EUR/USD

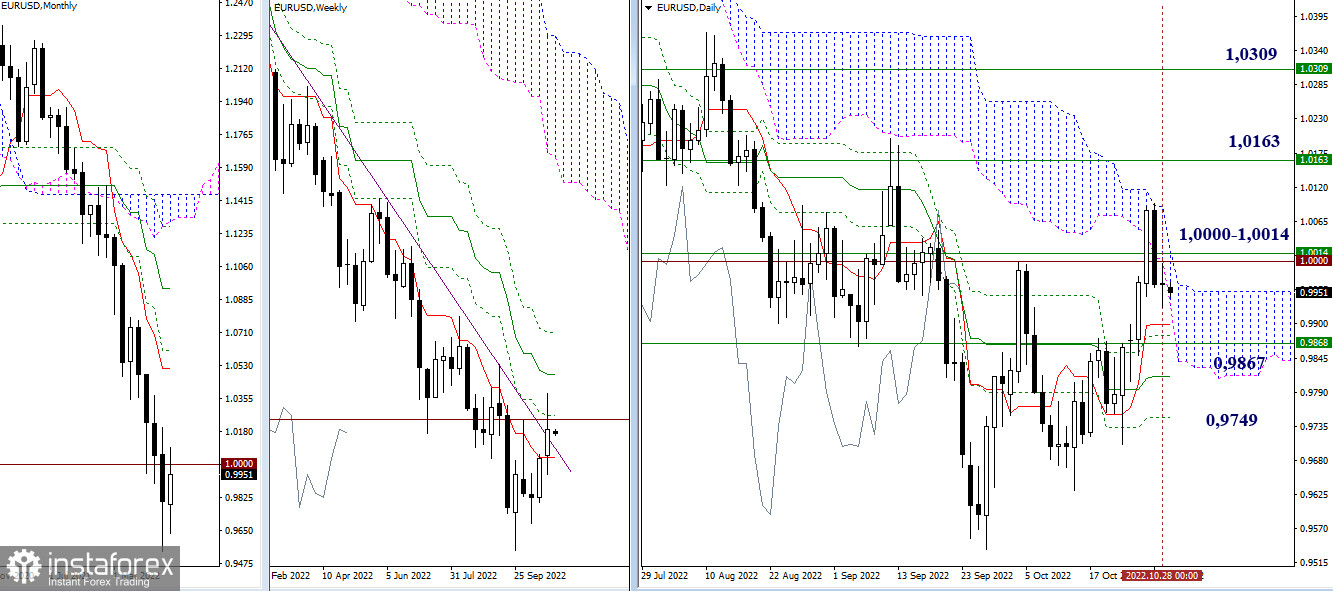

Higher timeframes

Having tested the resistance zone last week, which combined the daily cloud and the levels of 1.0000 - 1.1014, the pair failed to close higher and formed a long upper shadow. As a result, these benchmarks are still relevant for the bulls. A breakdown will open the way to the next resistance of the daily Ichimoku cross - 1.0163 (medium-term trend) - 1.0309 (the final level of the weekly cross), and will also allow us to consider the target's reference point for the breakdown of the daily cloud. In the event of ending growth and the development of the current rebound, bears will need to find support for the weekly short-term trend (0.9867) and eliminate the daily golden cross (0.9900 - 0.9815 - 0.9749).

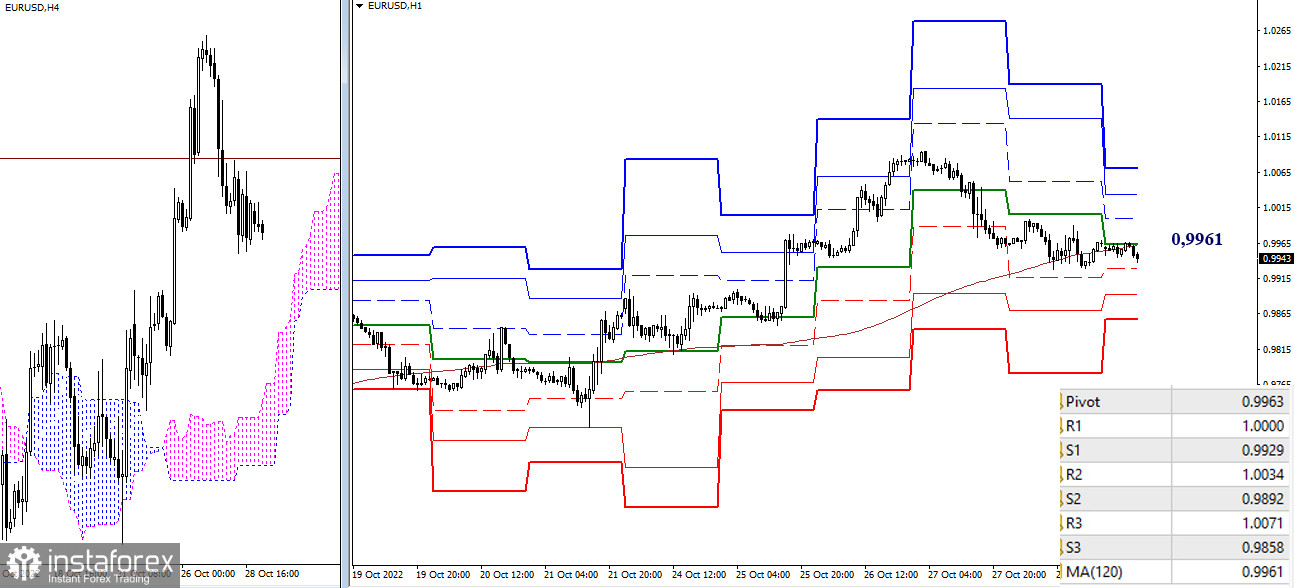

H4 - H1

There is uncertainty in the lower time frames. The pair is in the area where key levels are gravitating towards, which have now united at the 0.9961 line (long-term weekly trend + central Pivot level). As a result, the 1-hour time frame is currently dominated by uncertainty. When leaving the situation and one of the parties are active, today's reference points for the bulls can be 1.0000 - 1.0034 - 1.0071 (resistance of the classic Pivot levels), while the bears' reference points can be 0.9929 - 0.9892 – 0.9858 (support for classic Pivot levels).

***

GBP/USD

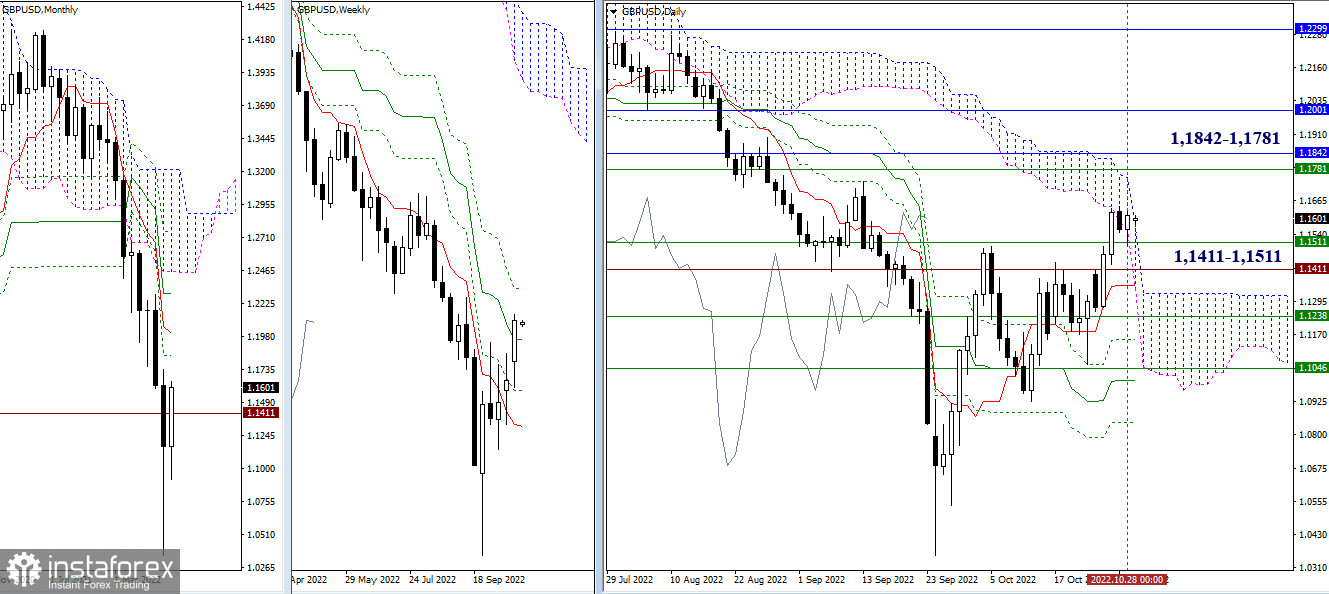

Higher time frames

The nature of the last weekly candle has an optimistic bullish tone. Bulls have gone beyond the resistances of 1.1411 (historical level) and 1.1511 (weekly medium-term trend) and are using them as support as they fight the daily cloud. Consolidation in the bullish zone relative to the cloud will form an upward target and allow us to consider new bullish prospects, for example, the nearest one can be noted at 1.1781 - 1.1842 (the final level of the weekly Ichimoku dead cross + monthly Fibo Kijun).

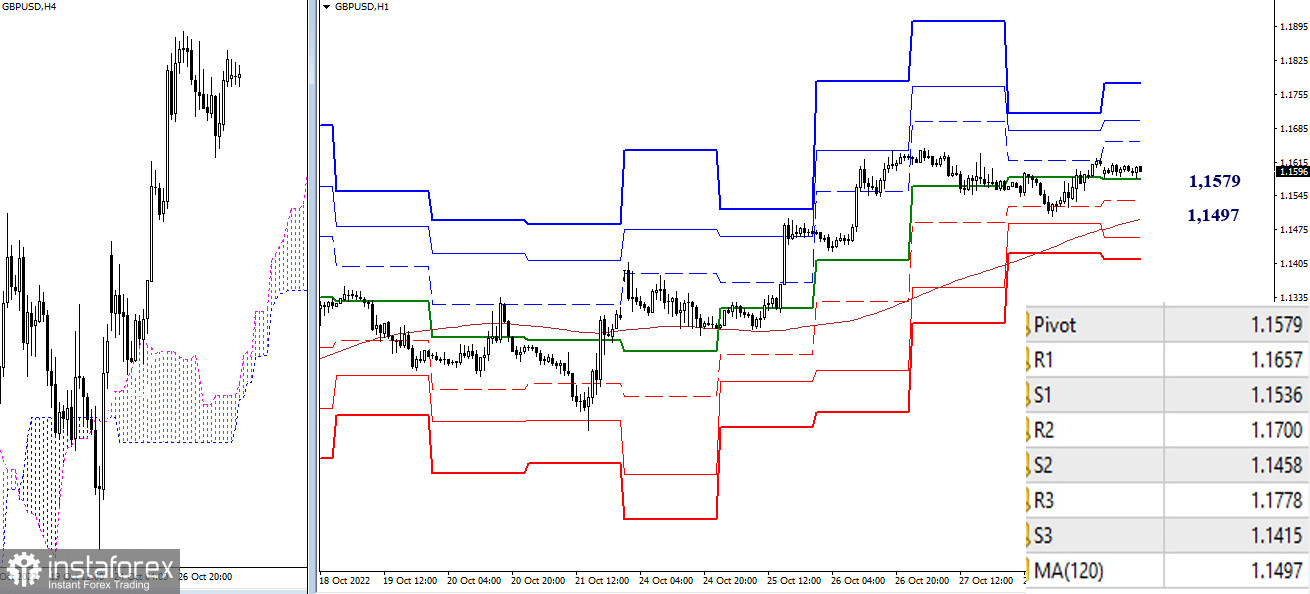

H4 - H1

At the moment, the bulls have the main advantage on the lower time frames. Nevertheless, the pair has been in a correction and moved sideways for a long time. If the bulls take the initiative first then their reference points for today can be at 1.1657 – 1.1700 – 1.1778 (the resistance of the classic Pivot levels). Bears need to capture key supports at 1.1579 (central Pivot level) and 1.1497 (long-term weekly trend) to change the current balance of power. Further, the support of the classic Pivot levels (1.1458 – 1.1415) can be useful as a guideline.

***

In the technical analysis of the situation, the following are used:

Higher time frames – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română