Analysis of transactions in the GBP / USD pair

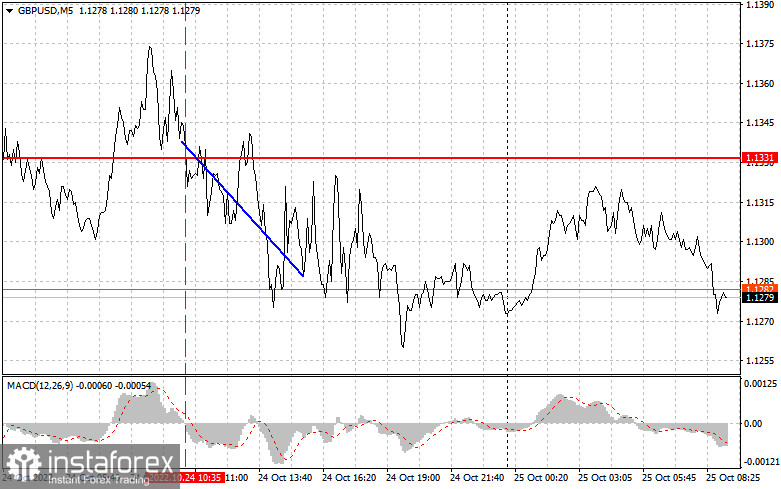

The test of 1.1331 happened when the MACD line was just starting to move below zero, which was a good reason to sell. It resulted in a price decrease of about 40 pips. No other signals appeared for the rest of the day.

Pound fell on Monday as PMI in the UK was weaker than expected. And although bulls did not react to the bad data on the US, a rebound may occur as many expect the new UK Prime Minister, former Finance Minister Rishi Sunak, to succeed in pulling the economy out of crisis.

The report on UK industrial orders is due out today, but it is of little interest to the market. As such, attention will be focused in the afternoon, particularly on the S&P / CS Composite-20 housing cost index and the US consumer confidence index. A slowdown or decrease in the figures will indicate that the US economy is sliding into recession. The speeches of Finance Minister Janet Yellen and Fed member Christopher Waller will also be of little interest.

For long positions:

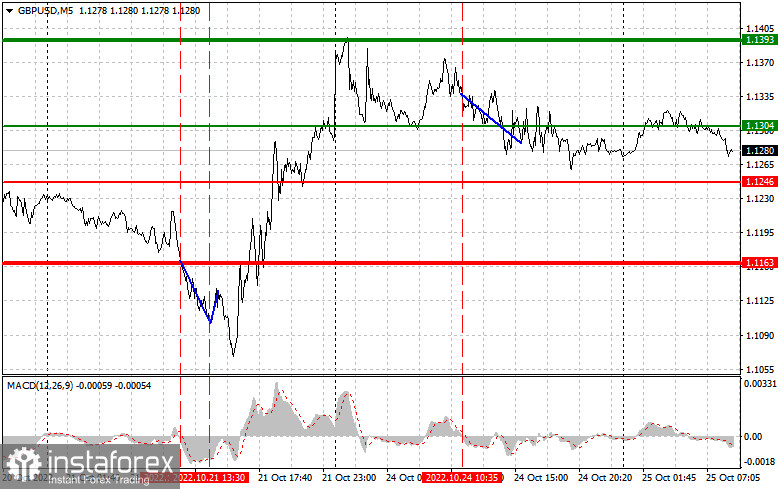

Buy pound when the quote reaches 1.1304 (green line on the chart) and take profit at the price of 1.1393 (thicker green line on the chart). Growth will occur if statistics in the UK are better than expected, and if market reaction to the new UK prime minister is positive. But remember that when buying, the MACD line should be above zero or is starting to rise from it.

Pound can also be bought at 1.1246, however, the MACD line should be in the oversold area as only by that will the market reverse to 1.1304 and 1.1393.

For short positions:

Sell pound when the quote reaches 1.1246 (red line on the chart) and take profit at the price of 1.1163. Pressure will return if news in the UK are negative, while statistics for the US exceed expectations. But take note that when selling, the MACD line should be below zero or is starting to move down from it.

Pound can also be sold at 1.1304, however, the MACD line should be in the overbought area, as only by that will the market reverse to 1.1246 and 1.1163.

What's on the chart:

The thin green line is the key level at which you can place long positions in the GBP/USD pair.

The thick green line is the target price, since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the GBP/USD pair.

The thick red line is the target price, since the quote is unlikely to move below this level.

MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decision based on the current market situation is an inherently losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română