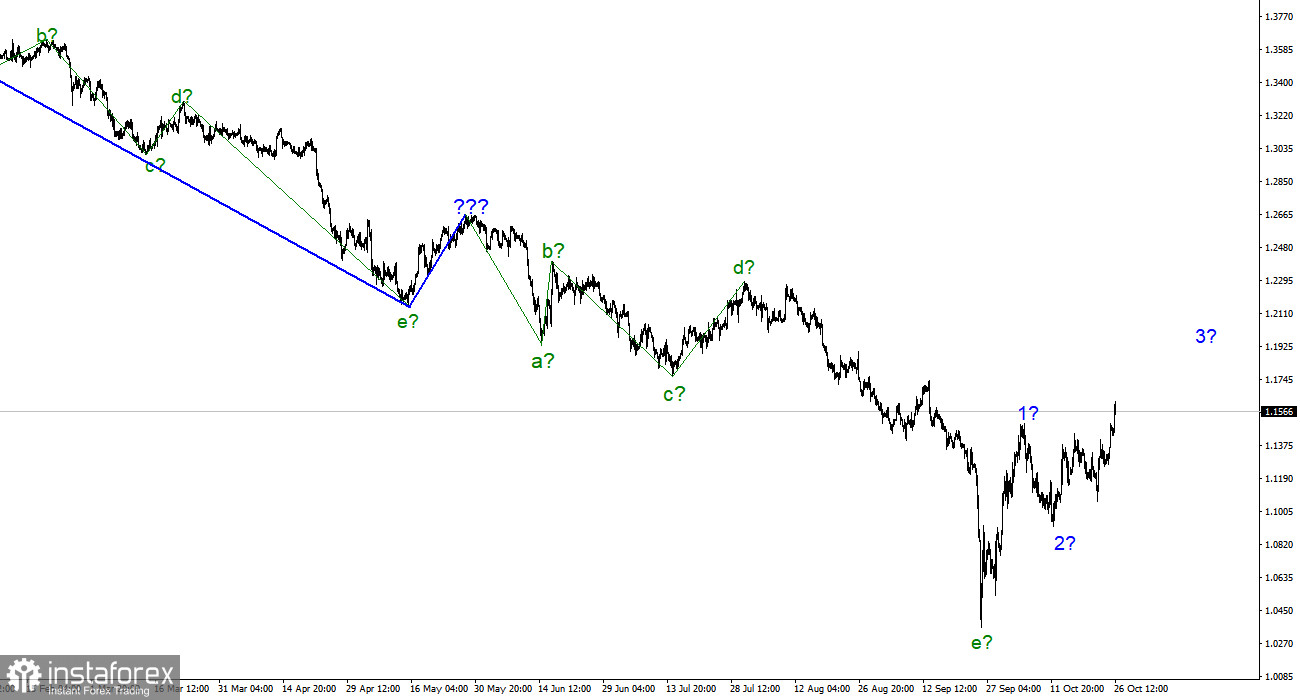

For the pound/dollar instrument, the wave marking looks quite complicated at the moment, but still does not require any clarifications. We have a supposedly completed downward trend segment, which consists of five waves a-b-c-d-e. If this is indeed the case, then the construction of a new upward trend section has begun. Its first and second waves are presumably completed, and the third wave is being built, which can be both 3 and C. Since the European wave marking has changed, now both wave markings coincide. As I have already said, the entire upward structure can be limited to only three waves. In this case, the completion of the third wave can occur at any time, after which the construction of a new downward trend section can begin, since the peak of this wave is already above the peak of the first wave. And if this wave is c, and not 3, then it should not be extended, just a small approach above the last peak is enough. Thus, we finally managed to sort out the wave markings, which have recently left many unanswered questions, but there are still huge doubts that the demand for the British will grow for a long time now.

Rishi Sunak became prime minister, and the British pound is growing for the third day in a row.

The exchange rate of the pound/dollar instrument increased by 110 basis points on October 26, and by 190 a day earlier. It is very strange to see such a strong increase in the British dollar since business activity indices were released in the UK this week, which again declined compared to the previous month. And there was no other important information. Of course, the appointment of Rishi Sunak is an important event, but I don't remember that the market reacted so violently to the resignation of Boris Johnson or the appointment of Liz Truss. Political news, of course, is very important, but in parallel with the British, there is a growing demand for a European, who certainly should not pay attention to political changes in the UK. For me, the current growth of the pound is strange.

The European currency has reason to grow this week. Already on Thursday, the ECB will summarize the results of the meeting and, most likely, raise the rate by 75 basis points. The Bank of England may make the same decision next week, but it is unlikely that the pound is growing now because the rate will be raised next week. It seems that now there really is a desire of the market to fix some of the positions on the dollar, to allow the instruments to adjust normally, and only then the future fate of both will be decided. In my opinion, the probability of resuming the construction of a downward section of the trend remains very high. At least because I don't see why the market is now increasing demand for the euro and the pound if there is no news background this week. Moreover, the Fed will also raise its rate next week, which may cause an increase in demand for the US currency. So far, I believe that everything will end with three waves for each instrument.

General conclusions.

The wave pattern of the pound/dollar instrument assumes the construction of a new upward trend segment. Thus, now I advise buying the instrument on the MACD reversals "up" with targets located near the estimated mark of 1,1705, which equates to 161.8% Fibonacci. You should buy cautiously, as the downward section of the trend may resume its construction.

At the higher wave scale, the picture is very similar to the Euro/Dollar instrument. The same ascending wave that does not fit the current wave pattern, the same five waves down after it. The downward section of the trend can turn out to be almost any length, but it may already be completed.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română