Long-term perspective.

The GBP/USD currency pair has increased by 40 points during the current week and remained above the critical line on the 24-hour TF. Thus, certain chances of a new upward trend are also preserved. We have already said earlier that the pound has more reasons for growth - technical. At least because it overcame the Kijun-sen line sharply and strongly moved away from its absolute lows. However, this is a double-edged sword. The last fall in the pound sterling might not have happened if not for the tax initiatives of former British Prime Minister Liz Truss. In general, her resignation turned out to be very unexpected since, at the beginning of the week, in an interview with Bloomberg, she said she was going to fight and did not intend to leave her post. We did not believe that she would leave voluntarily, and even so quickly, and we still could not announce a vote of no confidence in her in the near future. Thus, most likely, political pressure was exerted on her. However, all this is history and generally not interesting. Now I wonder who will become the new prime minister. And good old Boris Johnson can become one, as he is currently leading in the amount of support from the Conservatives, according to opinion polls. From the same conservatives who dismissed him a few months ago. The political pun in the Kingdom continues.

We need to wait for new elections, but the situation will not change dramatically for the pound sterling. Politics is, of course, interesting and important. As we have seen, the Prime Minister's short-sighted decision can collapse the financial markets. However, Johnson is unlikely to make the same mistake as Truss. And even more so, Rishi Sunak, who served as finance minister under Johnson, will not allow it. But in any case, the pound still has big problems with the grounds for growth. Technically, it can show an upward movement, but will one "technique" be enough for market participants?

COT analysis.

The latest COT report on the British pound showed a new strengthening of the "bearish" mood. During the week, the non-commercial group closed 8,600 buy contracts and opened 3,400 sell contracts. Thus, the net position of non-commercial traders fell by 12.9 thousand, which is quite a lot for the pound. The net position indicator has been growing slightly in recent weeks, but this is not the first time it has been growing. Still, the mood of major players remains "pronounced bearish," and the pound sterling maintains a downward trend in the medium term. And, if we recall the situation with the euro currency, there are big doubts that, based on COT reports, we can expect strong pair growth. How can you count on it if the market buys the dollar more than the pound? The non-commercial group has now opened a total of 91 thousand contracts for sale and 40 thousand for purchase. The difference, as we can see, is still very big. The euro cannot show growth in the "bullish" mood of major players, and the pound will suddenly be able to grow in a "bearish" mood. As for the total number of open buy and sell orders, the bulls have an advantage of over 25 thousand. But, as we can see, this indicator also does not help the pound much. We remain skeptical about the long-term growth of the British currency, although there are certain technical reasons for this.

Analysis of fundamental events.

During the current week, only one really important report was published in the UK - on inflation. The consumer price index rose by 10.1% y/y and, as we can see, continues to grow, despite the seven increases in the key rate. Many experts suggest that the rate in the UK should be raised to at least 5% to count on a significant reduction in inflation. But is there an opportunity for BA to raise the rate so high with the current financial and economic problems? From our point of view, no, and the ECB, together with BA, will stop tightening monetary policy in the near future. Or they will greatly slow down its pace. Both can create additional pressure on the pound, as the Fed will continue to accelerate its pace at the same time. In general, the prospects for the pound are bad as usual, and rising inflation does not mean that the British regulator will increase the aggressiveness of the monetary approach.

Trading plan for the week of October 24–28:

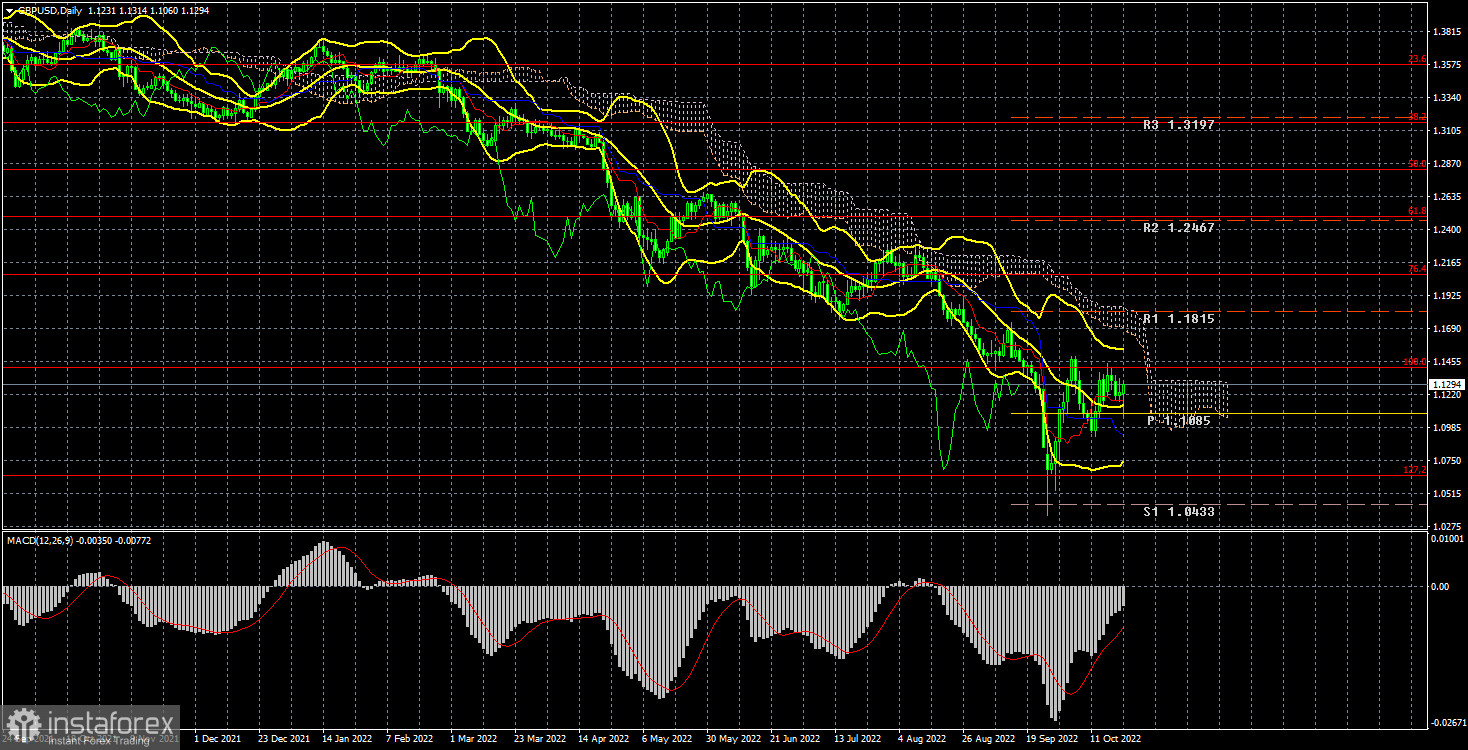

1) The pound/dollar pair as a whole maintains a long-term downward trend but is located above the critical line. Therefore, small purchases can now be considered as long as they are located above the Kijun-sen. The target is the Senkou Span B line, which runs at 1.1843. There are some reasons for the pair's growth, but there are still many reasons for a new fall. Be careful with your purchases.

2) The pound has made a significant step forward but remains in a position where it is difficult to wait for strong growth. If the price fixes below the Kijun-sen line, the pair's fall can quickly and cheerfully resume with targets of 1.0632–1.0357.

Explanations of the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels – target levels when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on the COT charts is the net position size of each category of traders.

Indicator 2 on the COT charts is the net position size for the "Non-commercial" group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română