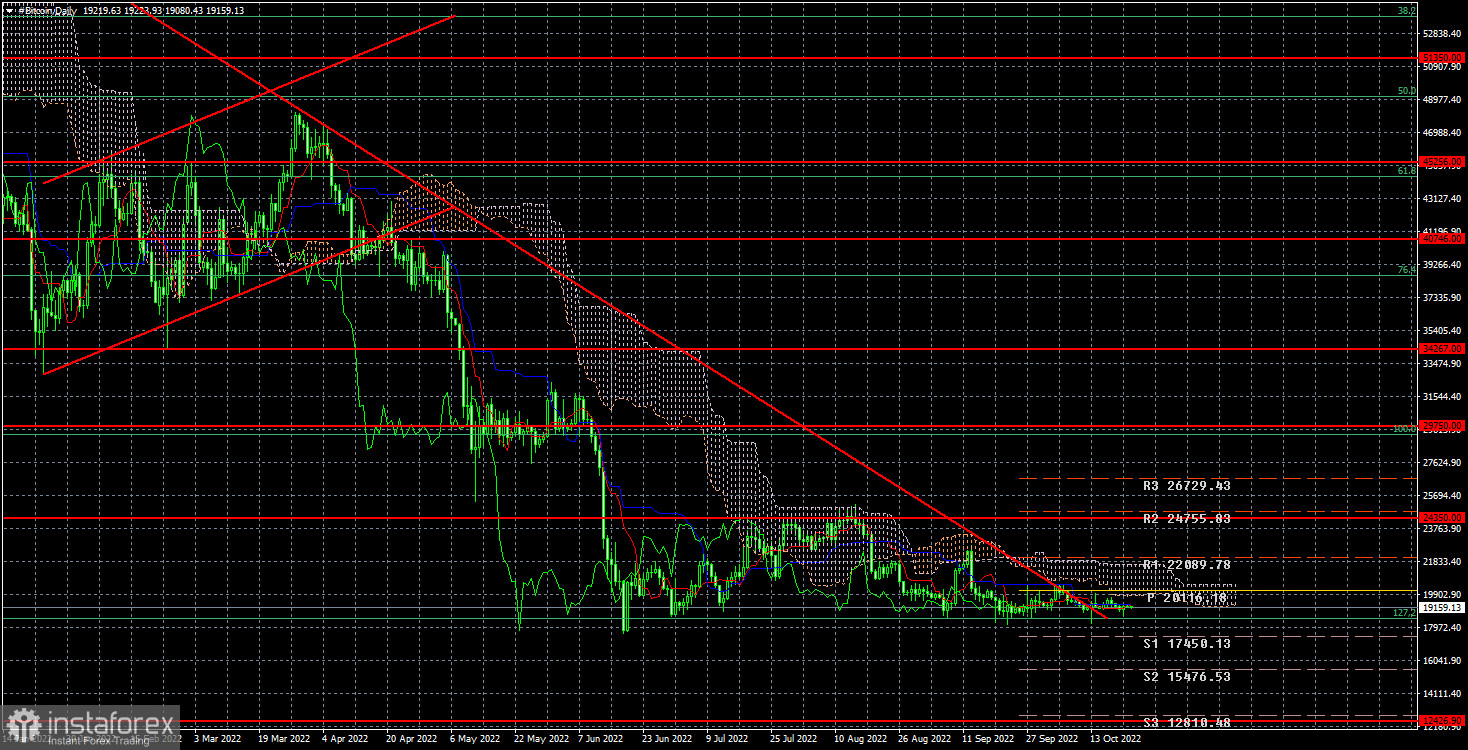

Bitcoin continues to trade in an almost absolute flat, just above the $18,500 level. Such a movement has been going on for a month. Isn't this a sign of the very stability that many dreamed of? Bitcoin is currently more stable than many fiat currencies, which depreciate against the dollar or trade in far more volatile and trending markets. However, these are all jokes. From a technical point of view, nothing has changed, and nothing could change, given the lack of movement. The pair has gained a foothold above the descending trend line, but this consolidation does not mean anything since it occurred in a complete flat. Thus, the main guideline now should be the side channel of $18,500–$20,500, not even $18,500–$24,500, where the price has been for four months. It is still necessary to wait to overcome the lower boundary of this channel since it is pointless to wait for a rebound from it. What kind of rebound can there be if the price moves along this level?

We still expect to see a new powerful drop in bitcoin. It should be understood that the longer bitcoin stays low, the more sellers there will be, not buyers. After all, bitcoin, for many, is a relatively fast and relatively easy way to earn money. If investments in securities or bonds need to be studied for your portfolio, then everything is much easier with bitcoin. Everyone knows it, and almost everyone prefers it to other cryptocurrencies, the number of which is already measured in thousands. However, the "buy and wait" rule only works during periods of cryptocurrency growth, and now we have seen a drop from $70,000 to $20,000. There was the same 70% drop that we talked about at the beginning of the year.

Moreover, bitcoin ended each of its "bullish" trends with a loss of 80–90% of its value. Minus 80% is the level of $14,000. Minus 90% is the $7,000 level. That is, approximately the level from which the growth began two years ago. We believe that bitcoin is unlikely to go below $10,000, but it is quite capable of getting close to this mark. Especially considering the current fundamental background.

In the 24-hour timeframe, the quotes of "bitcoin" could not overcome the level of $ 24,350, but they also could not overcome the level of $18,500 (127.2% Fibonacci) for several months. Thus, we have a side channel, and it is unclear how much time Bitcoin will spend on it. We recommend not rushing to open positions. It is better to wait for the price to exit this channel and only then open the corresponding transactions. Overcoming the $18,500 level will open the way to the $12,426 level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română