The euro is clinging to every opportunity not to return to the September lows. For the possible dismissal from the post of prime minister of Britain, Liz Truss, who frightened the financial markets with her plans. For the fall in gas prices in Europe and the high percentage of storage occupancy. For a strong start to the US corporate reporting season. Who else will help the bulls on EURUSD, except for themselves?

In fact, the fate of major currency and other dollar pairs depends on the path of the federal funds rate. The FOMC's September forecast assumed it would rise to 4.6%, however, due to the stubborn reluctance of US inflation to slow down, it would not surprise anyone if borrowing costs eventually rise to 5% or more. Another thing is that their peak is the peak of the USD index, as the markets will increasingly talk about the easing of monetary policy.

Thus, the trajectory is clear, it remains to deal with the timing. One of the most ardent Federal Reserve hawks, St. Louis Fed President James Bullard, believes that the central bank will stop aggressive upfront rate hikes by early 2023, after which it will switch to play-by-play mode - it will adjust the cost of borrowing depending on incoming data. Thus, EURUSD has high risks of further decline in the direction of 0.93-0.94, however, this is where the bottom will be.

The pressure on the euro is created by the worsening terms of trade and the energy crisis. You shouldn't think that 92% filling of gas storages will solve all problems. Only 10% of them belong to the state, the rest - to private companies. The latter can afford to sell blue fuel at affordable prices to Germany, which will make Italy and other eurozone countries freeze in cold winters and undermine European unity.

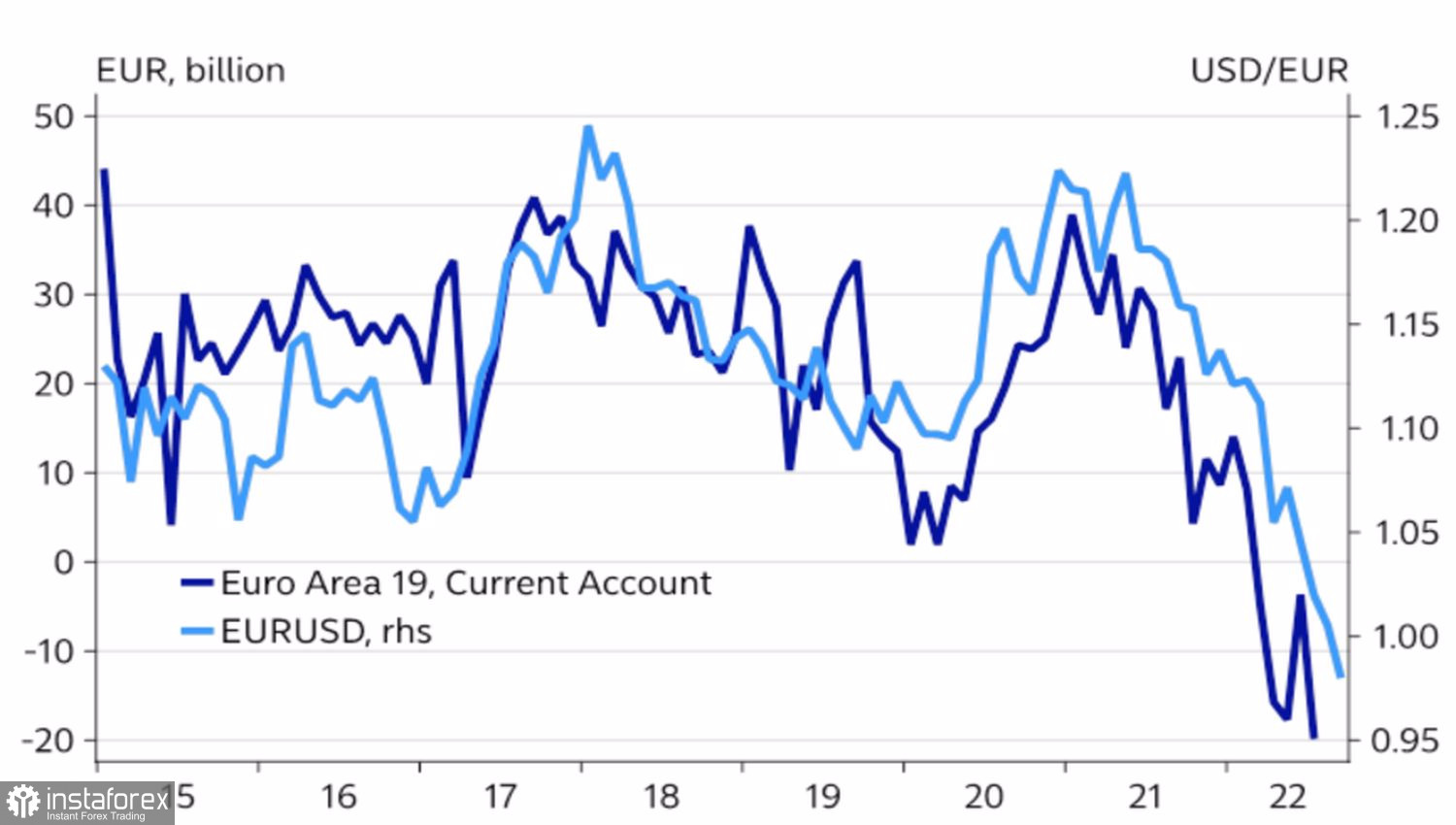

EURUSD and eurozone current account dynamics

The US dollar is supported by high demand for safe-haven assets ahead of the approaching recession in the global economy. According to well-known economist Nouriel Roubini, the recession in the United States will be deeper than in the 1970s. At the same time, turmoil in financial markets will force the Fed to change course and start easing monetary policy. Wait and see. So far, I'm only stating that historically, the USD index felt confident before a recession, but during a recession, on the contrary, it decreases, as the markets expected the Fed to drop rates, QE or other measures of monetary expansion.

Thus, a trend change in EURUSD will occur. But not anytime soon. Most likely, in the first and second quarters of 2023 amid a pause in the process of tightening the Fed's monetary policy and a recession in the American economy.

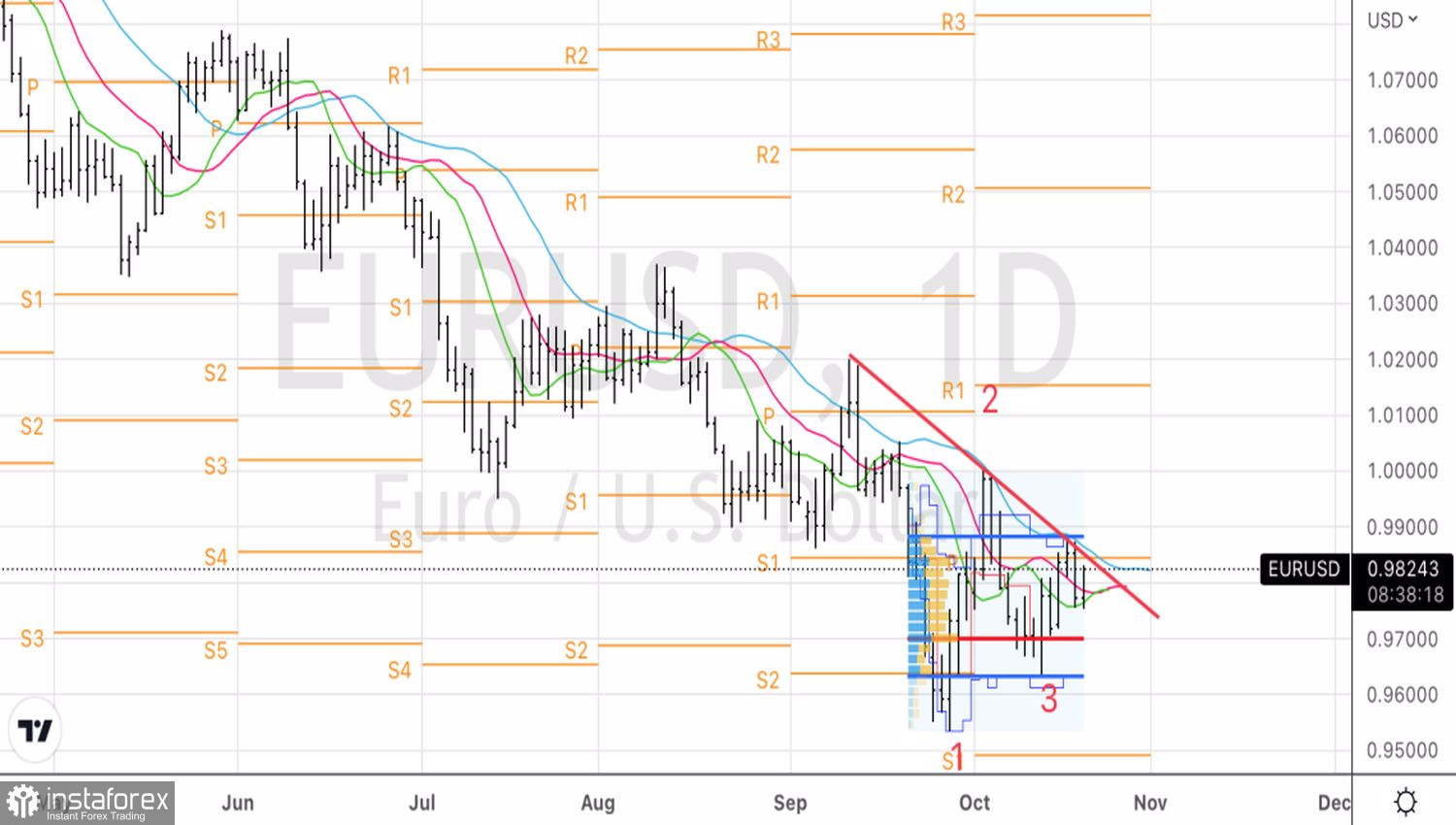

Technically, on the daily chart, EURUSD starts to consolidate in the range of 0.97-0.988 within the Splash and Shelf pattern on the 1-2-3 base. It is customary to win back such structures by placing two pending positions: to sell from 0.97 and to buy the euro against the US dollar from 0.988.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română