Bitcoin managed to pierce the important psychological level of $20,000. At the moment, the cryptocurrency reached the level of $21,000, but bears did not allow the asset to continue the uptrend.

Notably, the uptrend was possible due to several factors. The correction in the DXY, an uptrend in the stock market, and Bitcoin's low volatility became the main drivers for the flagship cryptocurrency to break through the upper boundary of the triangle pattern.

What's next?

Bitcoin has fixed above $20,000, the Fear and Greed Index has risen, and BTC sentiment has begun to improve. At the same time, Bitcoin did not manage to fully break through the downtrend level of $20,400. Moreover, the coin is maintaining a correction.

BTC/USD analysis

The volatility of the major cryptocurrency is declining to mid-October lows. This may improve investment interest in BTC even if the DXY index rises. The asset also was trading above the support level of $20,000 during the weekend.

In the medium term, the uptrend may continue and BTC quotes are likely to reverse. There are weak bearish signals on the daily chart seen at the start of the Asian session. We need to wait for the US session to get a clearer picture of how BTC is likely to trade this week.

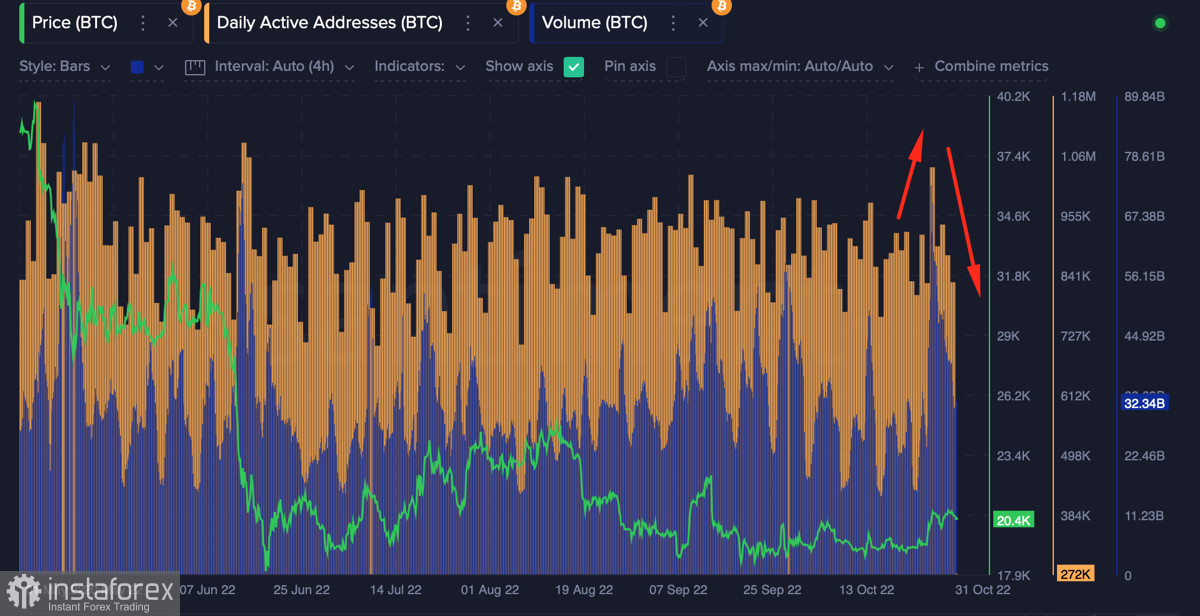

For a strong uptrend, Bitcoin needs higher trading volumes and growth in its onchain activity. During the formation of candlesticks, the growing volumes will confirm that bulls have returned to the market.

If trading volumes fall, this confirms that the crypto has started a correction. The BTC price is likely to reverse if the two above-mentioned conditions are met. If the current trading volumes are maintained with growth momentum in Bitcoin quotations, it will mean an attempt to collect liquidity without any real change.

Conclusions

Bitcoin may move to the upper boundary of the trading channel of $25,000 as well as to the lower boundary of $17,600. The next two or three days will show the state of the market after the weekend and after the next round of rate hikes. Key components of BTC analysis are trading volumes and onchain indicators, as well as the stock market and DXY investor sentiment.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română