Size matters. While investors observe bitcoin's falling volatility before their eyes and draw analogies from 2018, when in the same conditions the leader of the cryptocurrency sector collapsed like a stone after prolonged consolidation, the "bulls" on BTCUSD find a difference from the events of 4 years ago. In their opinion, trading volumes were falling then, but now they are still high. Although the indicator has moved away from its annual peaks, $100 billion worth of bitcoins, including $50 billion worth of derivatives, change hands every day. The first figure is a fifth of the daily turnover in the colossal size of the US stock market.

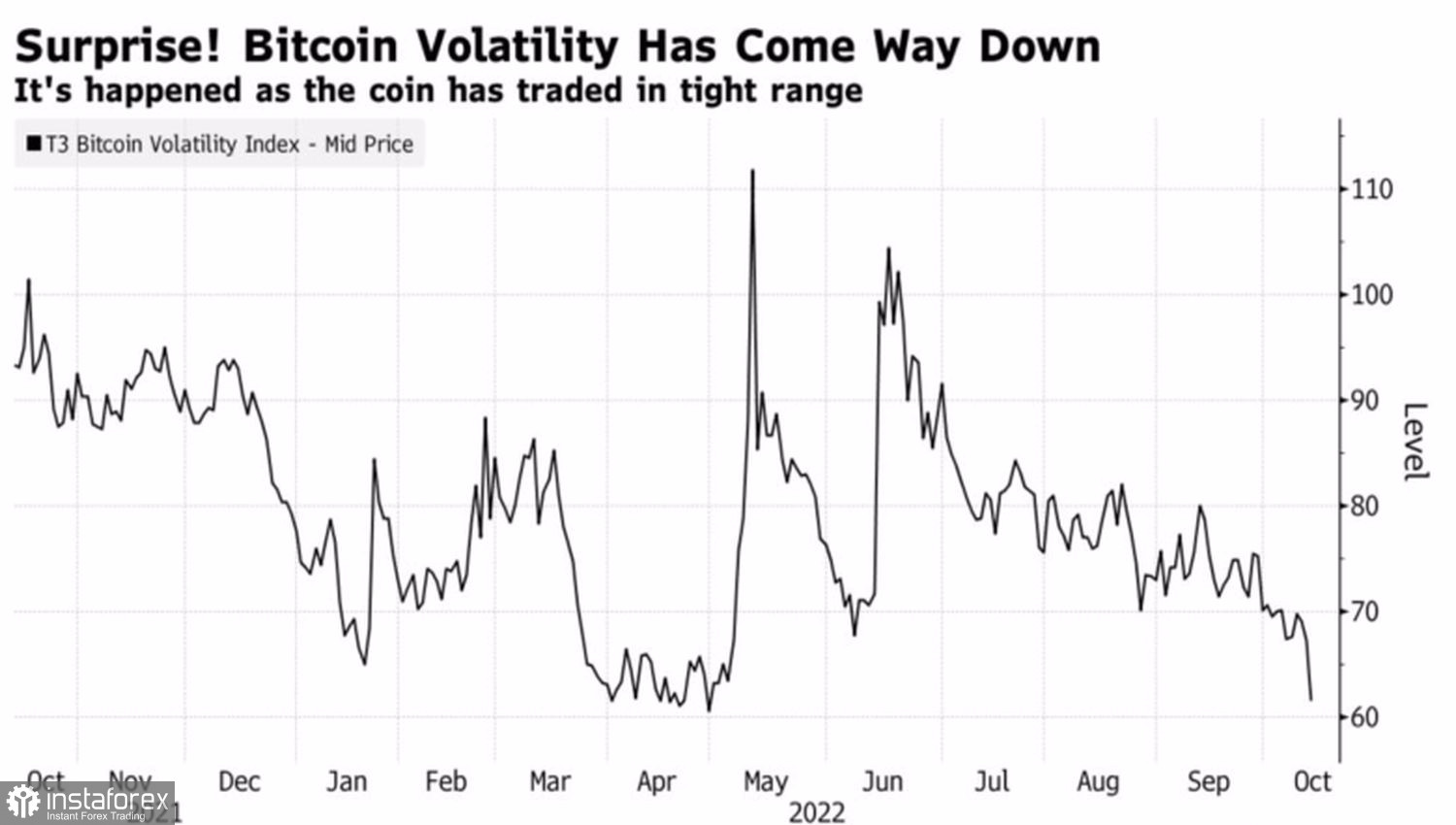

Behind the apparent calm in the crypto market, there is internal tension. Volatility has fallen to its lowest levels since April, and BTCUSD's attempts to break out of the 18,500–20,000 trading range are ending in failure. You can, of course, recall the history and the attack of the "bulls" on bitcoin at the end of the week by October 14. In the past, if the leader of the cryptocurrency sector left the 5% consolidation range and closed above it by 1%, then 60 days after 15 such signals, it grew by an average of 19%.

Bitcoin Volatility Dynamics

However, history is a fascinating thing, but unreliable. Market conditions may vary. Including trading volumes.

In any case, the time is not chosen. If you do not leave the crypto asset market, then you need to look for opportunities to make money even in the face of falling volatility before your eyes. Some investors find it to be buying options to make a profit on a narrow trading range. Others say that the BTCUSD peak towards the 18,000–19,000 area creates ideal conditions for buying in the long term. Let's wait and see who was right.

When the market is in tug-of-war mode for a long time, a radical change in attitude should not surprise anyone. Morgan Stanley, which has traditionally acted as a "bear" on US stock indices, claims that the hour has come for short-term purchases of shares. On the contrary, almost the main "bull" of Wall Street, JP Morgan, advises its clients to refrain from long positions for a while.

Bitcoin's momentum is still driven by risk appetite, so traders should keep a close eye on what's going on in the US stock market. The start of the corporate reporting season is encouraging, but the fact that the US Treasury yield has exceeded the 4% mark and continues to grow by leaps and bounds does not bode well for stock indices and BTCUSD. The fundamental valuation of stocks is declining, and investors are rushing to remove unattractive assets from the portfolio. The sale of equity securities is also carried out by miners who need to cover the costs of ongoing operations.

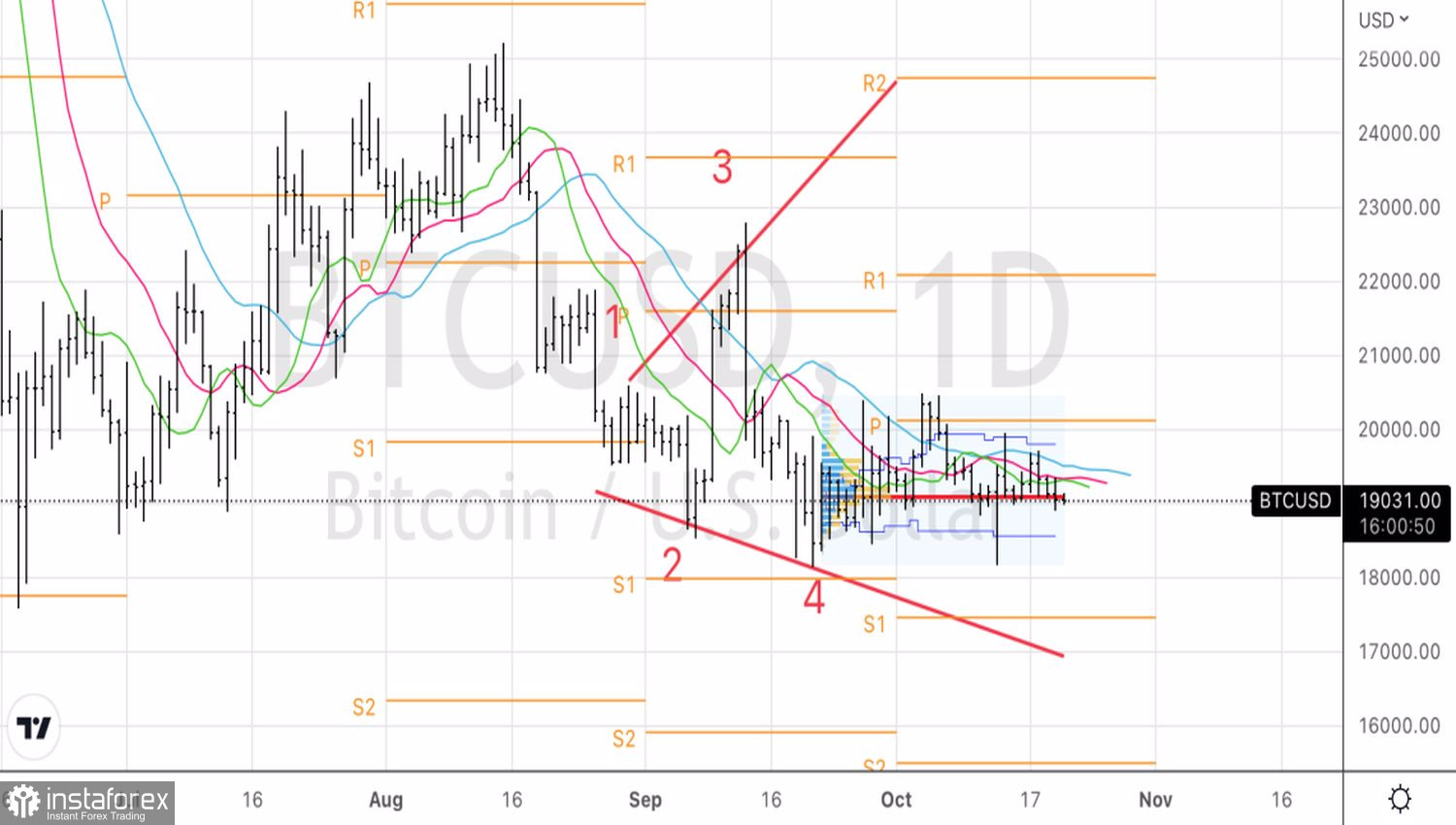

Technically, on the daily chart of bitcoin, quotes are wandering around the fair value at 19,100. It makes sense to use the rebound from 18,500 and 18,200 for purchases. Unsuccessful resistance tests at 19,800 and 20,100 are for sales.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română