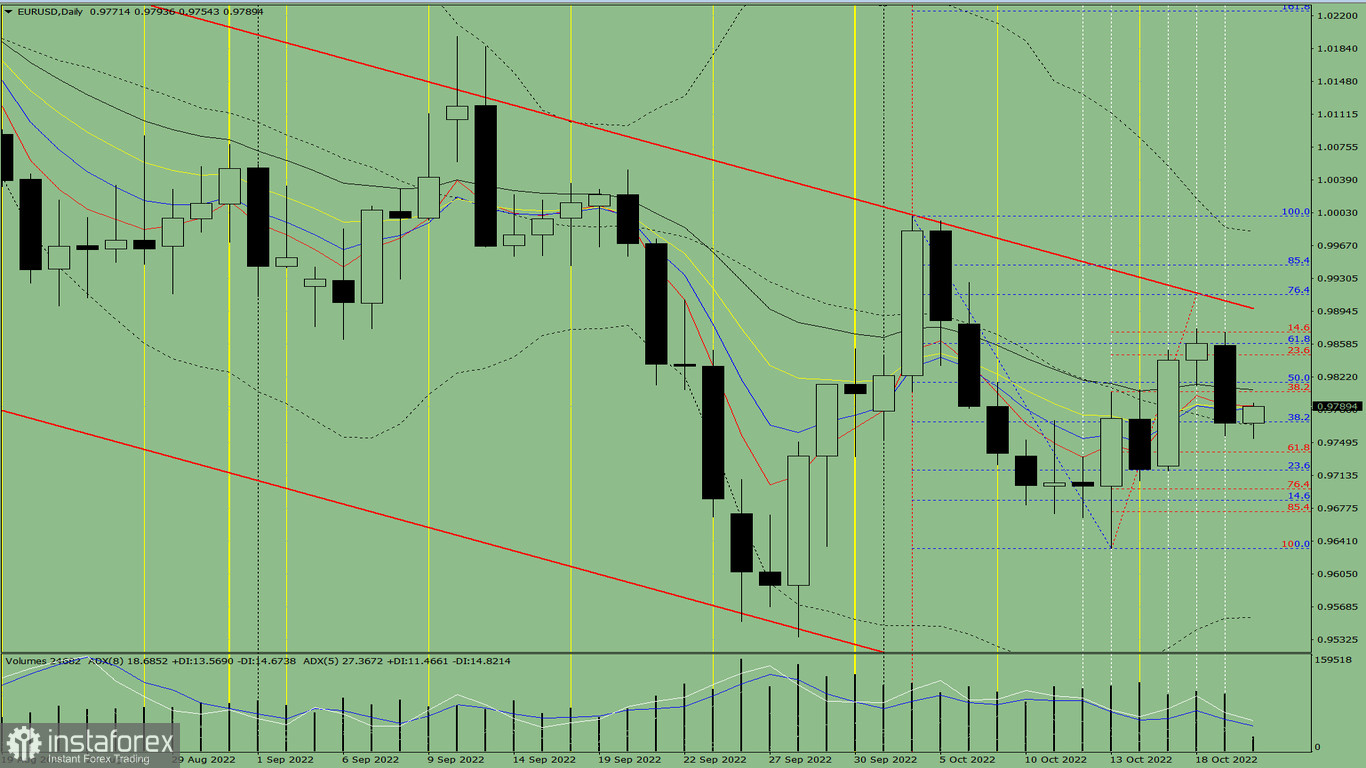

Trend analysis (fig. 1).

Today, the pair is likely to rise from 0.9771 (the closing of yesterday's daily candlestick). It may try to break through 0.9816 (blue dotted line), the Fibonacci retracement level of 50.0%. After reaching this level, the price is expected to grow higher to 0.9859 (blue dotted line), the Fibonacci retracement level of 61.8%. From this level, the price may maintain its upward movement.

Fig. 1 (daily chart).

Complex analysis:

- indicator analysis– up;

- Fibonacci levels – up;

- trading volumes – up;

- candlestick analysis – up;

- trend analysis – up;

- Bollinger lines – up;

- weekly chart - up.

Conclusion:

Today, the pair is likely to rise from 0.9771 (the closing of yesterday's daily candlestick). It may try to break through 0.9816 (blue dotted line), the Fibonacci retracement level of 50.0%. After reaching this level, the price is expected to grow higher to 0.9859 (blue dotted line), the Fibonacci retracement level of 61.8%. From this level, the price may maintain its upward movement.

Alternatively, it could advance from 0.9702 (closing of yesterday's daily candlestick) and try to break through 0.9816 (blue dotted line), the Fibonacci retracement level of 50.0%. If it approaches this level, it may drop to 0.9739 (red dotted line), the Fibonacci retracement level of 61.8%.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română