The pound against the dollar started the trading week with an upward gap, testing the 14th figure. At the same time, on Friday, the bears tried to gain a foothold in the area of the 10th price level. But no luck: the existing fundamental background does not contribute to the development of the downward trend, despite the political crisis that erupted this month in the UK. However, UK's political events, in fact, became the reason for the current strengthening of the pound.

Last week, Prime Minister Liz Truss announced her resignation. The odious anti-crisis plan, which included tax cuts, buried the political career of the head of government.

The pound took this news ambiguously. On the one hand, Truss was the reason for the collapse of the currency—GBP/USD at the end of September fell to a historic low, to the level of 1.0345. At the same time, the prime minister was widely criticized for her tax initiatives, because of which she had to hastily change the finance minister and abandon her previously announced budget plans. In general, the six-week period of her premiership was accompanied by chaotic political decisions, so the announced Happy End allowed the pound to strengthen its position. But at the same time as Truss left, the figure of Boris Johnson loomed on the horizon, who left Downing Street this summer with a scandal. The British currency was again under pressure, but in this case, rather due to political uncertainty.

However, yesterday it became known that Johnson will not nominate his candidacy. According to his version, he was unable to agree with the main candidates for the position in order to "act together in the interests of the nation." According to another version, Johnson was unable to enlist the support of the required number of Conservative MPs in the House of Commons.

One way or another, but the fact remains that after Boris left the race, a clear favorite appeared in the election race. With a high degree of probability, it can be assumed that the next Prime Minister of Great Britain will be Rishi Sunak. And at the moment, this is not bad news for the British currency. Sunak's good Oxford education, consistency and work experience in government structures, especially in the field of economics, play in his favor, since he held the position of finance minister in the cabinet of Boris Johnson.

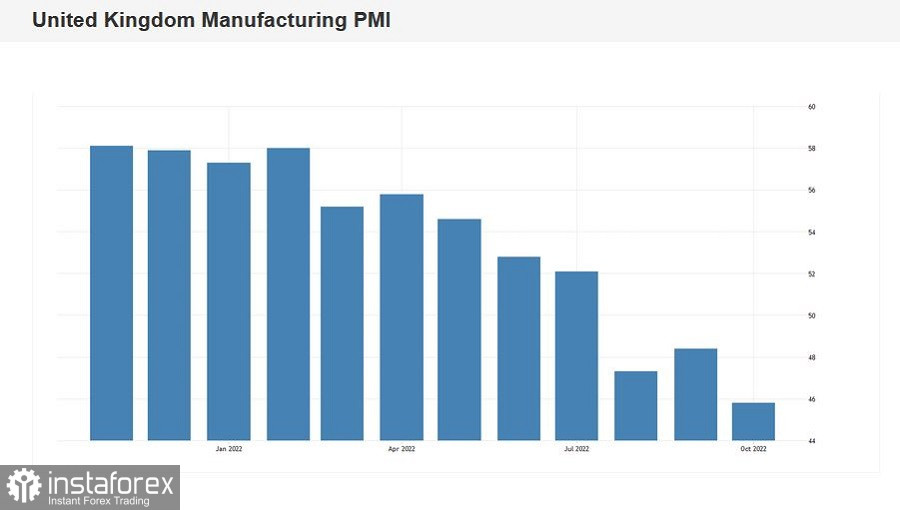

Against the background of such news, the pound paired with the dollar today tested the 14th figure. However, GBP/USD buyers were unable to develop an upward movement. Macroeconomic statistics summed it up. The PMI indices published today came out in the "red zone," putting pressure on the British currency. The indicators have updated multi-month lows, reflecting the state of the national economy. Thus, the PMI index for the manufacturing sector was at the level of 45.8 points (with the forecast of a decline to 47.9 points). This is the weakest result since May 2020. A similar trend was demonstrated by the PMI index in the service sector, which fell to 47.5 points—a multi–month low. This is the weakest growth rate since January 2021. The composite PMI index came out at 47.2 points (at least since February last year).

Recall that according to the latest published data, the volume of UK GDP in August decreased by 0.3% MoM. The indicator showed similar dynamics (-0.3%) in quarterly terms. The indicators of industrial production also disappointed. On a monthly basis, the indicator dived into the negative area again, reaching -1.8% (this component is in the negative area for the third month in a row). The same situation exists in the processing industry.

At the same time, inflation continues to set records: the overall consumer price index came out at the level of 0.5% MoM and 10.1% YoY (previously at 10.0%). This is a multi-year record: the indicator showed the strongest growth rate since April 1982. Core inflation showed similar dynamics. The core consumer price index jumped to 6.5%. This result is a 30-year high.

Thus, the notorious "specter of stagflation" continues to scare investors.

The PMI indices published today did not allow the buyers of GBP/USD to develop an upward movement, but at the same time, they did not return the price to Friday's level, that is, to the area of 11–12 figures. The political factor is holding back the pair from collapsing, even despite the publication of an extremely negative macroeconomic release (which added to the already sad picture).

From a technical point of view, the GBP/USD pair on the daily chart is located between the middle and upper lines of the Bollinger Bands indicator. The support level is located at 1.1180, which corresponds to the middle line of the Bollinger Bands, which coincides with the Tenkan-sen line. The nearest resistance level is the upper line of the Bollinger Bands on the four-hour chart at 1.1370. The main price barrier is the target 1.1520 (upper line of Bollinger Bands on D1). Considering the information background related to the possible (probable) election of Rishi Sunak to the post of Prime Minister of Great Britain, longs on GBP/USD are in priority.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română