The time of meetings of all three central banks that interest us is approaching. There has been a lot of talk lately about how much the stakes will rise this time. In light of these discussions, it is very interesting to see how the market will react to these changes in monetary policy. In my opinion, a turning point is approaching. In the US, the rate has already risen to 3%, which is the level "above neutral." The "neutral" level is the level at which high rates create no pressure on the economy. However, 3% is not enough for inflation to slow down, so I do not doubt that the Fed will raise the rate by 75 basis points at least once more.

In the European Union, the situation is somewhat different since the ECB began to raise the rate much later than the Fed. Therefore, it is only at the beginning of the path to achieving 2% inflation. If the US economy is very strong and has recovered well after the pandemic crisis, then economic growth in the European Union has been weaker, and the EU authorities are afraid of a reduction in GDP. In my opinion, the ECB will balance maintaining the minimum growth rates of the economy and the maximum possible interest rate. However, since now the rate is only 1.25% (below "neutral"), then at the next meeting, which will take place this week, the ECB may also raise the rate by 75 points.

The Bank of England does not lag behind the Fed regarding the number of tightening measures but lags in quality. The Bank of England's current rate is 2.25%, which can be called "neutral." However, at the last meeting, several members of the PREP committee voted for an increase not by 50 points but by 75. I think that due to rising inflation, the Bank of England will also decide to raise its rate by 75 points.

What happens? All three banks are highly likely to raise rates by 75 basis points. Such regulators' decisions will not give the market grounds for preference a particular currency. The rates will rise simultaneously, but the difference between them will remain the same. It's another matter if one of the banks fails to meet market expectations. The ECB and the Bank of England are the closest to this, which are forced to monitor not inflation but economic growth closely. Although the GDP of the European Union and Britain has been positive in recent months and quarters, it is from there that the greatest number of doubts about the practicality of a hard increase come. However, I think all three banks will meet analysts' forecasts this time.

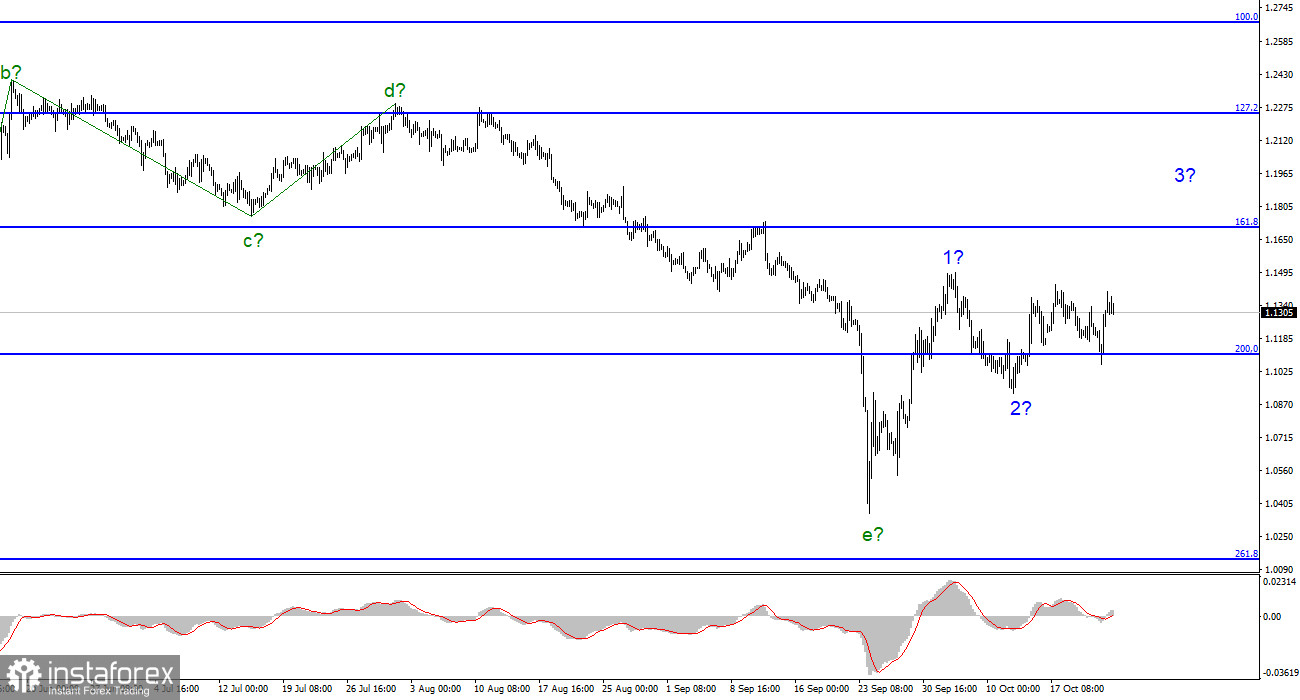

The scenario I described above gives no reason to expect changes in the wave markings in the near future. I am afraid we will be in limbo for a long time, not understanding which section of the trend is being built now. Both instruments can once again complicate the downward section of the trend from the current positions, or they can continue building an upward one. But this upward trend may turn out to be a three-wave, corrective one, after the rapid completion of which the construction of a downward trend will resume.

The wave pattern of the pound/dollar instrument assumes the construction of a new upward trend segment. Thus, I advise buying the instrument on the MACD reversals "up" with targets near the estimated mark of 1.1705, equating to 161.8% Fibonacci. It would be best if you were careful with sales and purchases since the downward section of the trend may become more complicated once again.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română