After a rally on Friday, the European stock market was trading within a narrow channel on Monday morning. Meanwhile, US stock futures declined at the start of the week ahead of the meetings of global central banks. Thus, the S&P 500 index dropped by 0.3% while the NASDAQ tech index lost nearly 0.4%. The Dow Jones posted minimum losses. The US Treasury yield advanced to 4.06% after rising by 9 basis points on Friday. The yield on Britain's gilt also increased ahead of the BoE's rate hike which can turn out to be the highest in 30 years.

The US dollar appreciated while the yen lost ground as traders are getting ready for another cycle of monetary tightening by the Fed this week. This will continue to widen the gap between the rate policies of the Fed and the BoJ. The euro and the pound also declined.

In the commodities market, wheat prices surged after Russia declared it pulled out from the grain export deal. This decision came after Ukraine attacked one of the ships carrying Russian grain.

Back to the financial market. Fed Chair Jerome Powell is expected to be less hawkish at the press conference on Wednesday although he may signal that more rate hikes are to come. Such rhetorics may support US stock indices. Powell will have to admit that the rate will soon hit its peak level required to tackle rising inflation.

Some analysts suggest that Fed officials will maintain their hawkish stance later after the key interest rate hits 5% by March 2023. Then, the regulator may start lowering the rate as keeping it at such a high level may threaten to push the US and the whole world into a recession. At the same time, US inflation accelerated in September, thus justifying further aggressive steps in monetary tightening.

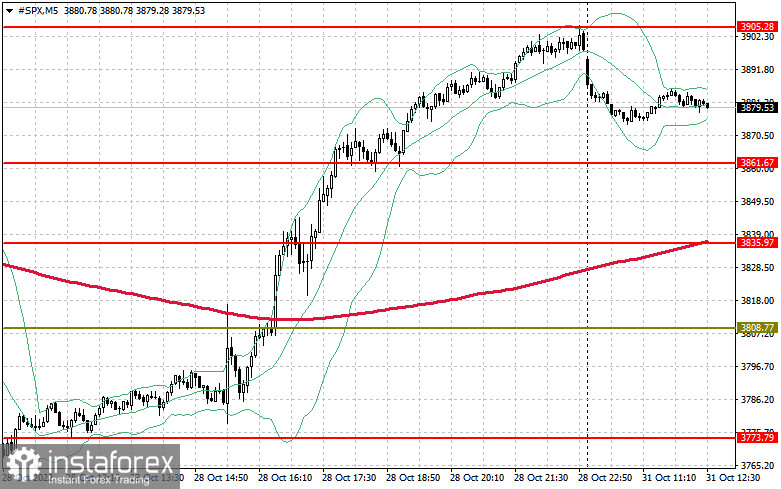

As for the technical picture for the S&P 500, the asset started the day on a lower note after the rally on Friday. The buyers' main task for today is to protect the support levels of $3,861 and $3,835. As long as the price is holding above these levels, risk assets will stay in demand. Besides, the index has a good chance to recover to the area of $3,905 and $3,942. This scenario will validate the further upside correction towards the resistance of $3,968. The level of $ 4,000 will serve as the highest target. In case of a downtrend, buyers will need to assert strength at $3,861. A breakout of this range will push the asset down to $3,835 and $3,808 and will allow the price to retest $3,773.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română