Thanks to the rally of US stock indices, the resignation of Liz Truss from the post of British Prime Minister and expectations of a 75 bps deposit rate increase at the October ECB meeting, the EURUSD bulls showed their teeth. They brought the pair's quotes closer to the 0.99 mark by arm's length, but then they were forced to take a step back. The central events of the last full week of October are not only the meeting of the Governing Council, but also the release of US GDP data for the third quarter. And there is already more positive for the dollar.

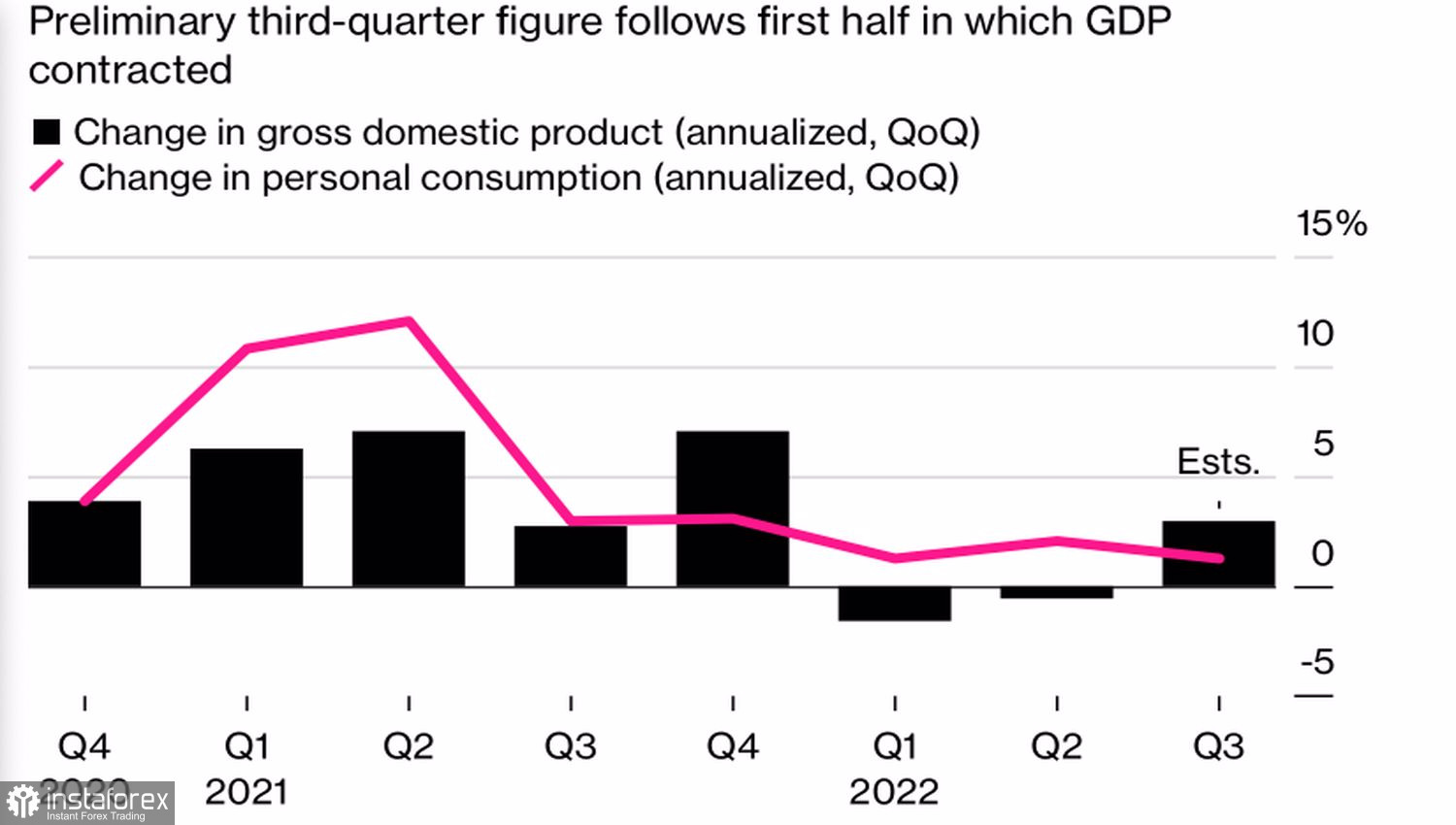

The stock market has recently been operating in the "bad news from the economy is good for us" mode. The stability of the US economy allows the Fed to aggressively raise the federal funds rate, the ceiling of which, according to the futures market, exceeds 5%. In this regard, Bloomberg experts' forecast of US GDP growth of 2.3% in the third quarter can be considered negative for the S&P 500 and good news for the EURUSD bears. Moreover, the leading indicator from the Federal Reserve Bank of Atlanta signals that the gross domestic product will expand by 2.9%.

Dynamics of US GDP

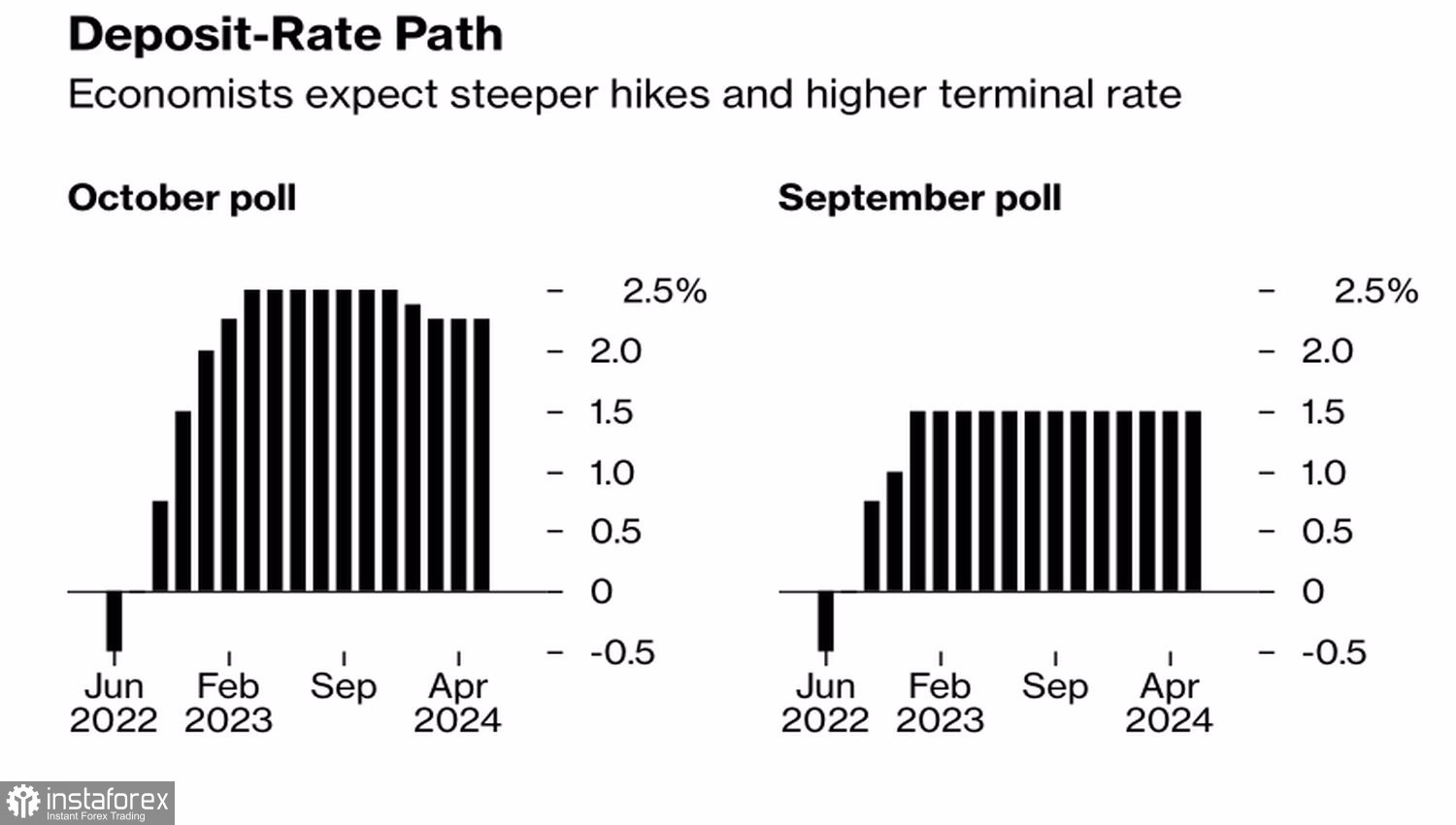

The ECB meeting is able to balance the situation in the main currency pair. Quite an interesting meeting. Even though the futures market is confident in raising the deposit rate by 75 bps, that is, this factor has already been taken into account in EURUSD quotes, the European Central Bank may present a surprise. Both with regard to the magnitude of the change in borrowing costs, and with the help of talk about the imminent launch of the quantitative tightening program – QT.

The question of the ceiling is also very relevant here. Bloomberg experts raised its value from 1.5% in the previous survey to 2.5% by March. The hawks of the Governing Council believe that 3% will be the optimal figure, while the mantra is coming out of Spain that inflation will fall on its own in 2023, so there is no point in going too far. 2.25–2.5% is quite enough, which can return consumer prices to the target in the medium term.

Expert forecasts for the ECB rate

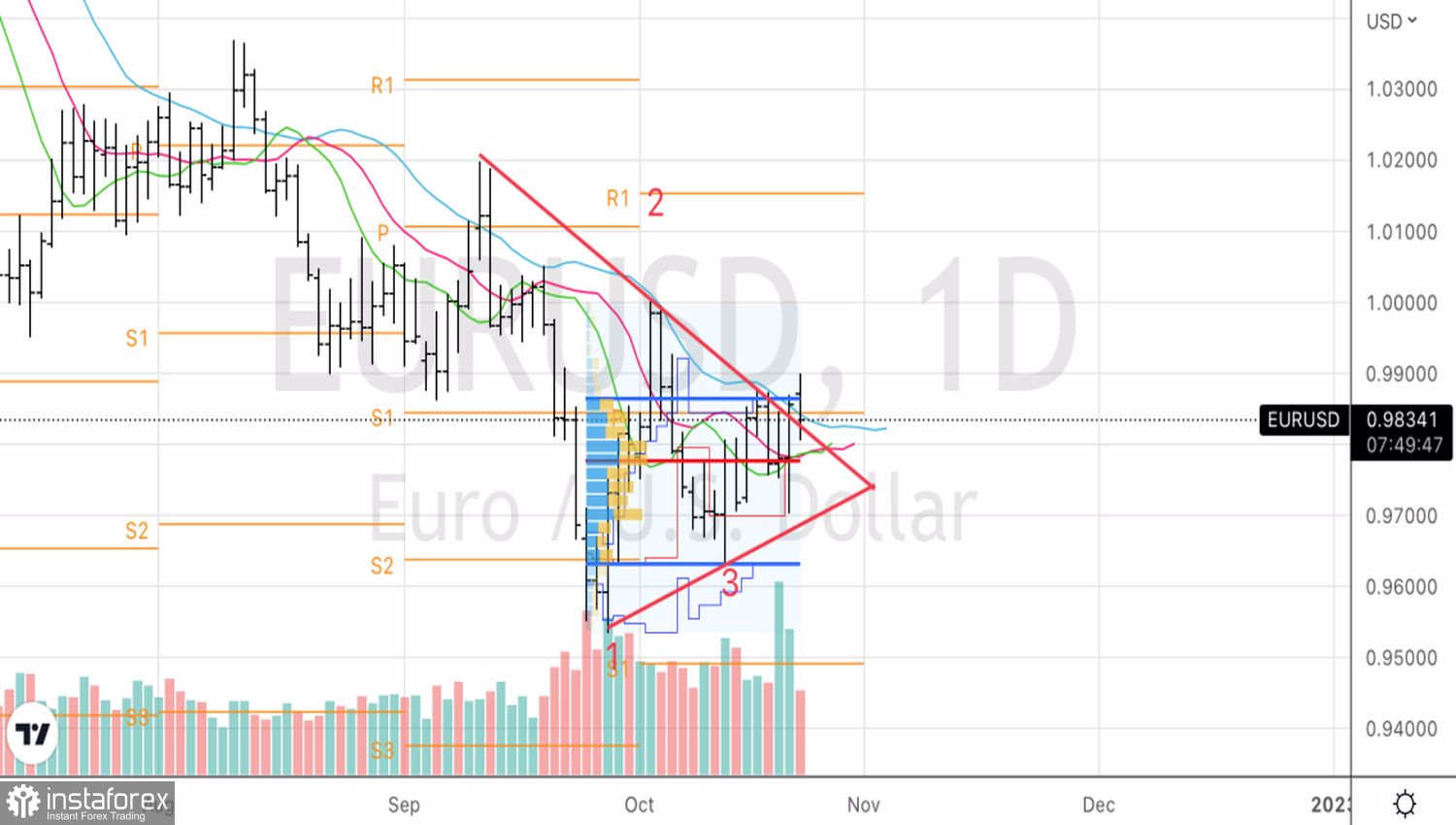

Throwing between a potentially bad market due to strong US statistics and a potentially strong euro due to the dominance of hawks in the European Central Bank increase the risks of EURUSD consolidation ahead of important events.

Of course, other factors can interfere with the balance of power. In particular, the election of Rishi Sunak as Prime Minister of Britain. Pessimists believe that the new head of government, whoever he is, will not help the pound. On the contrary, those for whom the glass is half full are sure that a person with such experience will save the UK economy, and his appointment will lend a helping hand not only to GBPUSD, but also to EURUSD.

Technically, the inability of the euro to go beyond the upper limit of the fair value of 0.963–0.986 indicates the weakness of the bulls. However, the level of 0.977 currently acts as a support. A rebound from it will allow the formation of short-term longs with a subsequent transition to medium-term shorts as EURUSD rises.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română