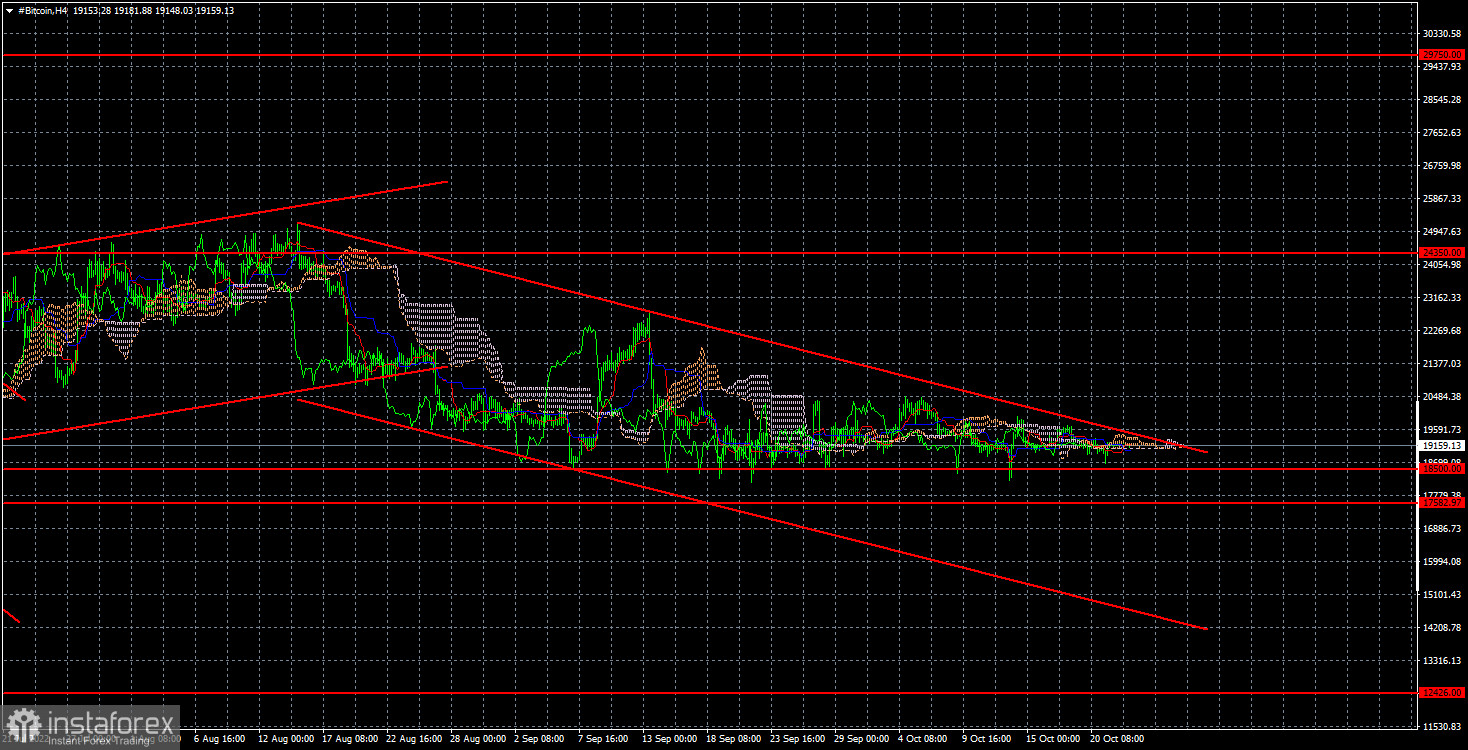

On the 4-hour TF, bitcoin continues to trade exclusively at the $18,500 level. The same thing can happen on the current TF as on the 24-hour TF. The pair may leave the descending channel within the flat, which is still likely to fall in the near future. However, given the months-long flat, this channel may also be recognized as irrelevant. Then only the side channels and the $18,500 level will remain on both TF. There is nothing more to add to the current technical picture.

In the meantime, we identified two key factors for bitcoin that can help it start experiencing serious future growth for a couple of years. They do not cancel our initial forecast of a drop in the area of $10,000–$12,000. But in the future, we may see another upward trend, within which last year's maximum will be updated. So, the first factor is the Fed's monetary policy. The US central bank is currently actively raising the key rate and selling bonds under the QT program. Both of these measures are aimed at combating high inflation and its return to 2%, creating a useless springboard for the growth of the cryptocurrency market.

Recall that risky assets (that is, not only cryptocurrencies) fall when monetary policy tightens. We can see how the euro and pound have been falling in the last nine months and how the American stock market is falling. But sooner or later, the moment will come when the rate will stop rising, inflation will eventually return to 2%, and the Fed will start lowering the rate to return it at least to a "neutral" level. Consequently, at this point, the demand for risky assets may begin to grow.

The second factor is halving. Halving is a reduction of the reward to miners for each block mined by half. The last halving was in May 2020; that is, it coincided with the past "bullish" trend and ultra-low rates all over the world. The new halving is planned for 2024. According to experts, it is in 2024 that the Fed may move to lower the key rate, and these two factors may again provoke a strong growth of "bitcoin." From our point of view, this is a reasonable forecast and a reasonable time frame for starting a new "bullish" trend.

In the 4-hour timeframe, the quotes for "bitcoin" continue to move sideways. We believe the decline will continue in the medium term, but we must wait for the price to consolidate below the $17,582-$18,500 area. If this happens, the first target for the fall will be a level of $ 12,426. The rebound from the level of $18,500 (or $17,582) can be used for small purchases, but be careful – we still have a downward trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română