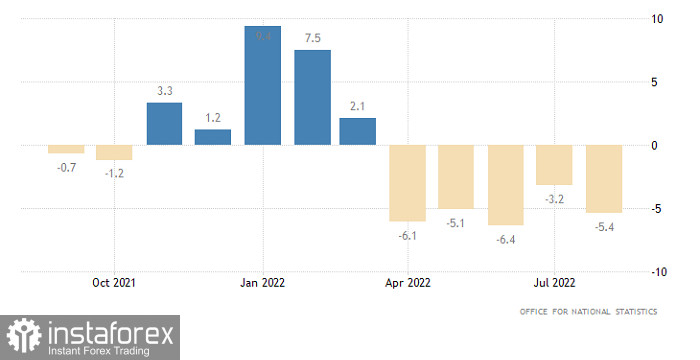

Liz Truss will go down in history as the UK's shortest-serving prime minister. She had to quit after 44 days in office. The pound sterling reacted to the news about her resignation with growth. However, excitement then quickly gave way to cautiousness, and the British currency pulled back to the open level of the day. Interestingly, Boris Johnson is among the MPs said to be considering bids. As a reminder, the former prime minister had to quit after a political scandal. Therefore, the resignation of Liz Truss may exacerbate the political crisis in the UK. Still, there is a glimmer of hope that things will change for the better. In this light, the market is likely to remain flat until the PM's successor and the Conservative Party's leader is elected. Therefore, a slowdown in the UK's retail sales slump to -4.3% from -5.4% won't really matter to the market.

United Kingdom Retail Sales:

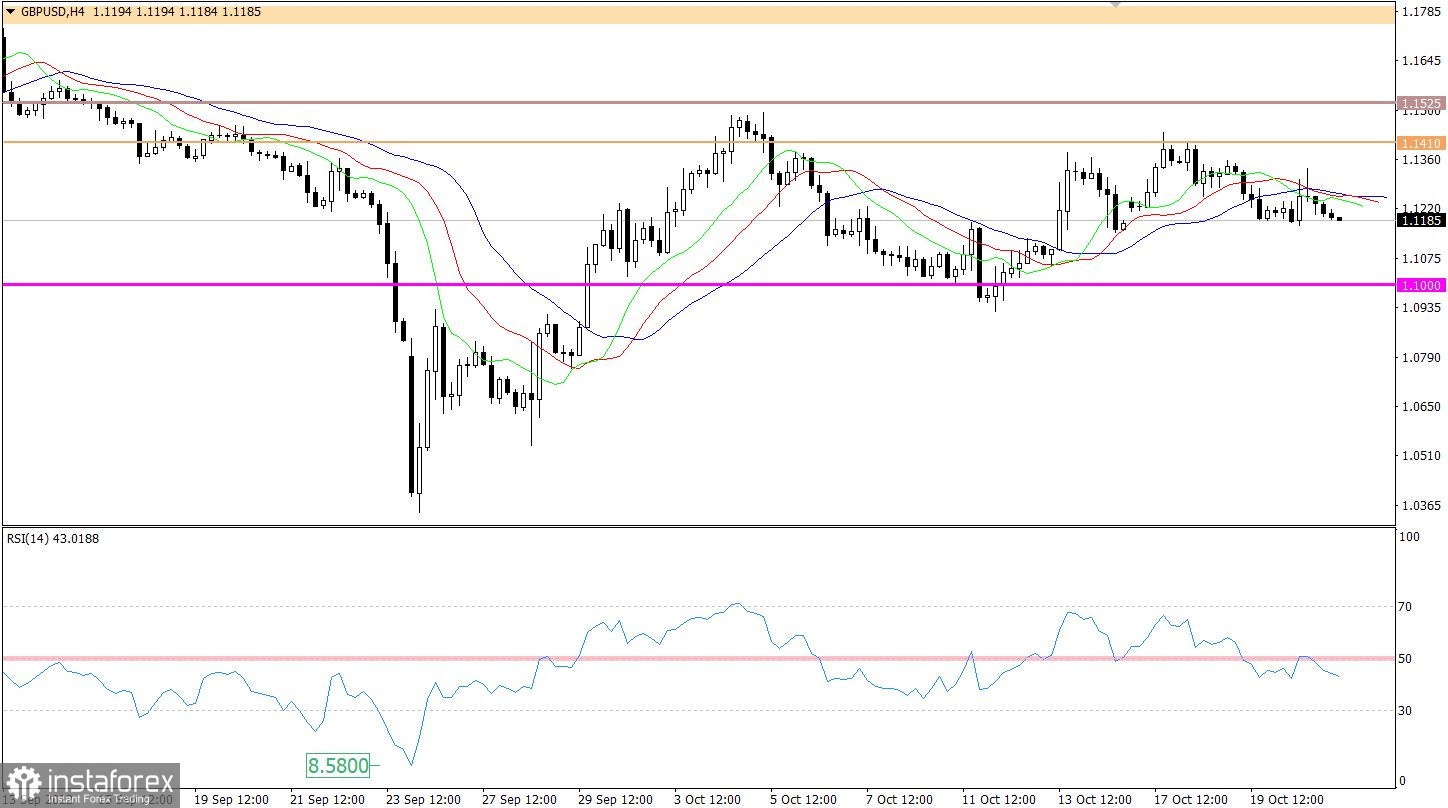

The GBP/USD pair shows uncertain trading despite news in the media. Support is now seen at 1.1150.

The RSI is moving down between lines 30 and 50 on the H4 chart, indicating a bearish bias.

Multiple crossovers of the Alligator's MAs on the H4 chart signal a flat market.

Outlook

Should the price consolidate below 1.1150, the bears would push the pair to 1.1000. Uncertainty in the market could trigger price fluctuations.

Based on complex indicator analysis, there is a signal to sell the instrument for short-term and intraday trading, as the price is approaching the mark of 1.1150.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română