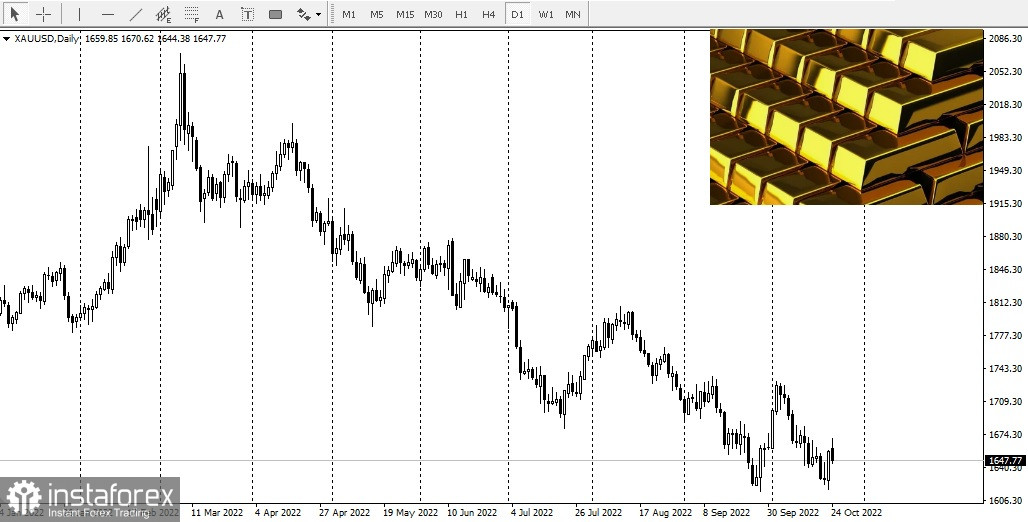

On Friday, gold prices rose above $1,650 per ounce; however, according to the latest weekly gold survey, the persistent bearish sentiment may limit growth this week.

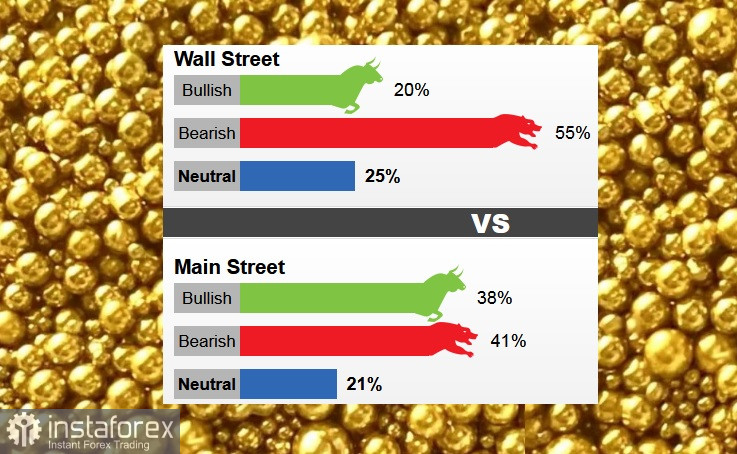

For the third week in a row, Wall Street analysts are firmly bearish; at the same time, bearish sentiment has a slight advantage among retail investors.

The gold market should have ended last week with sharp losses; however, a change in interest rate expectations on Friday gave the precious metal a new bullish impulse. According to the Wall Street Journal, some members of the Federal Reserve are considering slowing the pace of rate hikes after November as volatility and uncertainty prevail in financial markets.

According to the CME FedWatch Tool, the peak of interest rates above 5% will occur in early 2023.

According to Phillip Streible, chief market strategist at Blue Line Futures: although the Fed may slow down rate hikes by the end of the year, rising inflation means that the final rate has not changed.

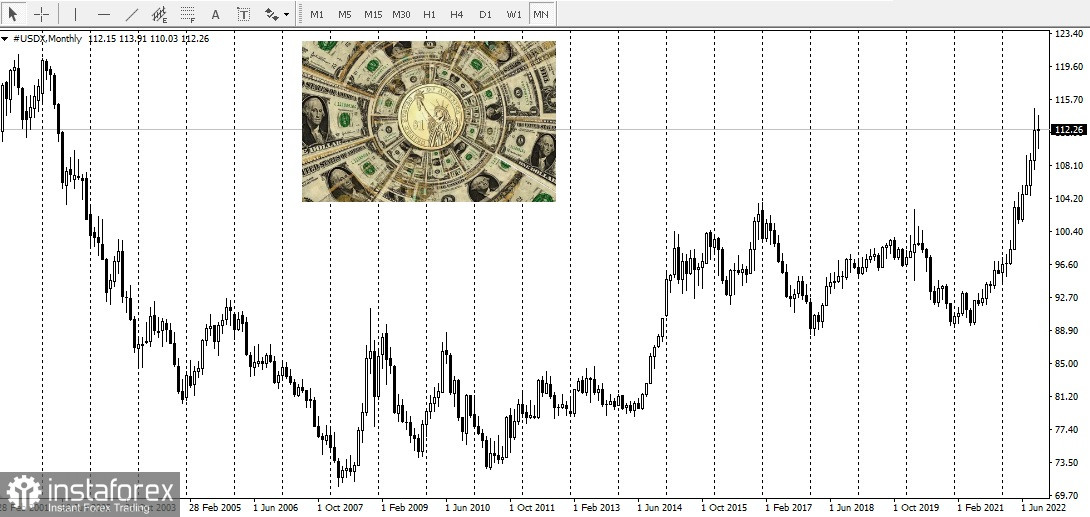

He added that he is neutral towards gold in the near future, as the rise in interest rates will continue to support the US dollar near its 20-year highs.

Last week, 20 market professionals took part in a Wall Street survey. Eleven analysts, or 55%, said they were bearish about gold this week. Four analysts, or 20%, said they were optimistic, and five analysts, or 25%, said they were neutral about the precious metal in the near term.

As for retail, 473 respondents took part in online surveys. 180 voters, or 38%, called for an increase in gold. Another 192, or 41%, predicted a drop in gold. The remaining 101 votes, or 21%, called for a side market.

Adam Button, Chief Currency Strategist Forexlive.com, said that while gold looks attractive in the long run, it remains bearish this week as the Federal Reserve is not yet ready for a reversal that supports the US dollar.

Ole Hansen, Head of Commodity Strategy at Saxo Bank, is neutral about gold, as interest rates will continue to rise.

Nevertheless, some analysts remain optimistic about gold as rising bond yields continue to affect the global economy.

Adrian Day, president of Adrian Day Asset Management, said he is optimistic as the monetary policy of the world's central banks is provoking a serious recession.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română