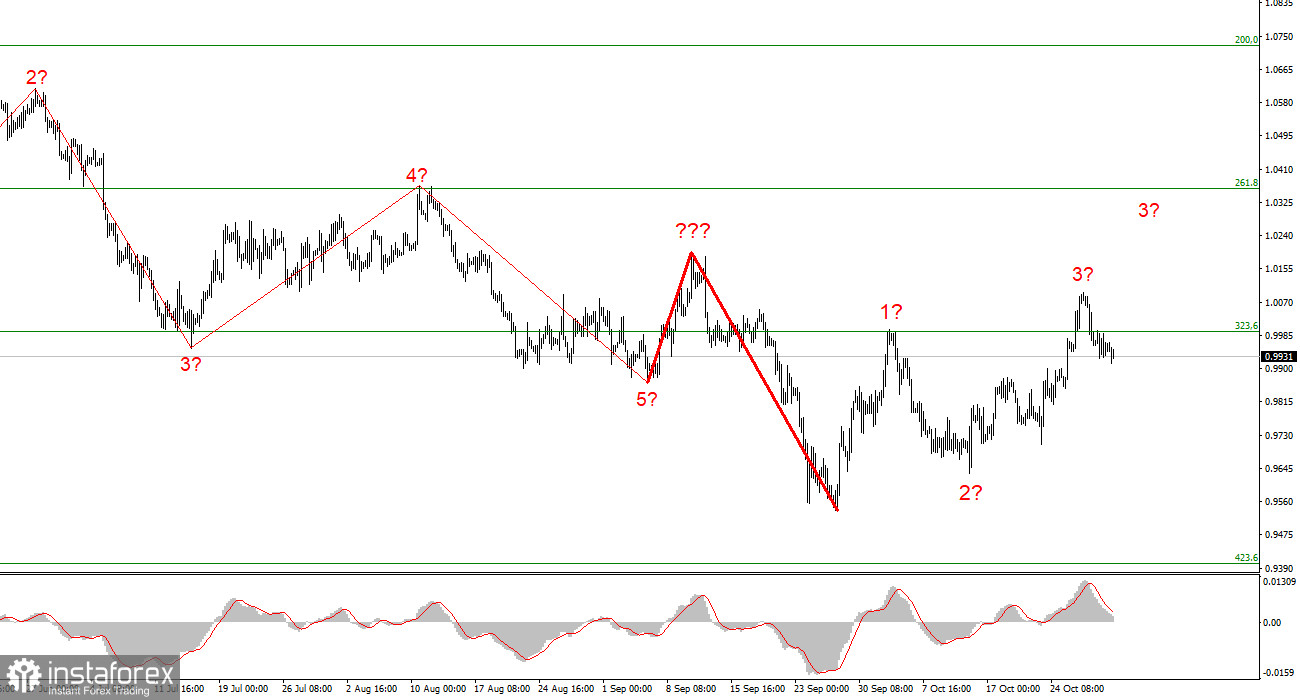

Based on the analysis, I conclude that the construction of an upward trend section has begun, but it may not last very long. At this time, the instrument can build an impulse wave, so I advise buying with targets near the estimated mark of 1.0361, which equates to 261.8% by Fibonacci, according to the MACD reversals "up." However, by the end of this trend section, you must be ready now.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take almost any length, so I think it is best to isolate the three and five-wave standard structures from the overall picture and work on them. One of these five waves can be just completed, and a new one has begun its construction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română