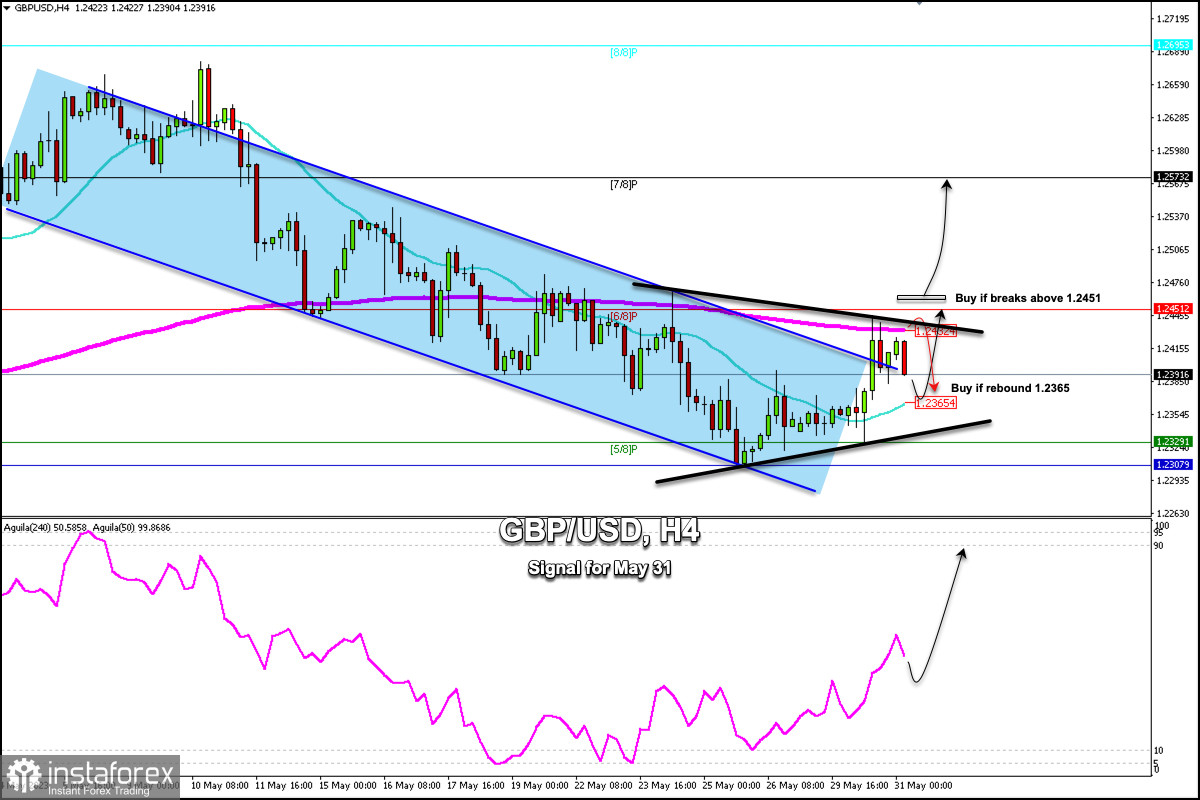

Early in the European session, the British pound (GBP/USD) is trading around 1.2391 below the 200 EMA and above the 21 SMA located at 1.2365.

We can observe that the pound maintains a bearish trend channel formed since the beginning of May but it could be accumulating and then resume its bullish cycle and GBP/USD could reach 7/8 Murray located at 1.2573.

The technical outlook for the next few days shows a small chance of bullish momentum, but the buyers may find it difficult to overcome the resistance at 1.2450 (6/8 Murray).

The recent optimism due to the increase in the US debt ceiling supports investors' confidence, which is reflected in generally positive sentiment around stock markets and weakens the safe-haven dollar.

Yesterday during the European session, the British pound reached the 3/8 Murray zone around 1.2329 and gave a strong technical bounce which saw a move towards the 6/8 Murray reaching a high of 1.2449.

In case a technical correction occurs in the next few hours and GBP/USD rebounds around 1.2365 (21 SMA) or 1.2335, this could be seen as a signal to buy with targets at around 1.2451.

Additionally, with a sharp break above the 6/8 Murray and above the 200 EMA, the instrument could reach the 7/8 Murray zone and ultimately, we could expect it to reach the 8/8 Murray at 1.2695.

On the contrary, if the British pound falls below 1.2330, a downward acceleration is expected, which could push the price down to 4/8 Murray located at 1.2207.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română