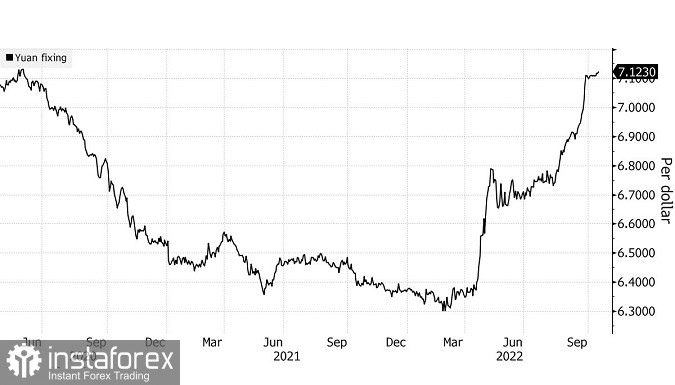

Xi Jinping's major leadership reshuffle, which awarded his loyalists all major government posts, has resulted in exasperation in Chinese markets. In Hong Kong, the Hang Seng Index had its worst day since the 2008 global financial crisis. The Chinese yuan has fallen to a 14-year low.

The Hang Seng China Enterprises index, a gauge of Chinese stocks listed in Hong Kong, plunged by 7.3% in its worst performance after any Communist Party congress since the index was established in 1994. As foreign investors fled mainland Chinese markets, selling a record amount of equities via trading links in Hong Kong, the CSI 300 index lost 3%. The onshore yuan fell by 0.6% to the lowest level since January 2008.

The market crash following a reshuffle highlighting Xi Jinping's unquestioned power over the ruling party demonstrates deep disappointment over a likely continuation of policy staked on Covid Zero and state-owned companies.

Shares of tech giants Alibaba Group Holding Ltd., Tencent Holdings Ltd., and Meituan slumped by more than 11% as investors remain skeptical about whether Xi and his allies will seek a rejuvenation of private enterprise.

"The market is concerned that with so many Xi supporters elected, Xi's unfettered ability to enact policies that are not market-friendly is now cemented," Justin Tang, head of Asian research at United First Partners said.

While appointment of Xi Jinping's allies to key government posts may help accelerate major agendas, the addition of Covid Zero advocates to the Politburo Standing Committee diminishes the chance of any early loosening of COVID-19 restrictions.

On Monday, foreigners sold mainland Chinese stocks worth 17.9 billion yuan ($2.5 billion dollars) via trade links with Hong Kong, the biggest such sell-off since 2016.

This goes in contrast to global stocks, which had their best weekly performance since July last week. According to Bloomberg, the Hang Seng Index is trading at its lowest level against the S&P 500 since 2001.

Many key Chinese economic data, which were published on Monday after abrupt delays last week, showed a mixed recovery. The economy grew faster than expected in the third quarter. Industrial activity improved despite COVID restrictions and a property slump, but retail sales weakened.

Economists remain wary about future growth given the continuing COVID lockdowns. In one district in central Guangzhou, the authorities stopped in-person schooling and dining-in at restaurants, sparking concerns about potential disruption in the southern manufacturing hub.

"The Hong Kong market is seeing a panic selling moment," Dickie Wong, executive director of research at Kingston Securities Ltd. said. "While China reported macro data that beat expectation, the market is on a way down, as the leadership reshuffle and tensions between China and US continue to drag down sentiment and adds uncertainty."

In the FX market, the offshore yuan is once again nearing its weak end of the 2% trading limit around the fixing, signaling a rise in bearish sentiment toward the currency. The People's Bank of China set the fixing at 7.1230 per dollar on Monday, weaker than the recent pattern of near 7.11 per dollar.

Chinese high-yield dollar bonds, dominated by notes sold by real estate firms, fell by about 1-3 cents on Monday, according to data by credit traders.

"The market situation currently might be the worst I've even seen in my career. Sentiment is even worse than the 2008 global financial crisis," Harris Wan, vice president at iFAST Global Markets noted.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română