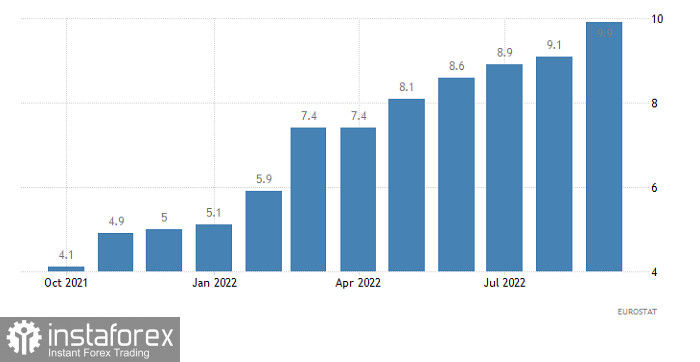

There is nothing surprising in the fact that the market actually stands still. Not only was the macroeconomic calendar completely empty on Friday, but a preliminary estimate of inflation in the euro area will be released today. Basically, everything else doesn't matter. So even if any other data were published, no one would pay attention to them anyway. After all, the question of the succeeding pace of raising the refinancing rate of the European Central Bank is on the agenda. If the forecasts are confirmed, and the growth rate of consumer prices accelerates from 9.9% to 10.4%, then there will be no doubt that the ECB will again raise the refinancing rate by 75 basis points during its December meeting. Whereas, in general, there is no doubt that at the same time the Federal Reserve would only raise its refinancing rate by 50 basis points. In other words, a further increase in inflation in Europe will provoke the euro's growth, and it will pull the pound along with it, which will also noticeably strengthen its positions.

Inflation (Europe):

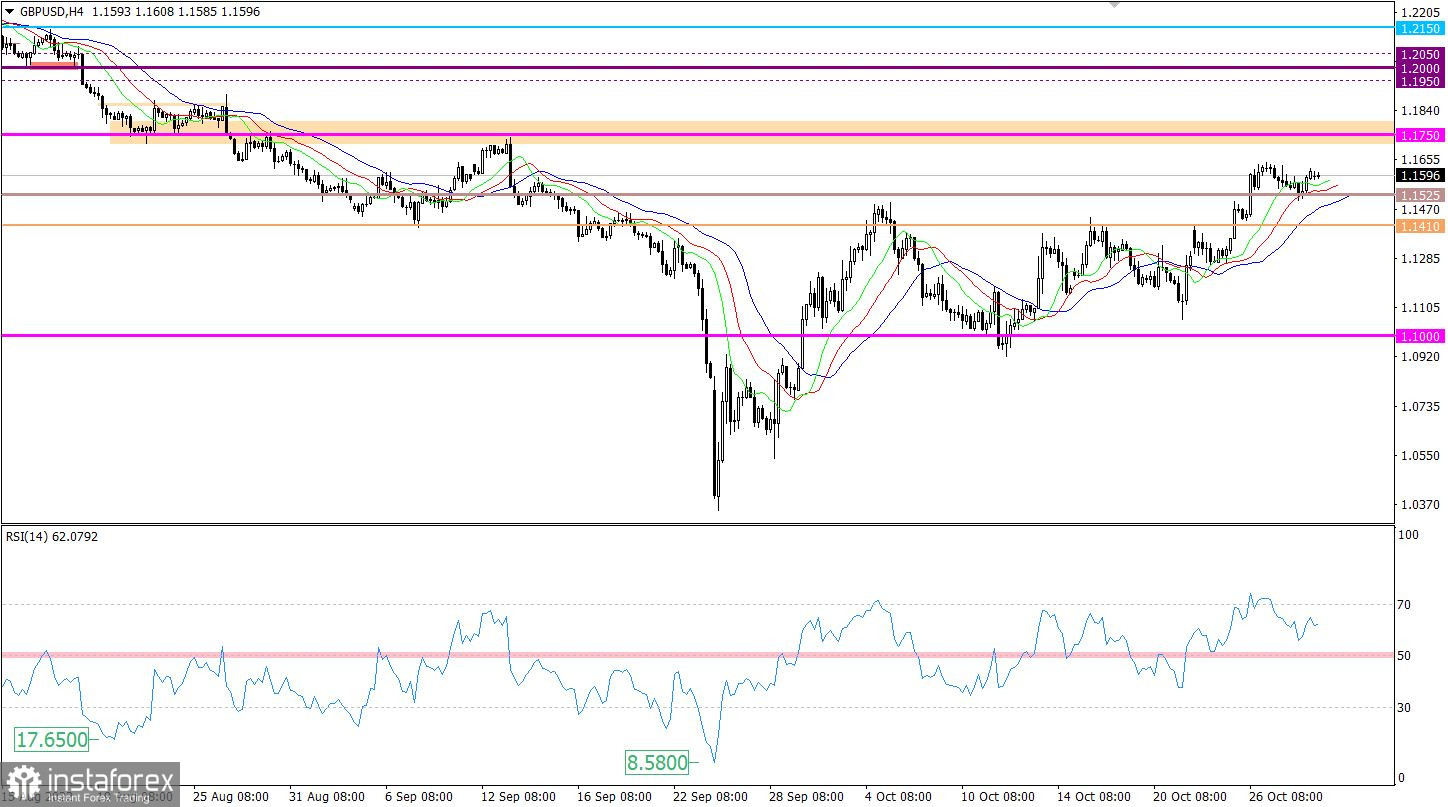

The GBPUSD currency pair managed to bounce back from the previously passed resistance area of 1.1410/1.1525, winning it back as support. It is worth noting that the low activity during the end of last week indicates a regrouping of trading forces, in the forthcoming acceleration in the market.

The RSI H4 and D1 technical instrument is moving in the upper area of the 50/70 indicator, which indicates a bullish mood among market participants.

The MA sliding lines on the Alligator H4 have an intersection between the green and red lines. This technical signal indicates a slowdown in the upward cycle. Alligator D1 has the prerequisites for growth, the moving MA lines are directed upwards.

Expectations and prospects

At the moment, there is a range between the values of 1.1525/1.1645. A temporary stop can serve as a lever in the market, which will betray activity in the subsequent movement.

The optimal trading tactic will be the method of an outgoing momentum from the established range.

Complex indicator analysis in the short-term and intraday periods has a variable signal due to price stagnation. In the medium term, there is a primary buy signal due to the price staying above the 1.1410/1.1525 area.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română