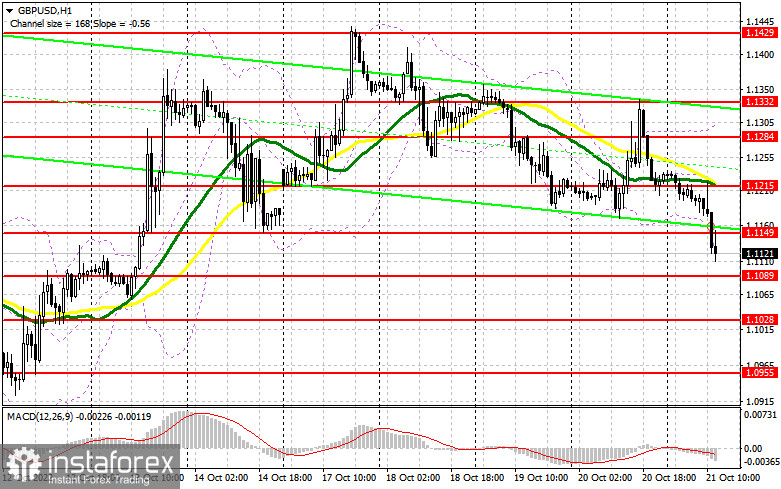

When to go long on GBP/USD:

Disappointing macro data in the UK triggered a mass sell-off in the pound. It prompted speculation that the Bank of England could slow down the pace of rate hikes. Yesterday, hints came from the regulator itself. The interview of FOMC official John Williams due later today will hardly be of any interest to the market. I expect the pound to fall and test the 1.1089 mark, where bullish activity is likely to increase. Anyway, buying the pair at this level would be possible after a false breakout only. The pair could then head towards resistance seen at 1.1149 and test this barrier. It remains to be seen whether the euro stays in the sideways channel or goes down at the close of the trading week. A breakout and a test of the 1.1149 mark would generate a buy signal with the target at 1.1215 resistance. Notably, the market saw an increase in bearish activity at this level in the European session. In addition, the barrier is in line with bearish moving averages. By breaking and testing the 1.1215 mark from top to bottom, the price could head towards 1.1284 where it would be wiser to lock in profits. Should GBP/USD react with a fall to the release of strong macro data and hawkish statements of the FOMC representatives when there is no bullish activity at 1.1089, the pound would feel pressure. So, long positions could be considered after a false breakout at 1.1028 or when the quote bounces off 1.0955 or 1.0876, allowing a correction of 30-35 pips intraday.

When to go short on GBP/USD:

The bears tightened their grip on the market. Now they should protect 1.1149 resistance. A false breakout through the barrier would generate a sell signal with the target at the weekly low of 1.1089. A breakout and a re-test of the mark from bottom to top would create a nice entry point with the target at 1.1028 where bullish activity is expected to increase. The most distant target stands at 1.0955 where it would be wiser to lock in profits. Should GBP/USD show growth in the North American session when there is no bearish activity at 1.1149, the bulls would attempt to regain control over the market and test 1.1215 resistance. A false breakout through the mark would make a sell entry point, and the downtrend would extend. Should there be no activity at this level, GBP/USD could be sold when the price bounces off 1.1284, allowing a bearish correction of 30-35 pips intraday.

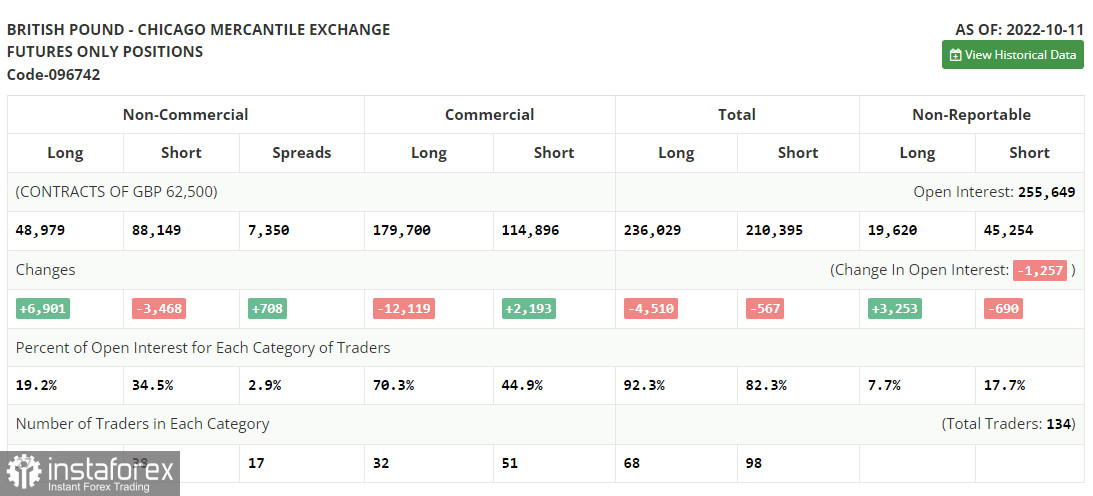

Commitments of Traders:

B COT report for October 11 logged a sharp drop in short positions and a rise in long ones. Following the Bank of England's intervention, many traders now bet on a stronger pound in the medium term. It recently became known that the regulator decided to halt the QT program to revive the bond market sent into turmoil by Prime Minister Liz Truss. Still, it remains to be seen whether the pound rallies in the medium term given that a recession is looming and the greenback is strengthening amid the hawkish Federal Reserve. According to the latest COT report, long non-commercial positions grew by 6,901 to 48,979, while short non-commercial positions dropped by 3,468 to 88,149. As a result, the non-commercial net position came at -39,170 versus -49,539. The weekly closing price fell to 1.1036 from 1.1494.

Indicator signals:

Moving averages

Trading is carried out below the 30-day and 50-day moving averages, reflecting an increase in the pressure on the pound.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

Resistance is seen at around 1.1284, in line with the upper band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română