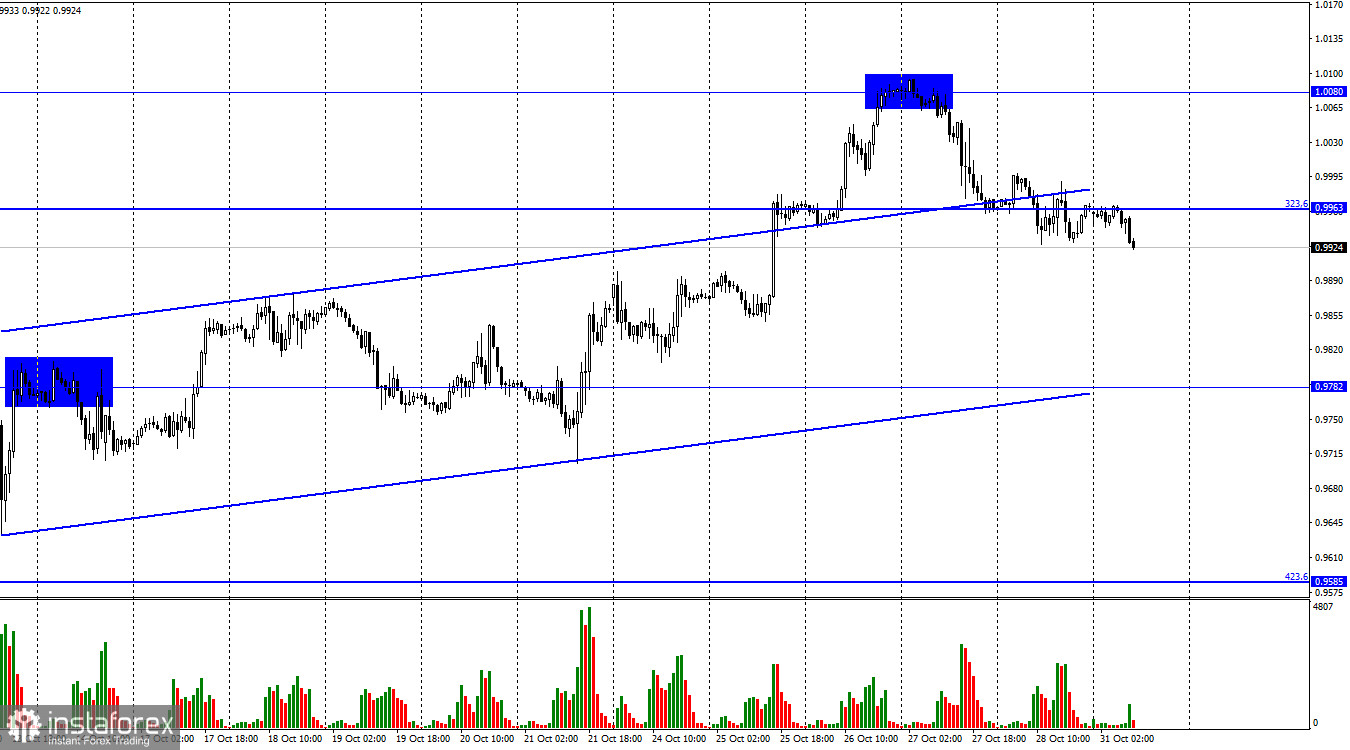

On Friday, the EUR/USD pair continued the process of falling and secured under the corrective level of 323.6% (0.9963). Thus, the fall of quotes can be continued toward the next level of 0.9782, which is still within the ascending trend corridor. The mood of traders remains bullish.

This week there will be a very strong information background for the euro-dollar pair, so get ready for strong movements and high activity. The week begins not boring, as it often happens, but with reports on GDP and inflation in the eurozone. These reports will be available in an hour, but traders are getting rid of the European currency in the morning, expecting bad data. It should be noted that in the last three quarters, the European economy has shown good growth rates. However, by the end of the third quarter, this indicator may slow down to 0.2% QoQ. This fact seems to bother traders because the European economy is getting closer to recession.

The ECB meeting was left behind, and traders fully considered the interest rate increase by 0.75%. And this week, there will be a meeting of the Fed, and the American regulator should also increase its rate. So, we have a "hawkish" decision from the American regulator and potentially weak statistics from the European Union. After all, inflation is likely to show growth again. Traders expect it to accelerate to at least 10.2%. With such an informational background, I would expect the fall of the European currency in the first 2-3 days of this week. The European currency still cannot feel calm, and consolidation under the ascending corridor will show that the bear traders did not go anywhere but took a break for a while. Also, this week, an important report on payrolls in the United States will be released (on Friday). Since all the recent reports have been quite strong, there is no reason to expect a sharp reduction in the number of new jobs in the American economy. The whole current week may turn out to be "green."

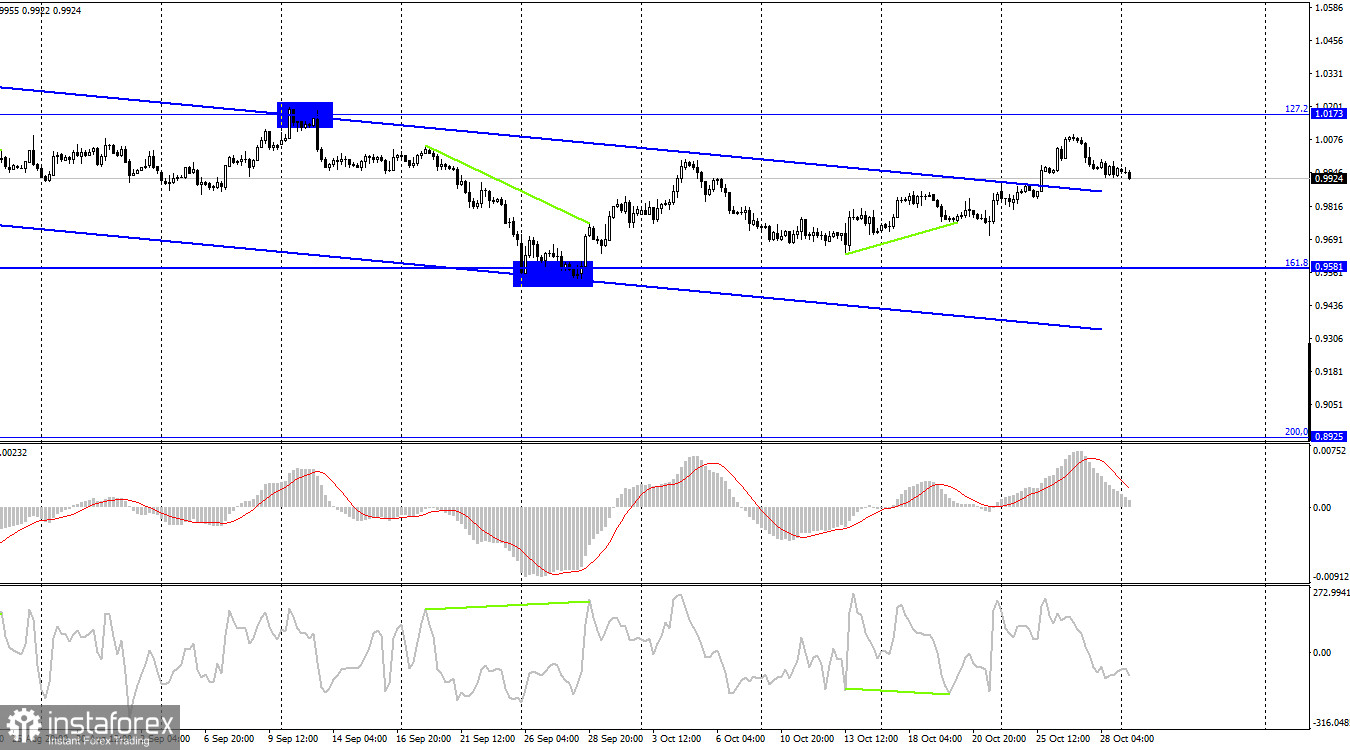

On the 4-hour chart, the pair has secured above the downward trend corridor and can continue the growth process toward the corrective level of 127.2% (1.0173). This is the key moment of this month, as this consolidation changes the graphical picture from "bearish" to "bullish." Currently, the pair is falling but retains good technical grounds for growth. This week should put everything in its place.

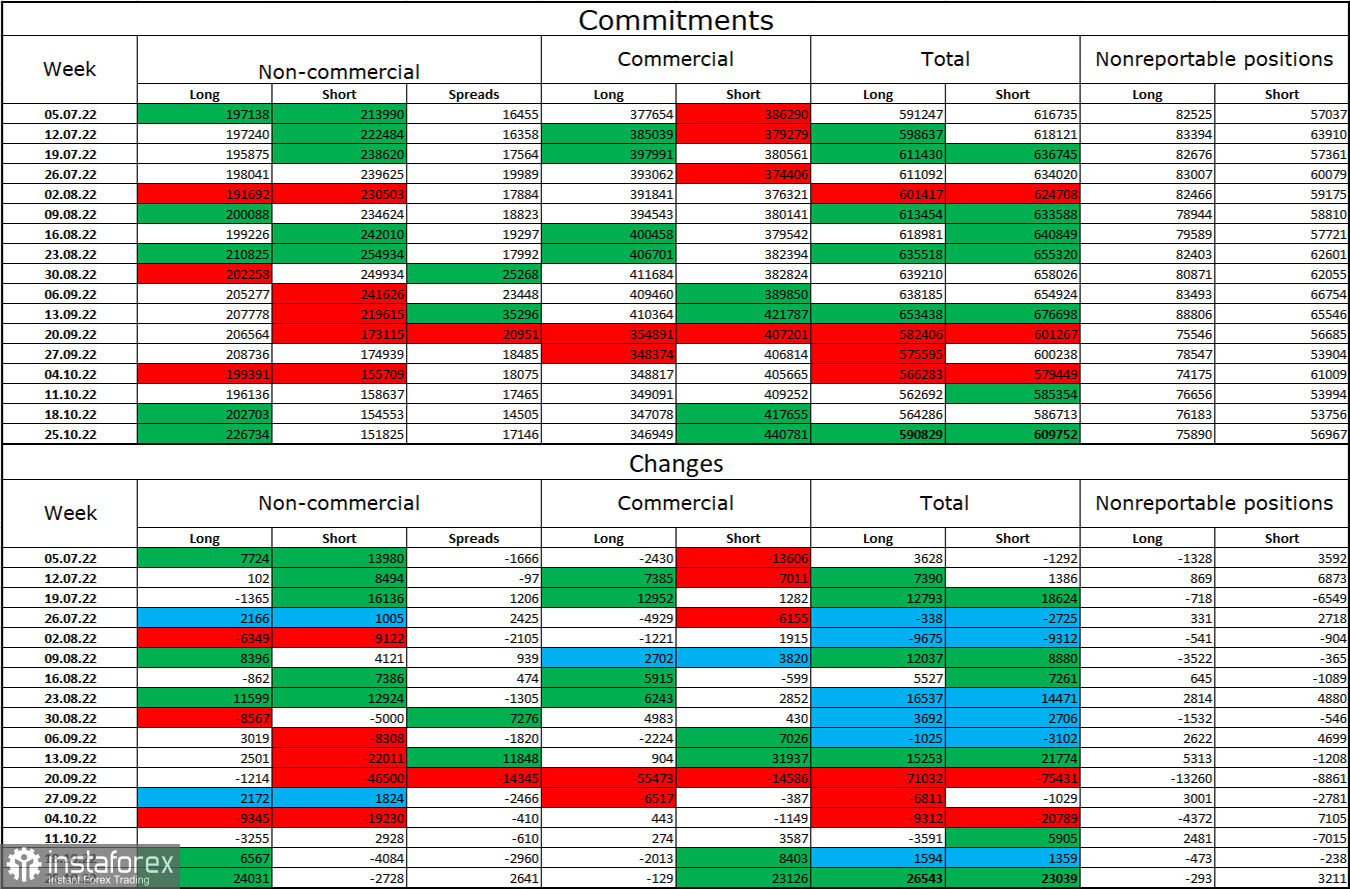

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 24,031 long contracts and closed 2,728 short contracts. This means that the mood of large traders has become more "bullish" than before. The total number of long contracts concentrated in the hands of speculators now amounts to 226 thousand, and short contracts – 151 thousand. However, the euro is still experiencing serious problems with growth. In the last few weeks, the chances of the growth of the euro currency have been increasing, but traders are not ready at this time to completely abandon purchases of the US dollar. Therefore, I would now bet on a descending corridor on a 4-hour chart, over which it was still possible to close. Accordingly, we can see the continuation of the growth of the euro currency. However, even the bullish mood of major players does not allow the euro currency to show strong growth.

News calendar for the USA and the European Union:

EU - consumer price index (CPI) (10:00 UTC).

EU – GDP for the third quarter (10:00 UTC).

On October 31, the calendar of economic events of the European Union contains two important entries. The influence of the information background on the mood today can be quite strong.

EUR/USD forecast and recommendations to traders:

I recommended selling the pair when rebounding from the 1.0080 level with targets of 0.9963 and 0.9782. The first level has been worked out, and we expect a fall to the second. I recommend buying the euro currency when rebounding from the 0.9782 level on the hourly chart with targets of 0.9963 and 1.0080.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română