The GBP/JPY pair dropped in the short term and now is located at 173.13 far below yesterday's high of 174.27. The price action signaled exhausted buyers, so the sellers could take the lead again.

Surprisingly or not, the Japanese Yen appreciated in the short term even if the Japanese economic data disappointed today. Retail Sales reported a 5.0% growth versus the 7.1% growth estimated, Prelim Industrial Production dropped by 0.4% compared to the 1.4% growth estimated, Consumer Confidence came in at 36.0 points below 36.1 points forecasts, while Housing Starts registered an 11.9% drop compared to the 0.9% drop estimated. Later, the US and the Eurozone data could have an impact on the Japanese Yen.

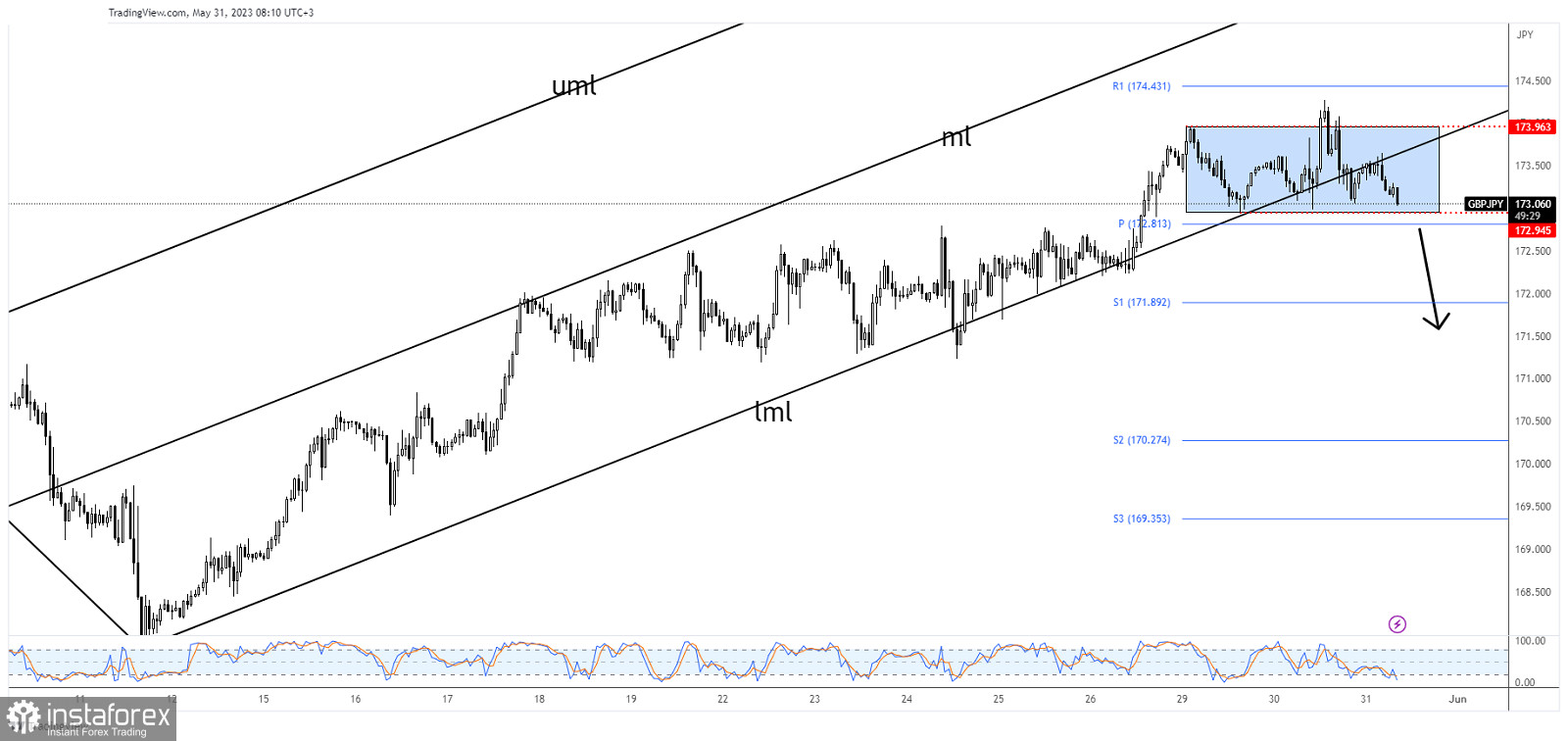

GBP/JPY Overbought Signs!

From the technical point of view, GBP/JPY registered only false breakouts above 173.96 and now it has registered a valid breakdown below the lower median line (lml) of the ascending pitchfork.

It's trapped between 173.96 and 172.94 levels. After the false breakouts from this range, the price action signaled an imminent breakdown. Now, it challenges the 172.94 and is almost to hit the weekly pivot point of 172.81.

GBP/JPY Outlook!

A bearish closure below the weekly pivot point of 172.81 is seen as a bearish signal. This could announce a strong downside movement.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română