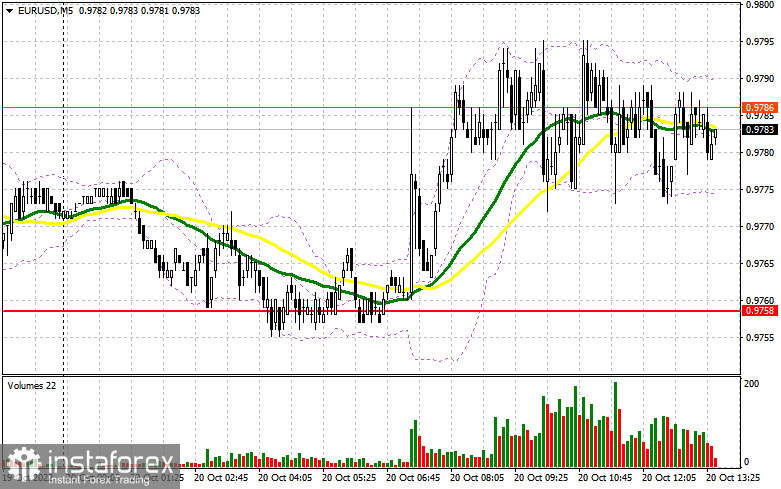

In the morning article, I turned your attention to the level of 0.9758 and recommended making decisions with this level in focus. Now, let's look at the 5-minute chart and try to figure out what actually happened. A sharp decrease in market volatility following the publication of Germany's Producer Price Index. The reading once again jumped. Therefore, the pair is trapped in the sideways channel. The pair also failed to reach the levels indicated in the morning article. So, there were no entry points to the market in the morning. The technical outlook remained unchanged for the American session.

When to open long positions on EUR/USD:

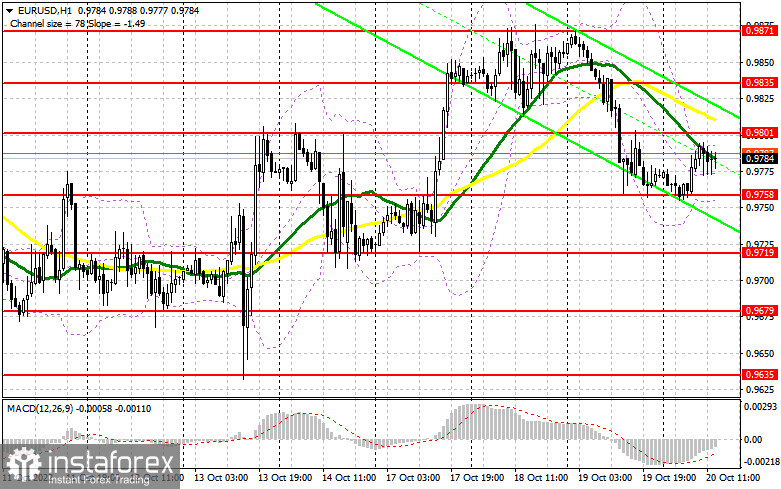

The second half of the day is going to be more eventful. The Philadelphia Fed Manufacturing Index and the US initial jobless claims report are due. If the readings are in line with the forecasts, readers are likely to focus their attention on the report on the existing home sales report and the speeches of Fed policymakers. They are sure to speak in favor of further monetary tightening. It is a bullish factor for the US dollar in the short term perspective. If the pair declines, only a false breakout of 0.9758 will give an excellent buy signal with the prospect of a rise to 0.9801. Yesterday, the pair failed to advance above this level. There are moving averages in this range, which will limit the upward movement of the pair. Bulls are likely to regain the upper hand only if a false breakout of this level and a downward test take place. It might happen already during the American session. If so, it may trigger an upward reversal. Bears will have to close Stop Loss orders. It will generate an additional buy signal with the possibility of a jump to 0.9835. It could also strengthen the bullish trend that has been unfolding since October 13. If the pair consolidates above 0.9835, it will open the path to 0.9871 where I recommend locking in profits. If EUR/USD declines and bulls show no activity at 0.9758, buyers will completely lose control of the market. Hence, the pressure on the euro will escalate. It will lead to the formation of a further downward channel and a fall to 0.9719. It is better to open long positions after a false breakout of this level takes place. You can buy EUR/USD immediately at a bounce from 0.9679 or 0.9635, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

The bears are also sitting on the sidelines. However, the longer they remain inactive, the higher the risk of a sharp recovery of the euro. If so, the euro is likely to win back yesterday's losses rather quickly. The pair's trajectory partially depends on the US economic reports. Yet, technical indicators may change rapidly, signaling a bullish bias. It is better to open short positions after a false breakout of 0.9801, which will give an excellent sell signal. The price may return to 0.9758, the lower border formed by the results of yesterday's trading. Given that it will be the fourth attempt to break through this level, sellers are likely to finally push the price to 0.9758. A drop below this level as well as an upward test will provide a sell signal for EUR/USD. It will force bulls to close their Stop Loss orders. If this scenario comes true, the pair may decrease to 0.9719. A more distant target will be the 0.9679 level where I recommend locking in profits. If EUR/USD rises during the US session and bears show no energy at 0.9801, demand for the pair will increase. A strong upward correction is likely to occur. In this case, I advise you to cancel short positions until a false breakout of 0.9835 takes place. You can sell EUR/USD immediately at a bounce from the weekly high of 0.9871 or from 0.9917, keeping in mind a downward intraday correction of 30-35 pips.

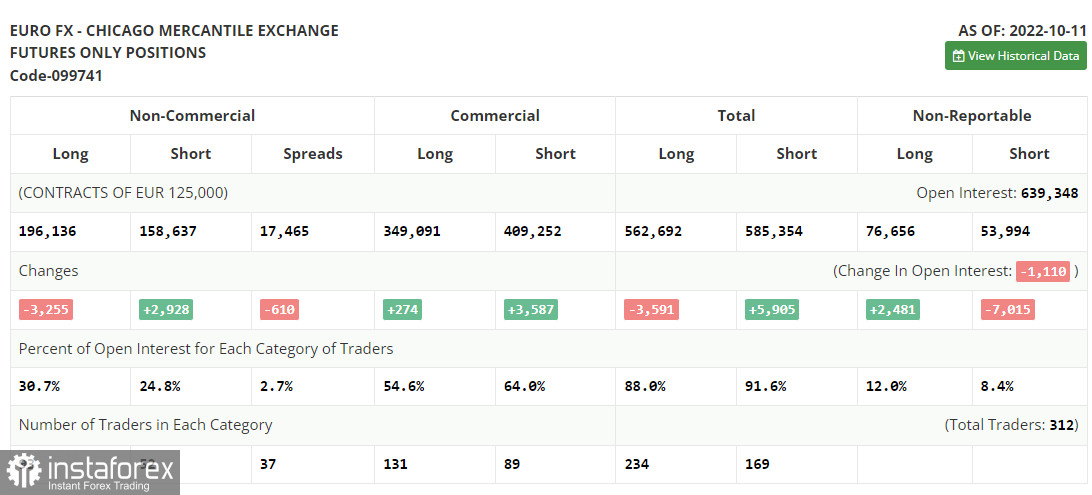

Commitments of Traders:

The COT report for October 11 logged a sharp fall in long positions and a rise in short ones. It seems that traders were bracing for the release of the US inflation and retail sales reports. It appears that taming inflation has become a real challenge for the Fed. As the September report shows, inflation slowed just by 0.1% from the previous reading. This is why the US regulator is likely to remain hawkish or become even more aggressive. Notably, it has been a while since the last mass sell-off of the euro below the parity level. In fact, such factors as geopolitical tensions and the tightening cycle of the Federal Reserve are not enough to push the pair lower. Therefore, it is better to open long positions on the euro in the medium term. The COT report revealed that the number of long non-commercial positions dropped by 3,255 to 196,136, while the number of short non-commercial positions grew by 2,928 to 158,637. In a week, the total non-commercial net position remained positive and amounted to 37,499 versus 43,682. Investors use this as an opportunity to buy the cheaper euro below parity and accumulate long positions, hoping for the end of the crisis and the pair's recovery in the long run. The weekly closing price decreased to 0.9757 from 1.0053.

Signals of technical indicators

Moving averages

EUR/USD is trading slightly below the 30- and 50-period moving averages. It means that bears are holding the upper hand.

Remark. The author is analyzing the period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart.

Bollinger Bands

If EUR/USD moves up, the indicator's upper border at 0.9800 will act as resistance.

A breakout of the upper border at about 1.1337 will trigger a new bullish wave of EUR. Alternatively, a breakout of the lower border at about 1.1305 will escalate pressure on EUR/USD.

Definitions of technical indicators

- Moving average recognizes an ongoing trend through leveling out volatility and market noise. A 50-period moving average is plotted in yellow on the chart.

- Moving average identifies an ongoing trend through leveling out volatility and market noise. A 30-period moving average is displayed as the green line.

- MACD indicator represents a relationship between two moving averages that is a ratio of Moving Average Convergence/Divergence. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A 9-day EMA of the MACD called the "signal line".

- Bollinger Bands is a momentum indicator. The upper and lower bands are typically 2 standard deviations +/- from a 20-day simple moving average.

- Non-commercial traders - speculators such as retail traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- The overall non-commercial net position balance is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română