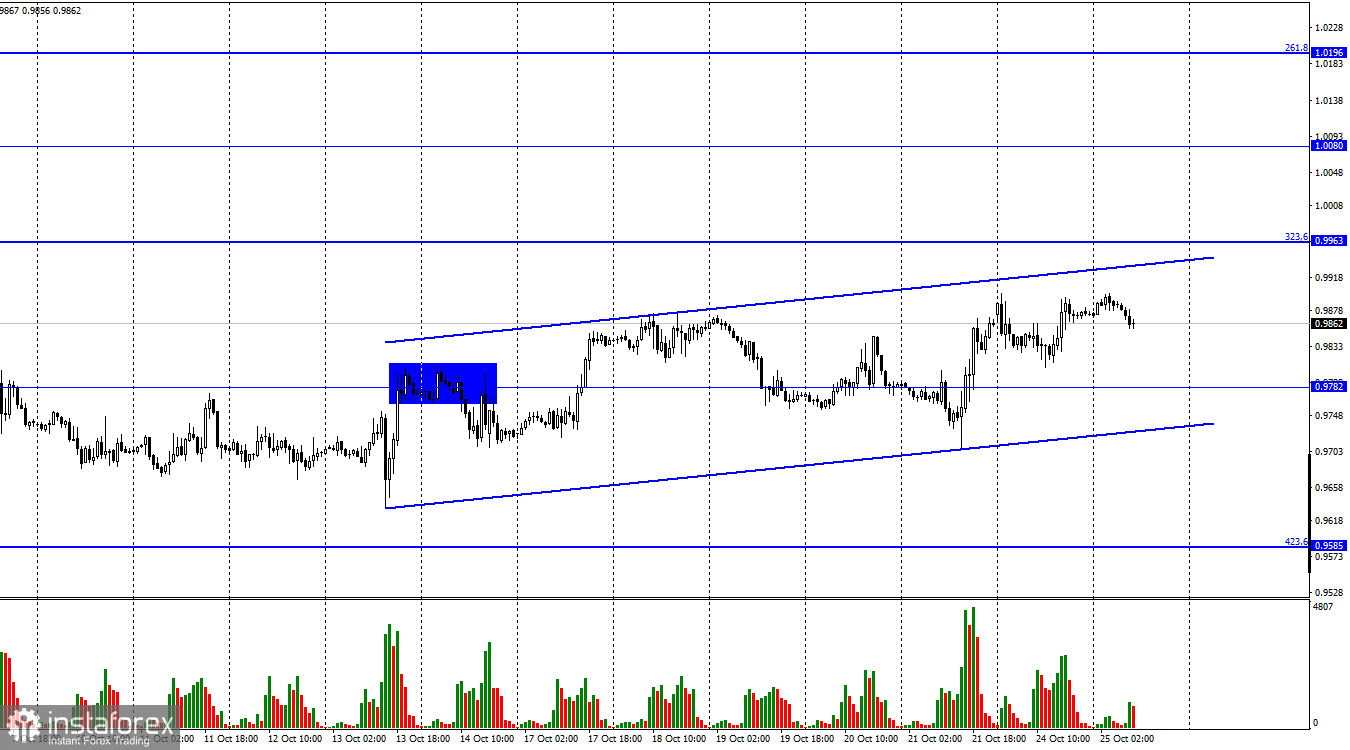

EUR/USD trading was sluggish on Monday so the pair closed the session without any changes. I placed a new trend channel on the chart. You can see that it is rather weak and is hardly pointing to the upside. This means that the euro has been rising very slowly lately, but still rising. Yet, bulls are hesitating to step in even ahead of the ECB meeting where the regulator will raise the rate once again. The euro could have advanced on expectations of another rate hike. However, this didn't happen. Market participants stay away from buying the euro which means they are not ready to get bullish on the pair even though the EU monetary policy will continue to tighten.

This week, there will be nothing to focus on. As we can see from the previous weeks, traders are not ready to push the pair to new levels. Probably, the speech by Christine Lagarde on Thursday will change the market sentiment. However, I think that the pair will be fluctuating during the day and then returns to the previous range. Therefore, the market is in a wait-and-see mode that can persist for a few days or weeks. Besides, I would like to point out that the price is holding near the upper line of the descending channel on the 4-hour chart. A rebound from this line may trigger a new fall in the euro. To get a sell signal, you need to wait for the price to close below the ascending channel on the H1 chart. These are the signals you need to watch for until Thursday. Then the situation may change.

I don't expect the euro to show impressive growth anytime soon. Traders had enough time to take the price away from the 20-year low. Yet, the pair has not even reached the parity level.

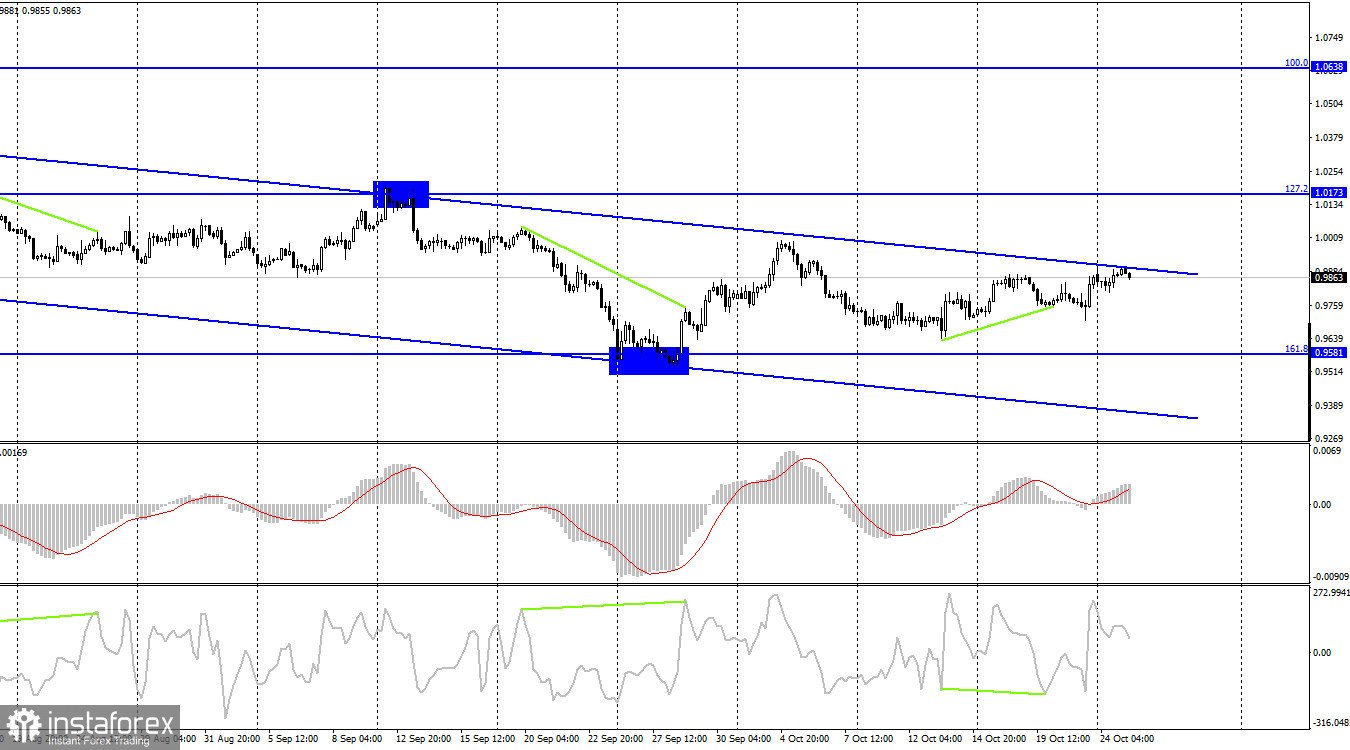

On the 4-hour chart, the pair continues to rise towards the upper line of the descending trend channel. Yet, the market sentiment is clearly bearish in this time frame. Only a firm hold above the descending channel will allow the euro to notably advance towards the Fibonacci retracement level of 127.2% at 1.0173. If the price bounces off the upper boundary of the channel, it will resume the fall to the level of 161.8% at 0.9581.

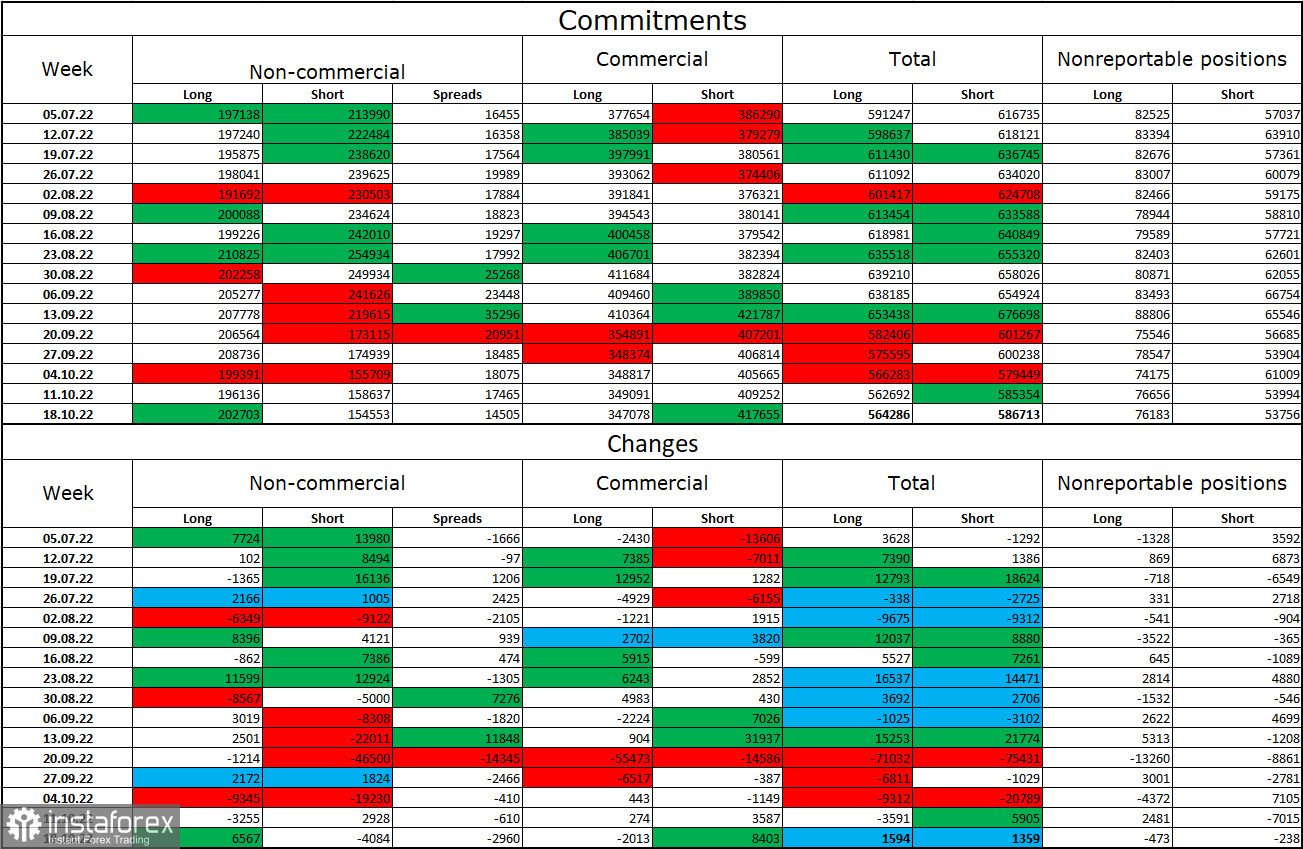

Commitments of Traders (COT) report:

Last week, traders opened 6,567 long contracts and closed 4,084 short contracts. This means that large market players became a bit more bullish on the pair. The sentiment is clearly bullish not bearish like with the British pound. The total number of long contracts opened by traders is 202,000 while the number of short contracts stands at 154,000. Yet, the euro is still struggling to develop a proper uptrend. In recent weeks, there were some chances for the euro to recover. However, traders are hesitant to buy it and prefer the US dollar instead. Therefore, I would advise you to focus on the main descending channel on the H4 chart although the price failed to close above it. So, we may see another fall in the euro soon. Even the bullish sentiment of larger market players does not allow the euro to develop growth.

Economic calendar for US and EU:

On October 25, both US and EU economic calendars show no significant events. Therefore, the impact of the information background on the market will be zero today.

EUR/USD forecast and trading tips:

I would recommend selling the pair if the price bounces off the upper line of the channel on the 4-hour chart. The target in this case should be the level of 0.9581. Buying the pair will be possible when the price holds firmly above the upper line of the channel on the H4 chart, with the target at 1.0173.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română