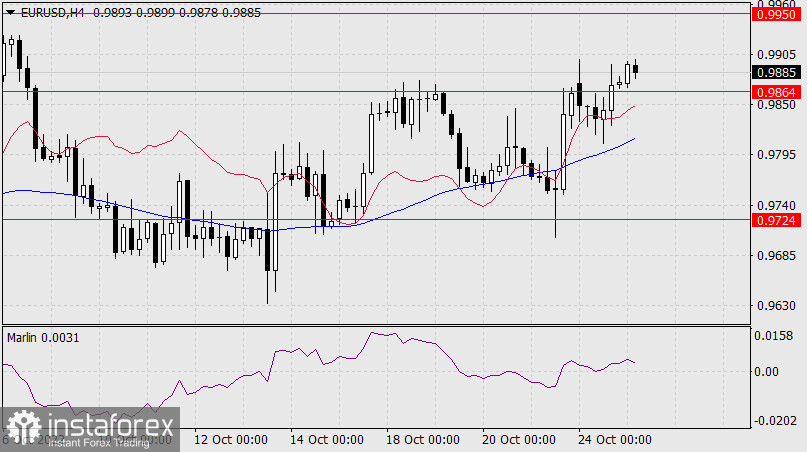

As a result of Monday, the euro did not fall, closing the day above Friday, above the balance and MACD indicator lines, and above the resistance of 0.9864. At the moment, the market is trying to win back the difference in sentiment between the Federal Reserve, which is slowing down the pace of rate hikes, and the European Central Bank, which is raising rates by 0.75% the day after tomorrow. We do not know how the market will de facto react to the ECB rate hike, although formally the mood of the players is clearly optimistic.

This optimism in technical terms is expressed in the fact that if the price goes above the upper limit of the price channel and above the resistance of 0.9950, the euro opens a target of 1.0050. But if there is no upward breakthrough, for example, the ECB will raise the rate by only 0.50%, which is already being talked about in the press, or, with a 0.75% rate hike, will copy the Fed's mood and declare that it is not possible to continue to maintain such a pace for the shrinking economy, the price can easily turn into a medium-term decline with the first target at 0.9724.

The price settled above the level of 0.9864 on the four-hour chart, above both indicator lines, the Marlin Oscillator is in the positive area. We follow the development of the current price growth. Long positions in the current situation is associated with increased risk.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română