Oil is starting to consolidate. At first glance, due to the retreat of the US dollar, on the one hand, and the slowdown in economic activity, on the other. But this is not just the case. Due to constant turmoil, investors' attention is constantly shifting from the problem of limited supply to the risks of a global recession, which does not allow Brent to spread its wings. At the same time, many negative factors associated with demand have already been taken into account in the quotes of the North Sea variety. This circumstance makes the potential of its peak limited.

Oil is quoted in US currency, so the USD index that took a step back is good news for Brent. The market is actively discussing the topic of slowing down the speed of the Fed's monetary restriction, in particular, raising the federal funds rate not by 75, but by 50 bps in December, as well as the arguments of FOMC officials on this topic in November. Coupled with positive corporate reporting and the appointment of Rishi Sunak as Prime Minister of Britain, this contributes to the S&P 500 rally, improves global risk appetite, and puts pressure on the US dollar.

Dynamics of oil and US dollar

In addition, the stock market now operates in the "bad news from the economy is good for us" mode. In this regard, a further slowdown in business activity, including the fastest pace of PMI reduction in the US manufacturing sector, became a good reason to buy equity securities and sell the dollar. For oil, this has become a double-edged sword. Purchasing managers' indices are falling not only in the United States, but also in Europe and other regions, which adds negativity to the piggy bank of declining global demand for black gold.

At the same time, according to SPI Asset Management, the risks of a recession in the global economy and a collapse in demand are overstated and are certainly taken into account in the price. On the contrary, the OPEC+ production cut by 2 million bpd, which is ready to begin in November, and the start of the EU embargo on Russian oil from December will allow Brent to return to $100 per barrel.

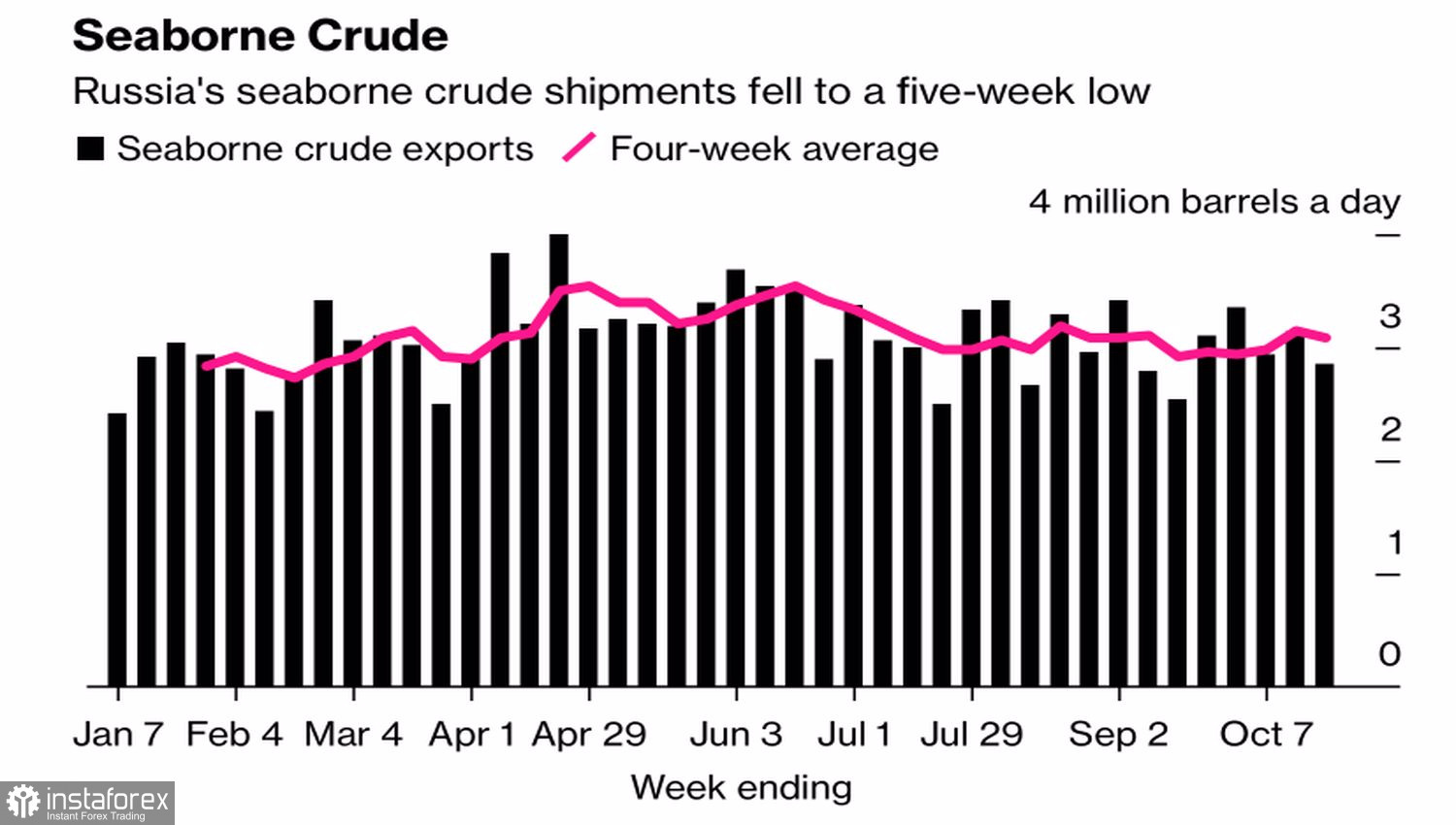

Dynamics of sea transportation of Russian oil

The IEA believes that about 80–90% of oil from the Russian Federation will not fall under the price ceiling set by the G7, which is good news for the global economy. It still needs Russian black gold. At the same time, according to Bloomberg, European sanctions will not come into effect from the beginning of December, but earlier. The volume of sea supplies in the week by October 21 fell to the lowest level since mid-September.

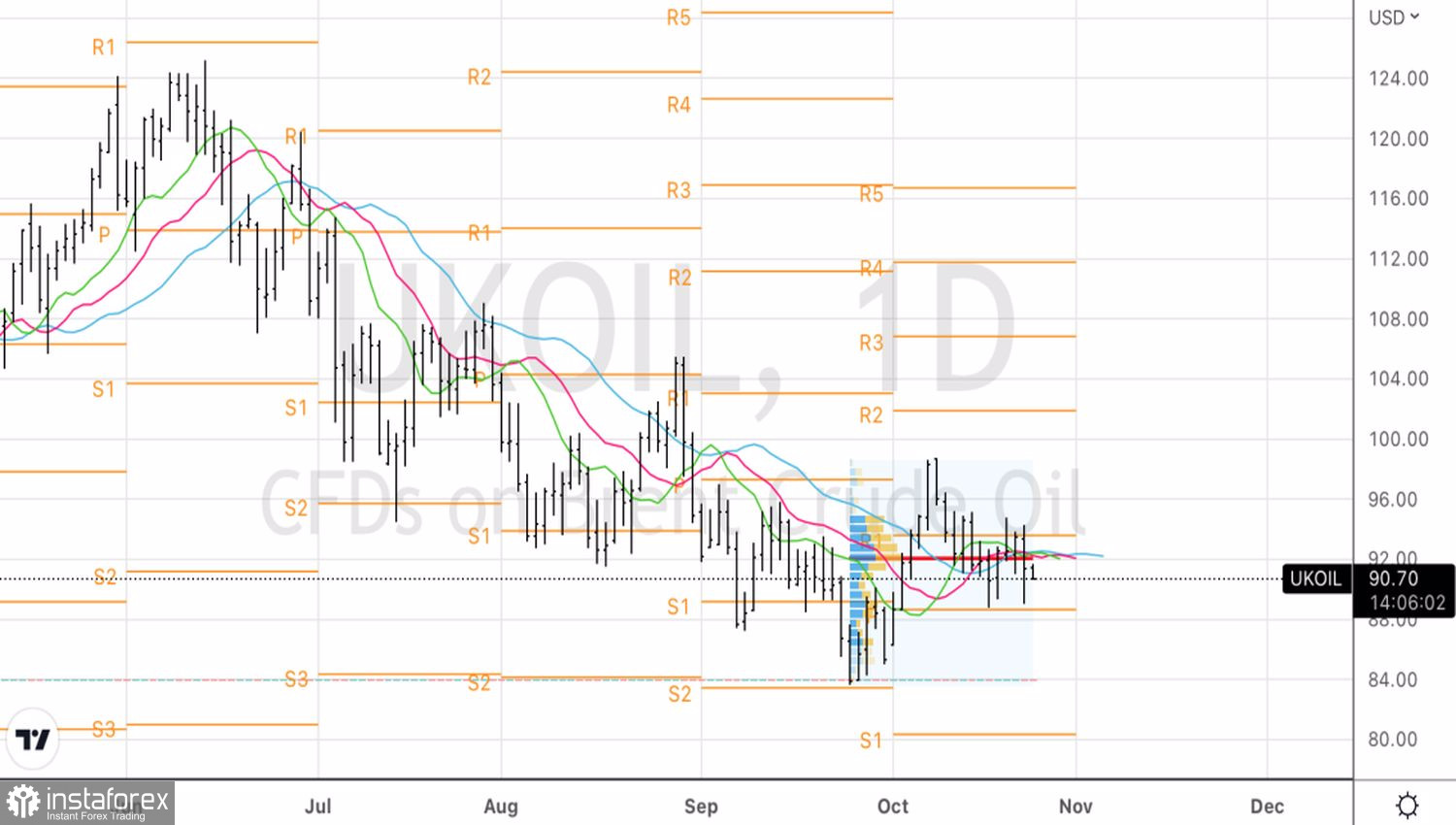

In my opinion, the risks of a global recession have not yet been fully factored into the price of oil. The US economy remains resilient despite the Fed's most aggressive monetary tightening cycle in decades. GDP in the third quarter is ready to grow by 2.3%. Yes, the probability of consolidation of the North Sea variety is high, but it can still continue to dive.

Technically, on the Brent daily chart, there is a Splash and shelf pattern on a 1-2-3 base. I recommend setting pending orders to buy at $94.8 and sell from $88.8 per barrel.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română