This is not the twist you are looking for. A series of disappointing statistics on business activity, the housing market, and consumer sentiment, coupled with a statement by San Francisco Fed President Mary Daly that the Fed should start planning to slow down monetary restrictions, inspired EURUSD bulls to feats. The main currency pair soared above parity for the first time since September 20 and, according to ING, is able to develop a correction in the direction of 1.02. One of the drivers of the rally, according to the company, is the fall in gas prices, which improves the eurozone's terms of trade.

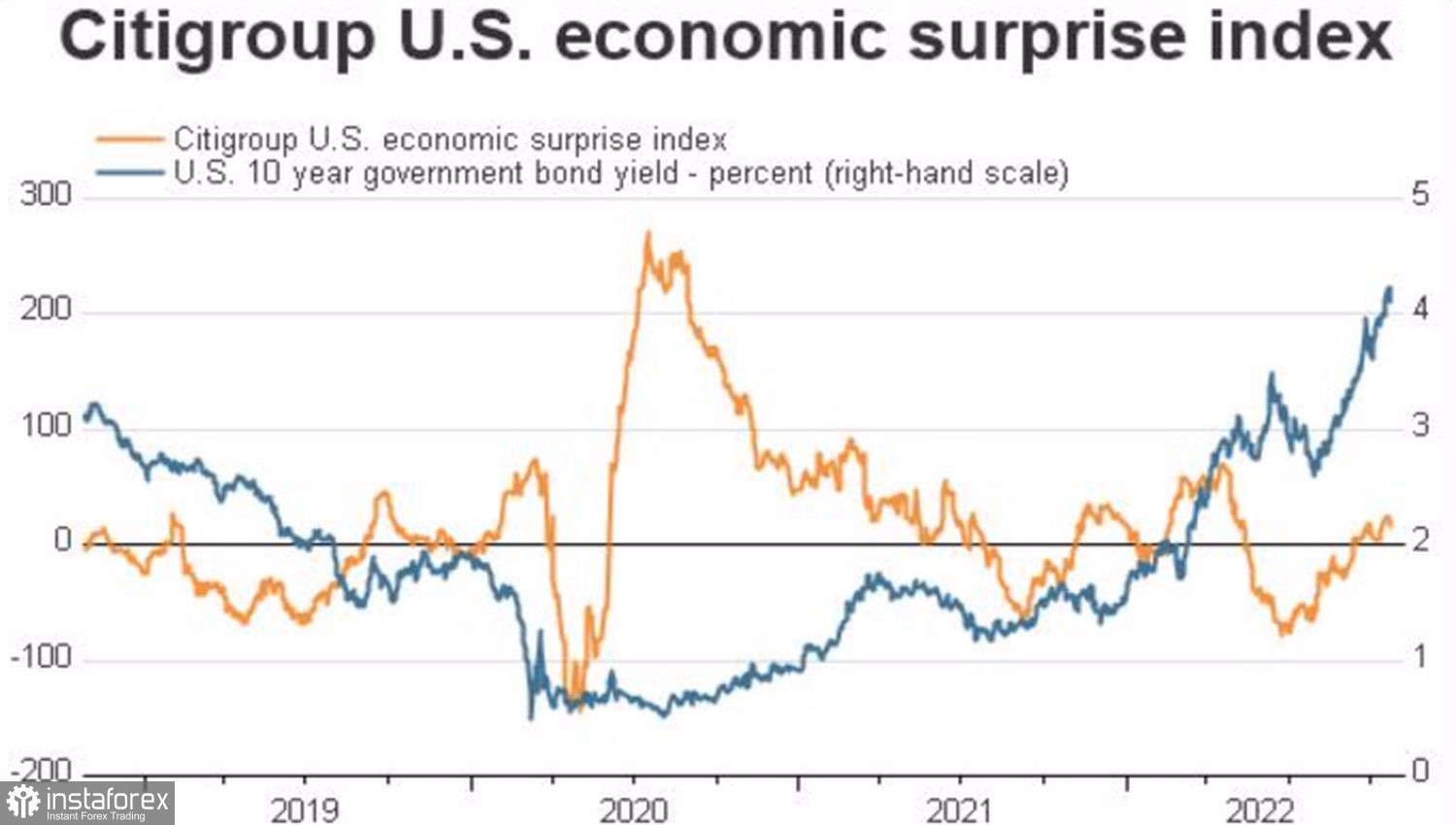

It's one thing for CME derivatives to give out an 80% chance of a 75 bps increase in the federal funds rate in December, another when the odds fall below 50%. The baseline scenario is half a percentage point, which markets perceive as a slowdown in the Fed's rate of monetary restriction. At the same time, a number of negative economic surprises only add fuel to the fire, putting pressure on the yield of treasury bonds and the US dollar.

Dynamics of economic surprises and US bond yields

EURUSD is rushing up like a rocket, which looks logical against the background of approximately twice the speculative rates on the American currency exceeding their average values for 5 years. Hedge funds have had no illusions about the euro and pound lately, and closing shorts on these currencies leads to their strengthening.

At the same time, the markets have already been burned at least three times, wishful thinking—not getting tired of looking for a "dovish" Fed reversal where there is none. Twice they were pointed out to an error by macro statistics on the US, including inflation and employment, once by Jerome Powell in Jackson Hole. Will the Fed put the markets in place this time? Or, on the contrary, it will indicate a decrease in the growth rate of borrowing costs, as investors expect. The wait is not long—until the beginning of November. In the meantime, the euro is basking in the rays of glory.

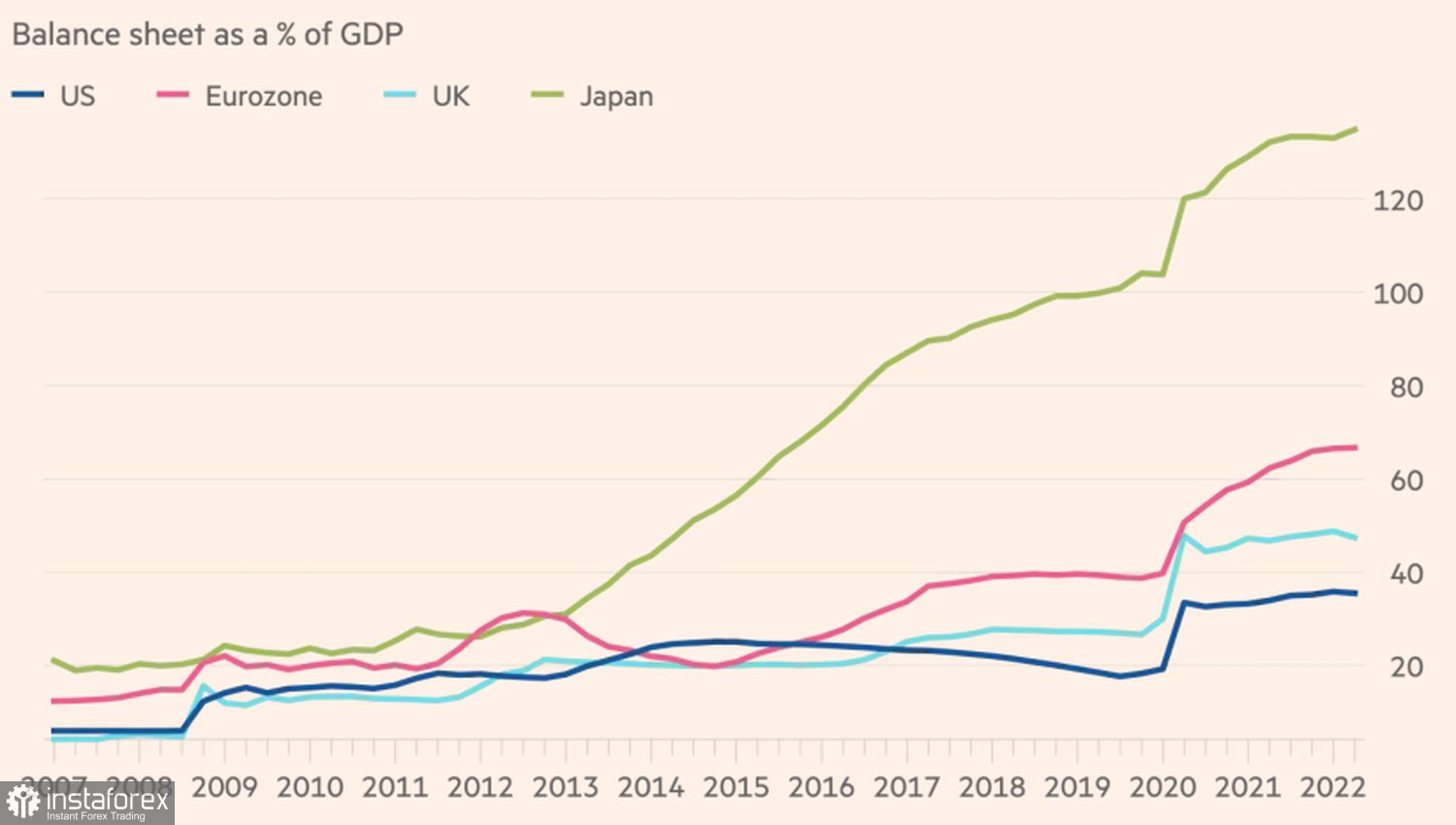

Rumors that the ECB will not only raise the deposit rate at its meeting on October 27, but also outline a plan to wind down the €8.8 billion balance sheet, or even launch QT altogether added fuel to the fire. However, the main instigator of the EURUSD peak is still the US dollar, as evidenced by its weakening against other major world currencies, not only the euro.

Dynamics of the balance sheets of the four leading central banks of the world

If the reasons for the EURUSD correction were in the ECB, one could try to win back the principle "buy euro on rumors, sell on facts." However, the lack of a major sell-off in response to the results of the Governing Council meeting and the speech of Christine Lagarde will convince you that you will have to wait until the FOMC meeting in early November.

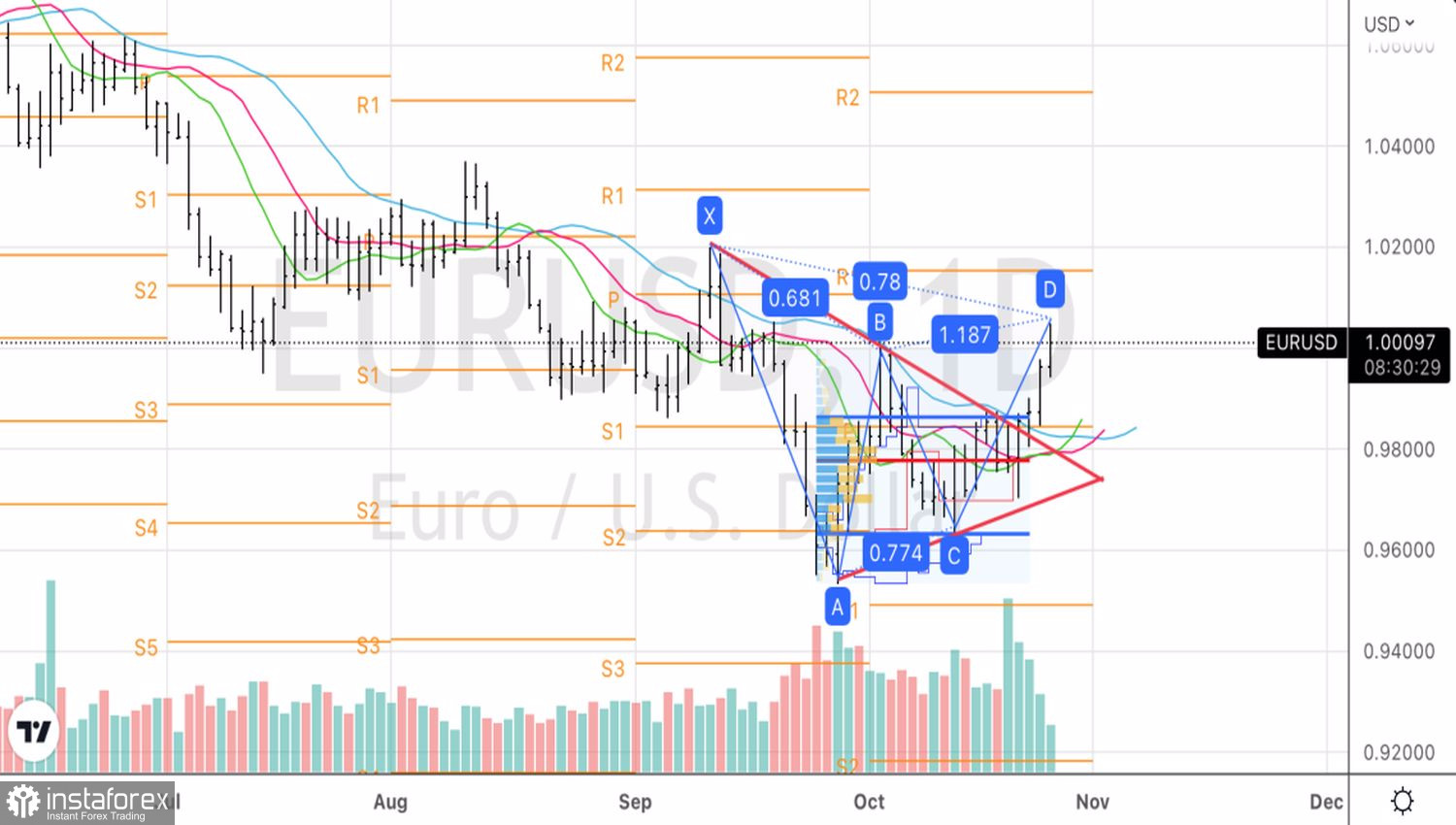

Technically, on the EURUSD daily chart, there is a realization of the Gartley harmonic trading pattern. After reaching the 78.6% Fibonacci level, the pair went down. Its further fate will depend on the ability of the "bears" to return the euro below the pivot point by $0.996. If it doesn't work, the pullback will continue. While the quotes are higher, we buy in the direction of $1.011 and $1.015.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română