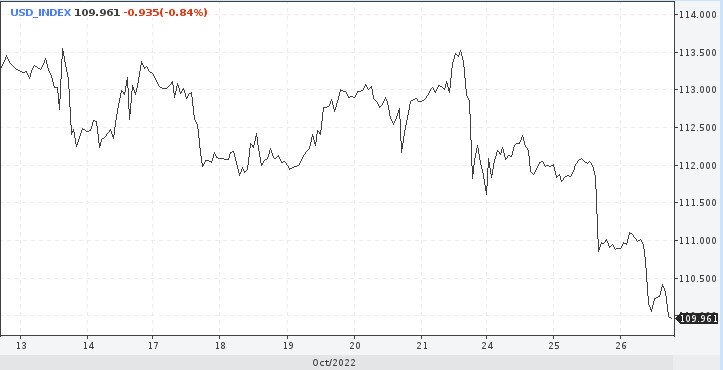

The US dollar seems to be losing bullish momentum. The ongoing downward move doesn't look like a technical correction. Technical charts are generating appropriate signals. If the greenback weakens at such a fast pace, it is running the risk of plunging to the levels of February. All in all, having topped out, the US dollar is on the downward path.

How did everything begin? The US dollar triggered a downward correction two weeks ago. Its index has already tumbled to three-week lows. The decline accelerated at the end of the last week. The greenback came under downward pressure on Friday in light of the comments that the Federal Reserve could soften its monetary tightening. Meanwhile, market participants are speculating that the US central bank could ease the pace of further rate hikes. Besides, market participants predict some dovish turn in the Fed's rhetoric at the nearest policy meeting on November 1-2.

Looking at technical charts, we can notice the following picture. The US dollar index has tried to break the trendline passing through the peaks of 2018, 2020, and 2022. All attempts have been to no avail. Hence, the index pulled back and developed a downward bias.

It could mean that the index has conquered its peak and will hardly surpass the levels above 114.00. So, the time is ripe to revise market sentiment and price in the bearish trend?

Perhaps the bearish outlook is not as imminent as it might seem for the time being. Next week, it will be clear whether the Federal Reserve will confirm its commitment to fighting against high inflation at any cost sacrificing economic growth.

In the US dollar index fails to cross the trendline, the realistic scenario would be a decline to 105.00. Moreover, analysts don't rule out a retracement as low as 97.00, the levels where the index was trading before Russia's invasion of Ukraine. If this prediction comes true, the US dollar index could plunge by 12% from its peak levels.

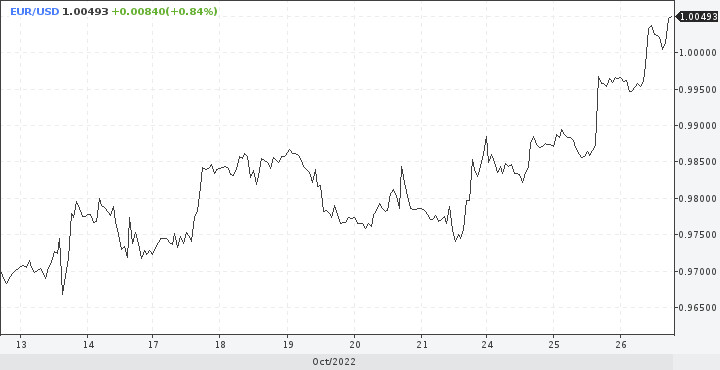

European currencies are ready for recovery as the month is coming to an end and some high-impact events are in the cards. The euro has been feeling confident for the whole month. Indeed, it has eventually crossed the parity level with the US dollar this month.

EUR/USD has been growing in confidence in the run-up to the crucial event, the ECB policy meeting tomorrow. The regulator announced drastic measures against rampant inflation. Thus, the market consensus suggests a rate hike by 75 basis points. This is bullish for the euro, bearing in mind the likelihood that the US Fed might ease the pace of further rate hikes.

Besides, the euro also finds support from the resolution of the political crisis in the UK. In turn, this quells the overall economic havoc in Europe. The fundamental picture is overshadowed by the simmering energy crisis which escalates the threat of a grave recession. This negative fundamental caps the full-fledged bullish momentum in EUR/USD.

Apparently, the euro buyers are poised to try testing the target of 1.9600-1.0200. Higher levels will hardly be reached in the short term under the current ailing economic conditions.

Still, the euro is sure to take advantage of the weakness in the US dollar index. The odds are that EUR/USD will develop a robust correction with the target at 1.0600. Nevertheless, it makes to be cautious about the bullish outlook for EUR/USD because of the differential between the ECB's and the Fed's monetary policies. The hawkish Federal Reserve doesn't allow analysts to predict that the euro has completed its bearish cycle against the US dollar.

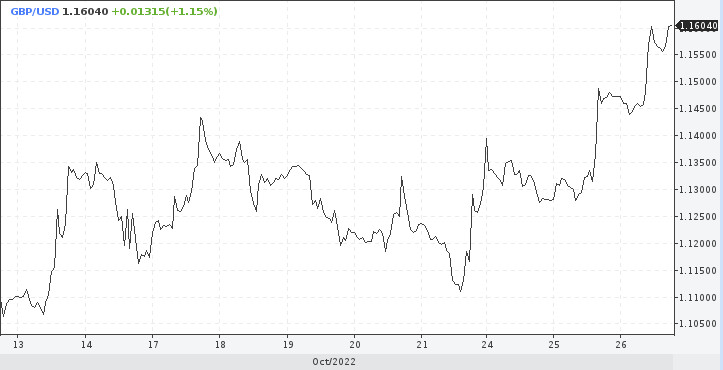

GBP/USD is also eager to regain its footing amid the decline in the US dollar. However, the pound sterling is propped up by domestic factors. Global investors are betting on the new political tandem of Rishi Sunak and Jeremy Hunt. Their major task is not to let markets down.

The sterling is determined to break above 1.1540. It briefly touched 1.1600 intraday today. The technical picture opens the door towards higher levels of around 1.1820. Support is seen at 1.1390, 1.1310, and 1.1220.

These are short-term upward targets during the pound's recovery. Analysts still doubt bullish long-term prospects of GBP/USD.

On the political front, the Conservative party has settled down the political chaos, thus giving hope for a prudent fiscal policy of the new government. On the minus side, the domestic economy has been stuck in dire straits. As soon as the market shifts focus back towards the economic challenge, GBP bulls will have to think hard before they actually open long positions.

Some analysts are certain that the pound sterling will fall to 1.0800 again by the year-end. So, long positions after GBP/USD's recovery above 1.1500 look inappropriate.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română