The pound has been evaluating political news in a positive light since the morning. How will the mood of traders of the British currency develop in the near future and is it worth counting on the growth of the exchange rate in the future?

Today, investors are assessing the news about the appearance of a new British prime minister. Rishi Sunak was elected head of the ruling Conservative Party of Great Britain, and will also take the post of prime minister of the country.

England has surpassed itself in political twists and turns. Sunak will be Britain's third prime minister this year. In July, Boris Johnson announced his intention to resign. Liz Truss, who was elected in his place, was able to stay in the prime minister's chair for 44 days and also resigned due to an avalanche of criticism against her.

Many see the new prime minister as a source of stability. Perhaps there really is some truth in this, when compared with the chaotic rule of the Truss, during which serious volatility was observed in the markets. Time will tell what kind of ruler Rishi Sunak will be, but for now market players are breathing a sigh of relief and are in a cautiously positive frame of mind.

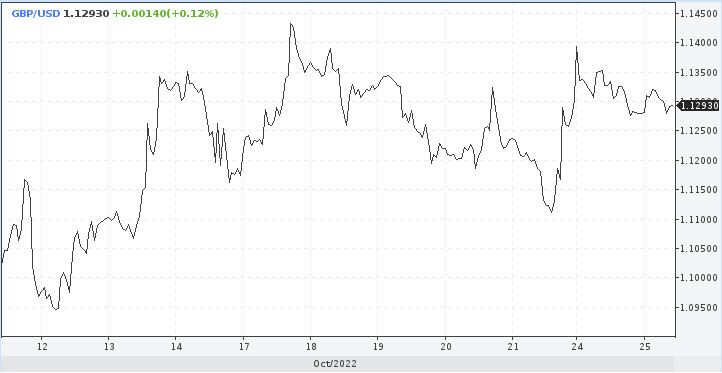

Today, the GBP/USD pair rose to 1.1293 from the previous closing level of 1.1275.

As expected, the pound may continue to rise in the short term, but it risks failing during the week. Economic data is ahead, and they are likely to show an even greater divergence from the US economy for the worse.

While the market has welcomed the recent developments surrounding the election of a new prime minister, they alone can do little to improve Britain's economic prospects. The GBP/USD pair may continue to rise, but estimates regarding the extent of the rate hike are already declining.

If the 1.1500-1.1700 range becomes a reality in the very near future, this does not mean that the quote will fly further and higher. Such a scenario is more like a decent short entry point. The target range for the end of the year is still 1.0800-1.1200.

Britain released a disappointing PMI on Monday. Indices of activity in the manufacturing sector and the service sector collapsed, falling below market expectations.

The composite index in October was 47.2, which is two points lower than in September. Its value has become the lowest in the last two years. In addition, the business activity indicator has been below 50 points for three consecutive months.

The reason for the sharp decline in the index in October is called political instability in the country, which caused turmoil in the financial markets.

Anyway, the current situation points to the recession that has formed in the country. A reduction in economic growth may occur as early as the third quarter, and in the fourth negative trends will only intensify.

The prospects of the pound, among other things, depend on the positioning of the US dollar and its further strength.

Will the decline in the dollar index last until the end of the week? Much will depend on how traders react to the upcoming economic reports in connection with the forecast of the Federal Reserve's policy. The focus is on the GDP report for the third quarter and the employment cost index for the same period. Data on wages and inflation will strengthen the hawkish attitude of the Fed.

One of the most significant risks for the pound this week will be the US GDP report. It can show that America is emerging from a technical recession, while the UK is entering an active phase of recession. Divergence in economic prospects will undermine the pound's recovery.

A serious obstacle is the core PCE price index's release this Friday, the Fed's preferred inflation indicator. The inflation rate is expected to increase from 4.9% year-on-year to 5.2%.

If so, it will be more than enough to guarantee the Fed's hawkish attitude, which has helped the dollar reach new heights against many currencies in the weeks since the bank set course to raise the benchmark interest rate to 4.5% by the end of the year and 4.75% at the beginning of the next.

In general, the dollar index is forecast to rise to 114.00 this week.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română