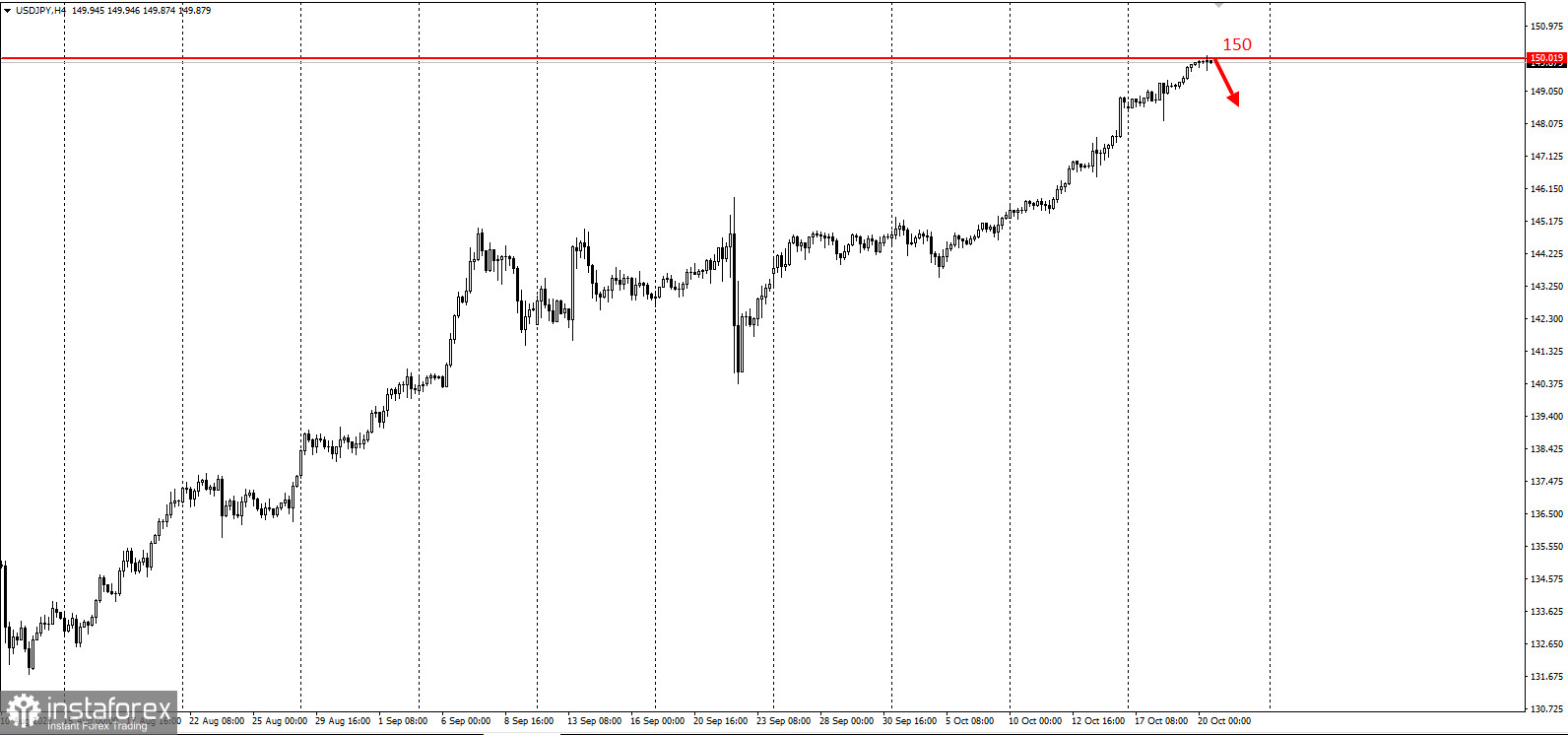

The depreciation of yen brought USD/JPY to the psychological level of 150. Most likely, this will force the Bank of Japan to be aggressive in its currency interventions.

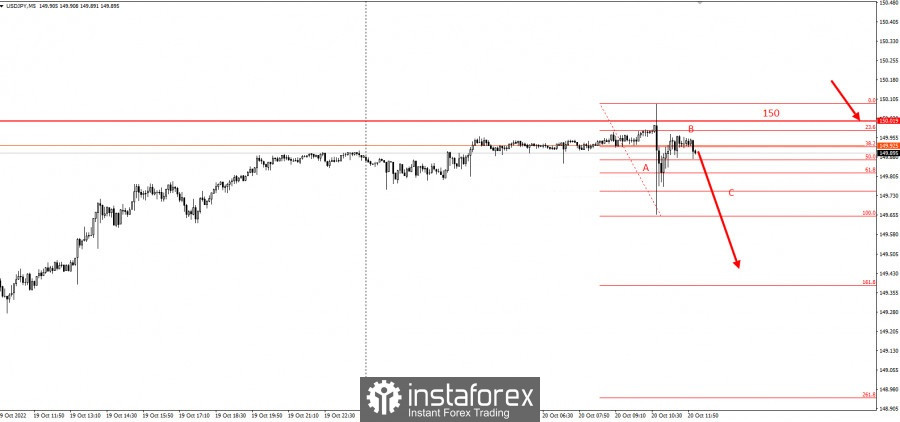

In fact, on Thursday morning, the Bank of Japan already carried out a small intervention, which can be taken as a reference when selling from 150.

A three-wave pattern (ABC) was also formed, in which wave A represents the selling pressure from 150. Traders can use this as basis when entering market and taking short positions according to the plan presented below. Stop loss could be set at 150.1, then exit the market below 149.6.

If the pair goes beyond 150, another set of sell-offs may occur in anticipation of new currency interventions by the Bank of Japan.

This trading idea is based on the "Price Action" and "Stop Hunting" methods.

Good luck and have a nice day! Don't forget to control the risks.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română